Some Shareholders May find It Hard To Increase Kamada Ltd.'s (TLV:KMDA) CEO Compensation This Year

Key Insights

- Kamada will host its Annual General Meeting on 28th of December

- Salary of US$410.0k is part of CEO Amir London's total remuneration

- The total compensation is similar to the average for the industry

- Kamada's total shareholder return over the past three years was 2.5% while its EPS was down 39% over the past three years

Performance at Kamada Ltd. (TLV:KMDA) has been reasonably good and CEO Amir London has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 28th of December, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Kamada

Comparing Kamada Ltd.'s CEO Compensation With The Industry

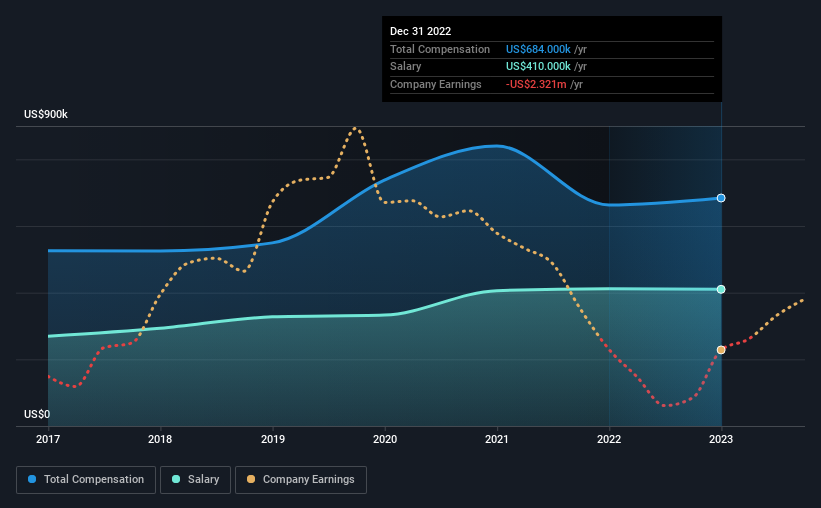

Our data indicates that Kamada Ltd. has a market capitalization of ₪1.2b, and total annual CEO compensation was reported as US$684k for the year to December 2022. That's a modest increase of 3.2% on the prior year. In particular, the salary of US$410.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

In comparison with other companies in the Israel Biotechs industry with market capitalizations ranging from ₪725m to ₪2.9b, the reported median CEO total compensation was US$657k. So it looks like Kamada compensates Amir London in line with the median for the industry. Moreover, Amir London also holds ₪1.1m worth of Kamada stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$410k | US$412k | 60% |

| Other | US$274k | US$251k | 40% |

| Total Compensation | US$684k | US$663k | 100% |

On an industry level, around 62% of total compensation represents salary and 38% is other remuneration. Our data reveals that Kamada allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Kamada Ltd.'s Growth Numbers

Over the last three years, Kamada Ltd. has shrunk its earnings per share by 39% per year. Its revenue is up 31% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Kamada Ltd. Been A Good Investment?

With a total shareholder return of 2.5% over three years, Kamada Ltd. has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Some shareholders will be pleased by the relatively good results, however, the results could still be improved. We reckon that there are some shareholders who may be hesitant to increase CEO pay further until EPS growth starts to improve, despite the robust revenue growth.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Kamada that investors should think about before committing capital to this stock.

Switching gears from Kamada, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade Kamada, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kamada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:KMDA

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives