As global markets experience a surge, with U.S. stocks reaching record highs driven by optimism around AI and potential trade deals, the landscape for high-growth tech stocks appears promising. In such an environment, identifying companies that are well-positioned to capitalize on technological advancements and market trends can be crucial for investors looking to explore opportunities in the tech sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

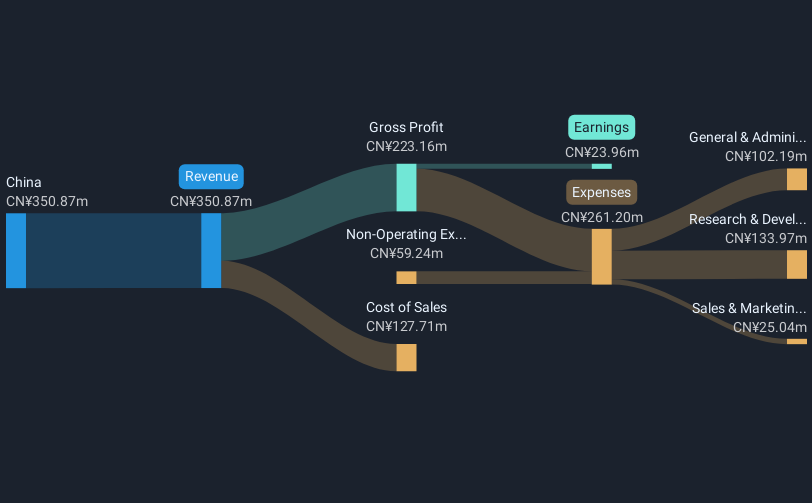

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd. operates in the information technology sector, focusing on providing advanced technology solutions, with a market capitalization of CN¥5.46 billion.

Operations: Suochen Information Technology specializes in delivering cutting-edge technology solutions within the IT sector. The company's revenue model is not detailed in the provided data, and specific financial metrics such as gross or net profit margins are unavailable for analysis.

Shanghai Suochen Information Technology Ltd., amidst a dynamic tech landscape, demonstrates robust revenue growth at 35.3% annually, outpacing the Chinese market average of 13.3%. This growth is complemented by an aggressive share repurchase program, with the company buying back 0.78% of its shares for CNY 50.5 million in the recent tranche, underscoring confidence in its financial health and commitment to shareholder value. However, challenges persist as evidenced by a significant drop in profit margins from 23% last year to 6.8%, and a forecasted low return on equity of 4.3% in three years' time—points that might concern potential investors about long-term profitability despite short-term gains.

- Dive into the specifics of Shanghai Suochen Information TechnologyLtd here with our thorough health report.

Learn about Shanghai Suochen Information TechnologyLtd's historical performance.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry with a market cap of CN¥4.71 billion.

Operations: Long Young Electronic (Kunshan) Co., Ltd. generates revenue primarily from its packaging and containers segment, amounting to CN¥275.97 million.

Long Young Electronic (Kunshan) stands out in the tech sector, with a projected annual revenue growth rate of 66.6%, significantly outstripping the Chinese market's average of 13.3%. This growth trajectory is supported by substantial R&D investments, which are crucial for maintaining its competitive edge and fostering innovation. The company's commitment to reinvesting in itself is further evidenced by its recent share repurchase initiative, where it bought back shares worth CNY 17.76 million, reflecting confidence in its future prospects despite current challenges such as a notable dip in profit margins from last year’s 41.9% to this year’s 25.2%. As Long Young continues to navigate the competitive landscape, these strategic moves could play a pivotal role in shaping its long-term success within the high-tech industry.

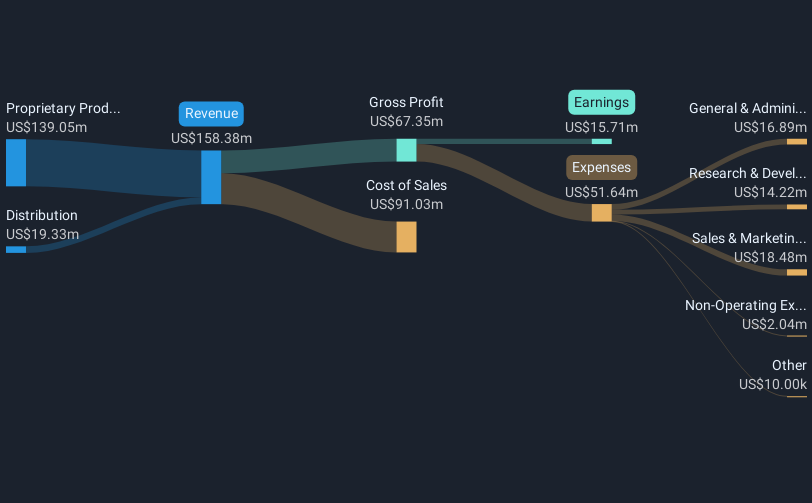

Kamada (TASE:KMDA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kamada Ltd. is a company that specializes in the manufacturing and sale of plasma-derived protein therapeutics, with a market capitalization of ₪1.41 billion.

Operations: The company generates revenue from two main segments: Proprietary Products, contributing $139.05 million, and Distribution, adding $19.33 million.

Kamada Ltd. is distinguishing itself in the biotech sector with a robust growth trajectory, evidenced by a 154.7% surge in earnings over the past year, outpacing the industry's average of 7.4%. This performance is underpinned by strategic R&D investments which have enabled significant innovations and efficiencies. Recently, Kamada secured a lucrative contract expected to generate $25 million over three years, enhancing its global footprint across diverse markets from North America to Asia. With revenue projections set to climb by 13% in 2025 and ongoing pursuits in M&A to bolster its portfolio further, Kamada's aggressive growth strategy aligns with its strong financial position—holding $72 million in cash—to support sustained expansion and shareholder value enhancement.

- Take a closer look at Kamada's potential here in our health report.

Understand Kamada's track record by examining our Past report.

Seize The Opportunity

- Delve into our full catalog of 1228 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kamada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KMDA

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives