Assessing Israel Chemicals (TASE:ILCO) Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Israel (TASE:ILCO) has recently caught the eye of investors, with its performance over the past year showing a meaningful turnaround. Shares have risen 28% in the past 12 months, even though longer-term returns remain mixed.

See our latest analysis for Israel.

Israel’s 1-year total shareholder return of 0.28% marks a quiet but positive shift, suggesting that recent momentum is edging slightly upward. While big news hasn’t dominated headlines lately, the gradual improvement could indicate early optimism building around the stock’s longer-term potential.

If you’re ready to spot the next mover beyond Israel, take the opportunity to discover fast growing stocks with high insider ownership.

With shares climbing in recent months, investors face a crucial question: is Israel’s current valuation an underappreciated opportunity, or has the market already factored in any potential growth ahead?

Price-to-Earnings of 15.6x: Is it justified?

ILCO is currently trading at a price-to-earnings (P/E) ratio of 15.6x, which appears attractively valued when compared to both its peers and the wider industry. The last close price sits at ₪1034.3, reinforcing the case for potential undervaluation relative to the market.

The price-to-earnings ratio measures how much investors are willing to pay per unit of earnings, serving as a key metric in evaluating profitability and market sentiment for companies in the chemicals sector like ILCO. A lower-than-average P/E ratio can sometimes signal undervalued shares, particularly when the company has a positive earnings track record.

ILCO’s P/E stands well below the Asian Chemicals industry average of 23.7x and the peer average of 34.6x. This sizeable discount suggests the market may not fully recognize ILCO's ability to generate strong earnings, despite recent earnings growth over five years and high-quality reporting. Such a gap can present a potential catch-up opportunity if investor sentiment changes.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.6x (UNDERVALUED)

However, slower recent returns and uncertain earnings growth remain risks that could quickly shift sentiment or limit the long-term upside of the stock.

Find out about the key risks to this Israel narrative.

Another View: What Does the SWS DCF Model Say?

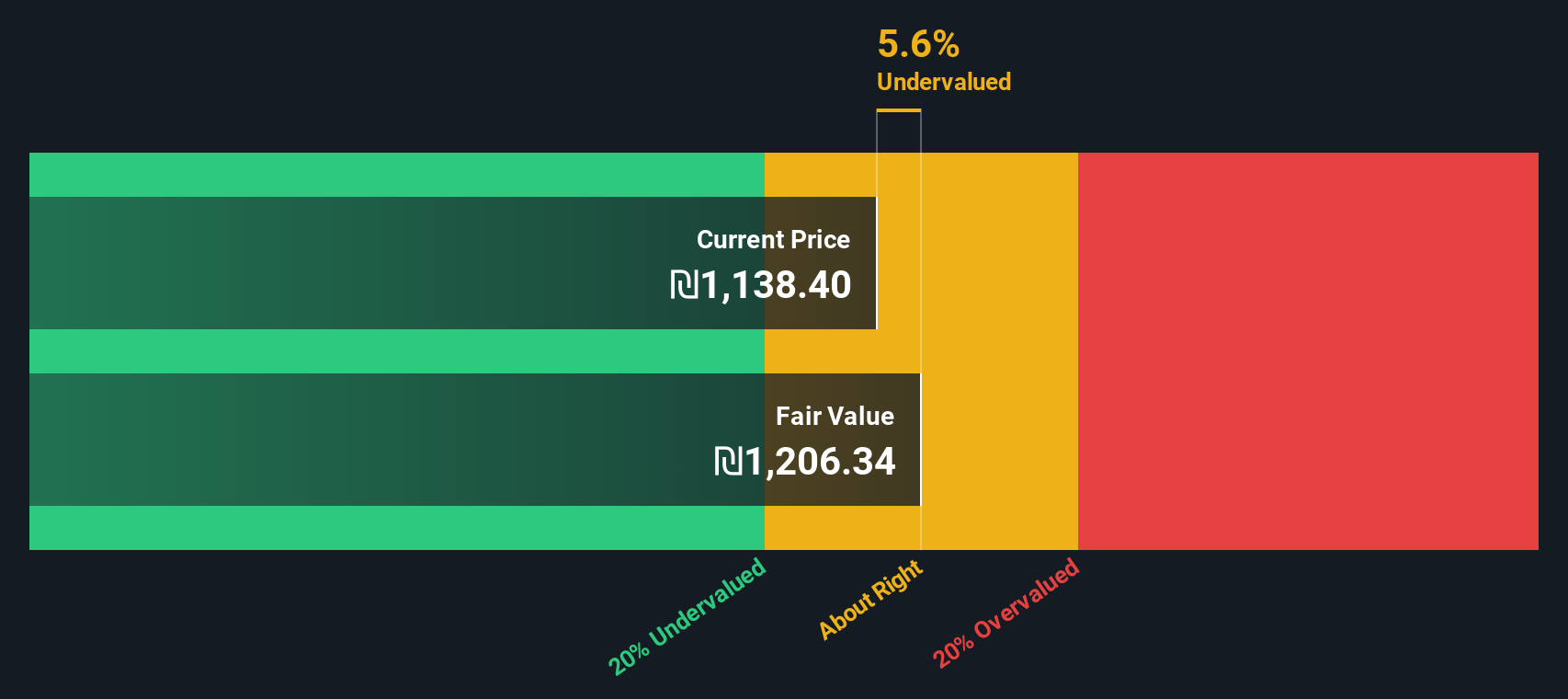

Looking at Israel’s valuation through the SWS DCF model provides another perspective. This approach estimates that shares are trading around 11.6% below their calculated fair value, suggesting the stock could have further upside. However, does a discounted price always mean an obvious buying opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Israel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Israel Narrative

It’s worth exploring the numbers for yourself and drawing your own conclusions. Building a personalized view takes just minutes—Do it your way.

A great starting point for your Israel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons now and get ahead of market trends with curated stock lists that highlight tomorrow’s winners before the crowd catches on.

- Boost your income strategy by evaluating companies with attractive yields through these 19 dividend stocks with yields > 3%.

- Capitalize on breakthrough innovation by tapping into these 24 AI penny stocks which are fueling the next big shift in technology and automation.

- Spot value before Wall Street does by targeting these 900 undervalued stocks based on cash flows that may be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ILCO

Israel

Operates in the specialty minerals and chemical businesses in Europe, Asia, South America, North America, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives