If You Had Bought Purple Biotech's (TLV:KTOV) Shares Five Years Ago You Would Be Down 90%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Anyone who held Purple Biotech Ltd. (TLV:KTOV) for five years would be nursing their metaphorical wounds since the share price dropped 90% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 46% over the last twelve months. Unhappily, the share price slid 1.9% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Purple Biotech

We don't think Purple Biotech's revenue of US$1,000,000 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). Investors will be hoping that Purple Biotech can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as Purple Biotech investors might realise.

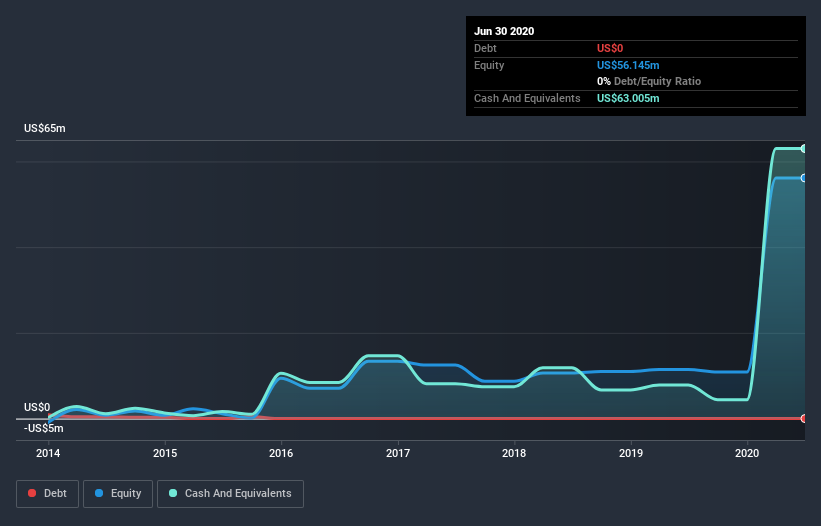

When it last reported its balance sheet in June 2020, Purple Biotech could boast a strong position, with cash in excess of all liabilities of US$33m. This gives management the flexibility to drive business growth, without worrying too much about cash reserves. But since the share price has dropped 14% per year, over 5 years , it seems like the market might have been over-excited previously. The image below shows how Purple Biotech's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

We regret to report that Purple Biotech shareholders are down 46% for the year. Unfortunately, that's worse than the broader market decline of 3.5%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Purple Biotech has 4 warning signs (and 3 which don't sit too well with us) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

When trading Purple Biotech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:PPBT

Purple Biotech

A clinical-stage company, focuses on developing therapies to overcome tumor immune evasion and drug resistance for cancer patients in the United States.

Flawless balance sheet moderate.

Market Insights

Community Narratives