- Israel

- /

- Real Estate

- /

- TASE:ISCN

Israel Canada (TASE:ISCN) Net Margins Boosted by One-Off Gain, Challenging Profitability Narrative

Reviewed by Simply Wall St

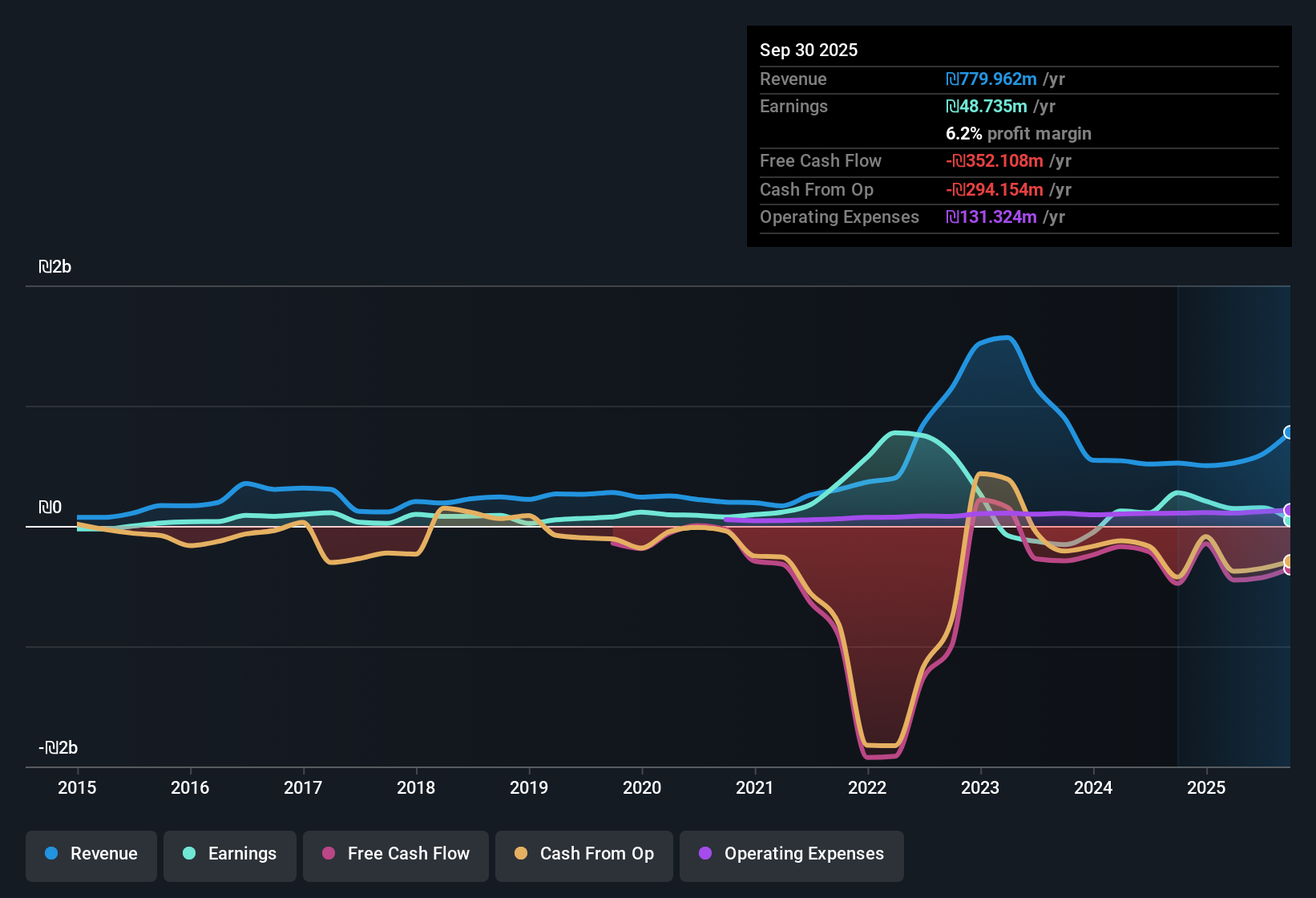

Israel Canada (T.R) (TASE:ISCN) just posted its Q3 2025 results, reporting revenue of ₪187.4 million and a net loss (excluding extra items) of ₪4.3 million. This translates to an EPS of -₪0.013. The company has seen revenue fluctuate over recent periods, rising from ₪143.1 million in Q3 2024 to ₪187.4 million in the latest quarter. EPS shifted from ₪0.53 to -₪0.013 across the same periods. Margins presented a mixed picture this quarter as investors weigh recent profitability against fluctuating earnings.

See our full analysis for Israel Canada (T.R).Next up, we will compare these fresh results with prevailing narratives and examine how the market story aligns with the company’s latest numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Expand on One-Off Gain

- Net profit margins climbed to 25.6%, surpassing the previous period's 21.3%. This increase was driven in part by a large, non-recurring gain of ₪54.2 million over the past year.

- Market analysis focuses on how the recent margin jump supports the viewpoint that Israel Canada (T.R)'s profitability is rebounding. However,

- the impact of a single significant gain means the sustainability of these margins remains uncertain, as normalized earnings may not reach this year’s reported levels,

- and the 38.4% earnings growth over the last year stands in sharp contrast to the prior five-year average annual earnings decline of 16.9%.

Share Price Commands a Premium to Peers

- The current share price of ₪15.83 results in a Price-To-Earnings Ratio of 34.5x, which is more than double the IL Real Estate industry average of 13.9x and above peers at 14.9x.

- With valuation at a substantial premium, it is noteworthy that this confidence may be tied to short-term earnings gains rather than a long-term turnaround, since

- the DCF fair value stands much lower at ₪0.78, highlighting a significant gap between market optimism and fundamental valuation,

- and longer-term indicators continue to point to potential risks: the company’s ability to cover interest payments remains stretched and share price volatility has increased in recent months.

Profitability Trends Defy Historical Decline

- Earnings growth of 38.4% over the last 12 months contrasts with a long-term average annual decline of 16.9%, as shown in both recent and trailing twelve-month figures.

- A key point in the market's perspective is that this sharp turnaround differs from the company’s historical results, because

- the recent profit increase is linked to one-off factors rather than widespread business momentum,

- leaving investors to consider whether the strong trailing earnings indicate sustained strength or simply a temporary improvement.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Israel Canada (T.R)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Israel Canada (T.R) is currently trading at a significant premium to its fundamental value. Recent earnings strength has been driven by one-off gains, with lingering risks to long-term sustainability.

Want confidence that aligns with fundamentals? Check out these 920 undervalued stocks based on cash flows to find companies trading well below their fair value and with stronger prospects for lasting upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISCN

Israel Canada (T.R)

Pangaea Real-Estate Ltd. is a principal investment firm specializing in investments in real estate.

Slight risk with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.