- Israel

- /

- Real Estate

- /

- TASE:MLSR

How Investors Are Reacting To Melisron (TASE:MLSR) Q3 Results And New Dividend Announcement

Reviewed by Sasha Jovanovic

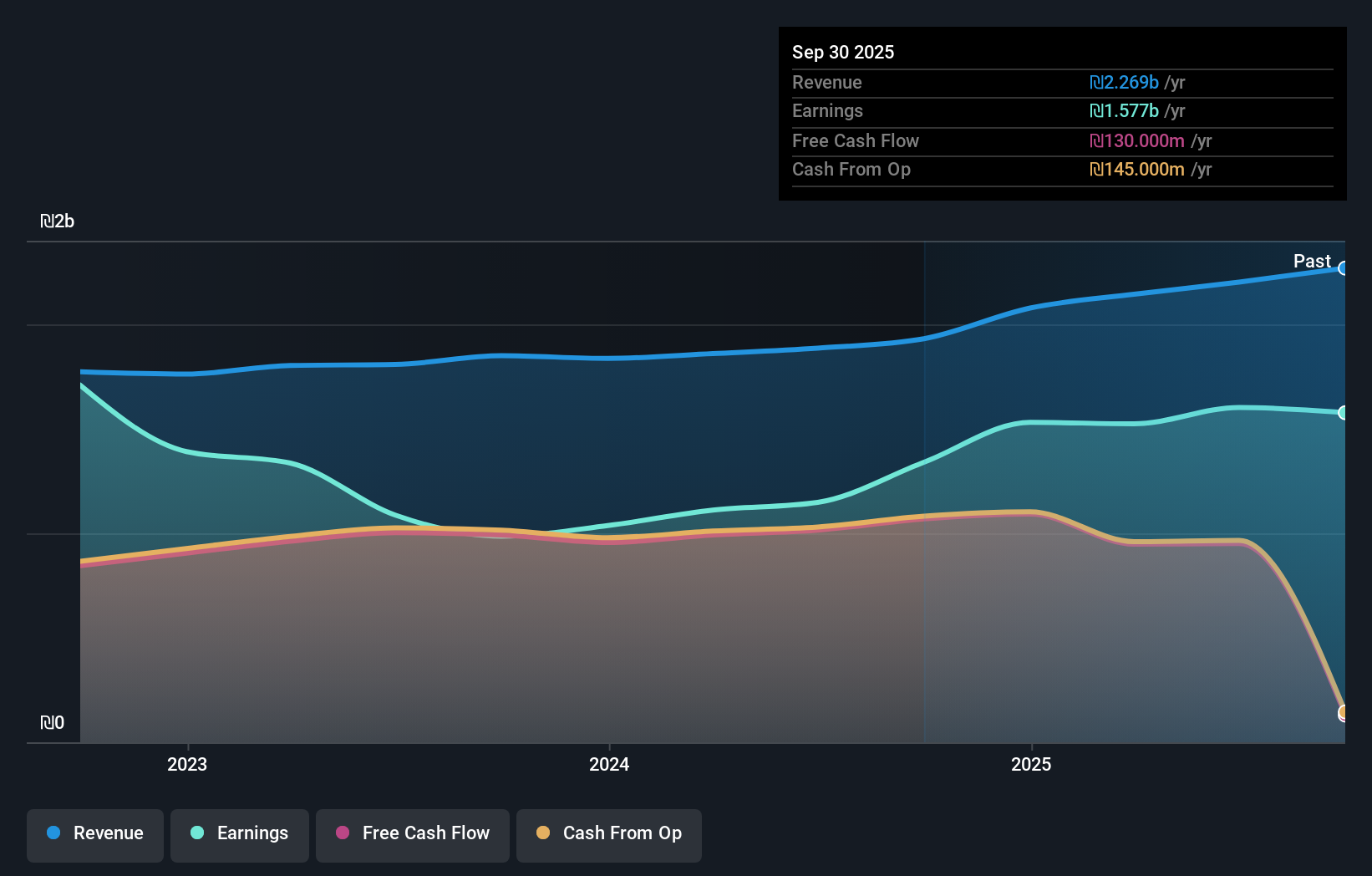

- Melisron Ltd. reported past third-quarter 2025 results, with sales rising to ILS 602 million while quarterly net income eased to ILS 286 million, alongside higher nine‑month earnings year on year.

- The company also declared a cash dividend of ILS 1.8883774 per share with a December 2, 2025 ex‑dividend date, highlighting its ongoing capital return to shareholders.

- With recent earnings showing revenue growth and an upcoming dividend payout, we’ll examine how these developments shape Melisron’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Melisron's Investment Narrative?

To own Melisron, you really need to believe in the resilience of its Israeli retail and office assets and in management’s ability to translate steady tenant demand into solid, recurring earnings, even with a relatively low 12.6% return on equity and interest costs that are not comfortably covered. The latest Q3 results fit this picture: sales kept climbing but quarterly profit and EPS slipped, reminding investors that growth is not in a straight line and that prior 12‑month figures were flattered by a ₪1.10 billion one off gain. The fresh dividend declaration reinforces the short term income story rather than changing it. So far, the share price reaction has been muted, suggesting the news modestly tweaks the near term earnings narrative rather than resetting the key risks or catalysts.

However, investors should not overlook how tight interest coverage could constrain Melisron if conditions change. Melisron's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Melisron - why the stock might be worth as much as ₪6.80!

Build Your Own Melisron Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Melisron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Melisron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Melisron's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MLSR

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026