The Middle Eastern stock markets have been experiencing a subdued phase, largely influenced by weak oil prices and cautious investor sentiment as they await key U.S. economic data. Despite these challenges, the region continues to offer intriguing opportunities for investors willing to explore beyond established giants. Penny stocks, often representing smaller or newer companies, remain an attractive option for those seeking affordability and growth potential in the current market landscape. In this article, we will discuss three such stocks that stand out for their financial strength and potential value.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.913 | ₪208.85M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.00 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.96 | SAR998M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.45 | AED14.58B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.733 | ₪214.54M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Akfen Gayrimenkul Yatirim Ortakligi (IBSE:AKFGY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Akfen Gayrimenkul Yatirim Ortakligi, operating as Akfen Real Estate Investment Trust Inc., is a company that evolved from Aksel Tourism Investments and Management Inc. through rebranding and restructuring, with a market cap of TRY10.52 billion.

Operations: The company's revenue is primarily derived from Real Estate Investments, totaling TRY1.21 billion.

Market Cap: TRY10.52B

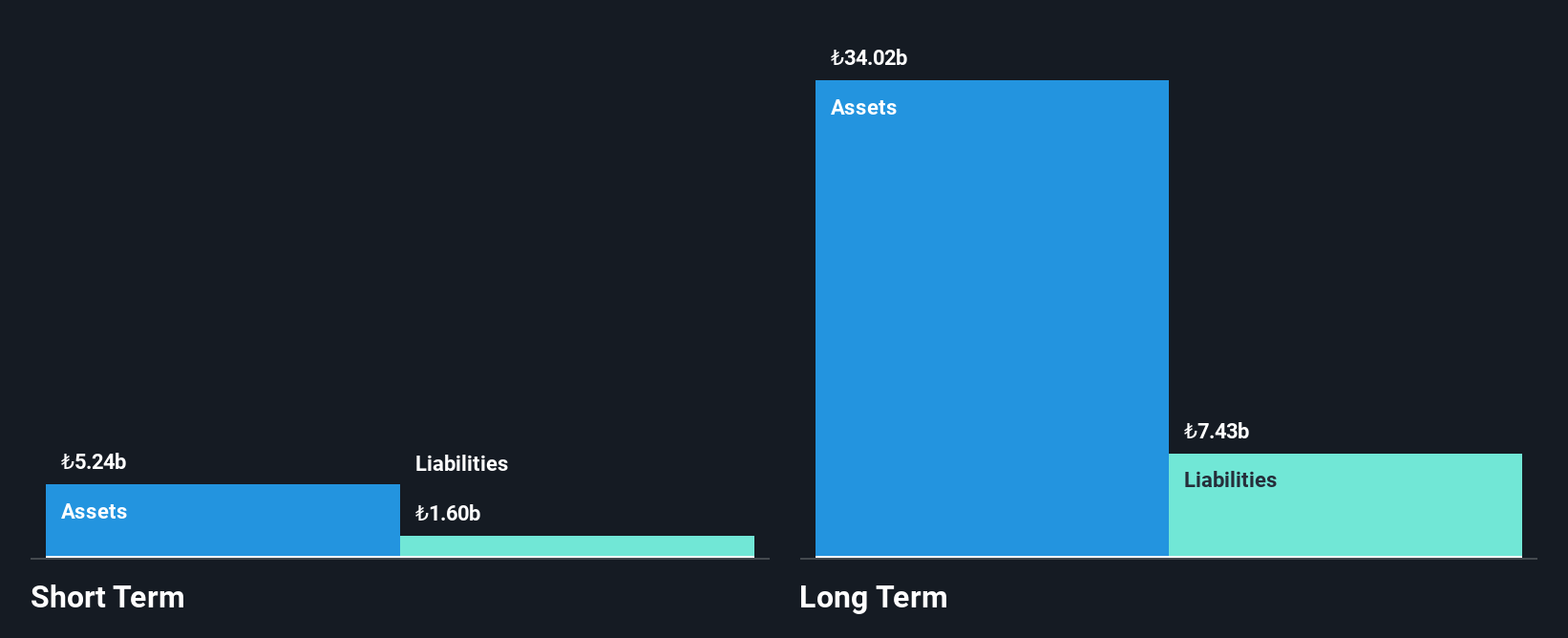

Akfen Gayrimenkul Yatirim Ortakligi has shown significant improvement by becoming profitable recently, with a notable reduction in its debt-to-equity ratio from 381.1% to 13.5% over five years, and interest payments well covered by EBIT at 3.7 times. However, the company faces challenges with long-term liabilities exceeding short-term assets and a low return on equity of 3.5%. Despite these hurdles, it offers value with a price-to-earnings ratio of 10.1x below the Turkish market average and stable weekly volatility over the past year at 5%. Recent earnings were impacted by a large one-off gain of TRY594.9 million.

- Navigate through the intricacies of Akfen Gayrimenkul Yatirim Ortakligi with our comprehensive balance sheet health report here.

- Explore historical data to track Akfen Gayrimenkul Yatirim Ortakligi's performance over time in our past results report.

Bram Industries (TASE:BRAM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bram Industries Ltd. operates through its subsidiaries in the development, production, and marketing of plastic products using injection-molding technology in Israel, with a market cap of ₪28.03 million.

Operations: The company generates revenue from two main segments: Packaging for the Food Industry, contributing ₪53.99 million, and Home Essentials Products - Plastic Products, adding ₪0.67 million.

Market Cap: ₪28.03M

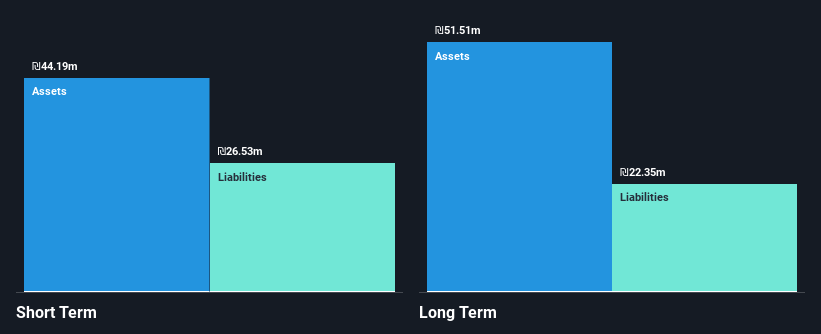

Bram Industries Ltd., with a market cap of ₪28.03 million, operates in the plastic products sector and has shown some financial resilience despite ongoing challenges. The company's short-term assets of ₪35.5 million exceed both its short-term liabilities of ₪22.1 million and long-term liabilities of ₪19.8 million, indicating solid liquidity management. However, it remains unprofitable with a net loss reduction from ILS 1.13 million to ILS 0.36 million year-over-year for Q3 2025, reflecting gradual improvements but persistent profitability issues. Despite debt reduction over five years, operating cash flow coverage remains weak at 7.8% against debt obligations.

- Click here to discover the nuances of Bram Industries with our detailed analytical financial health report.

- Understand Bram Industries' track record by examining our performance history report.

Utron (TASE:UTRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Utron Ltd specializes in the planning, development, production, construction, marketing, and maintenance of autonomous parking solutions with a market cap of ₪102.75 million.

Operations: The company's revenue is derived entirely from the Heavy Construction segment, totaling ₪101.91 million.

Market Cap: ₪102.75M

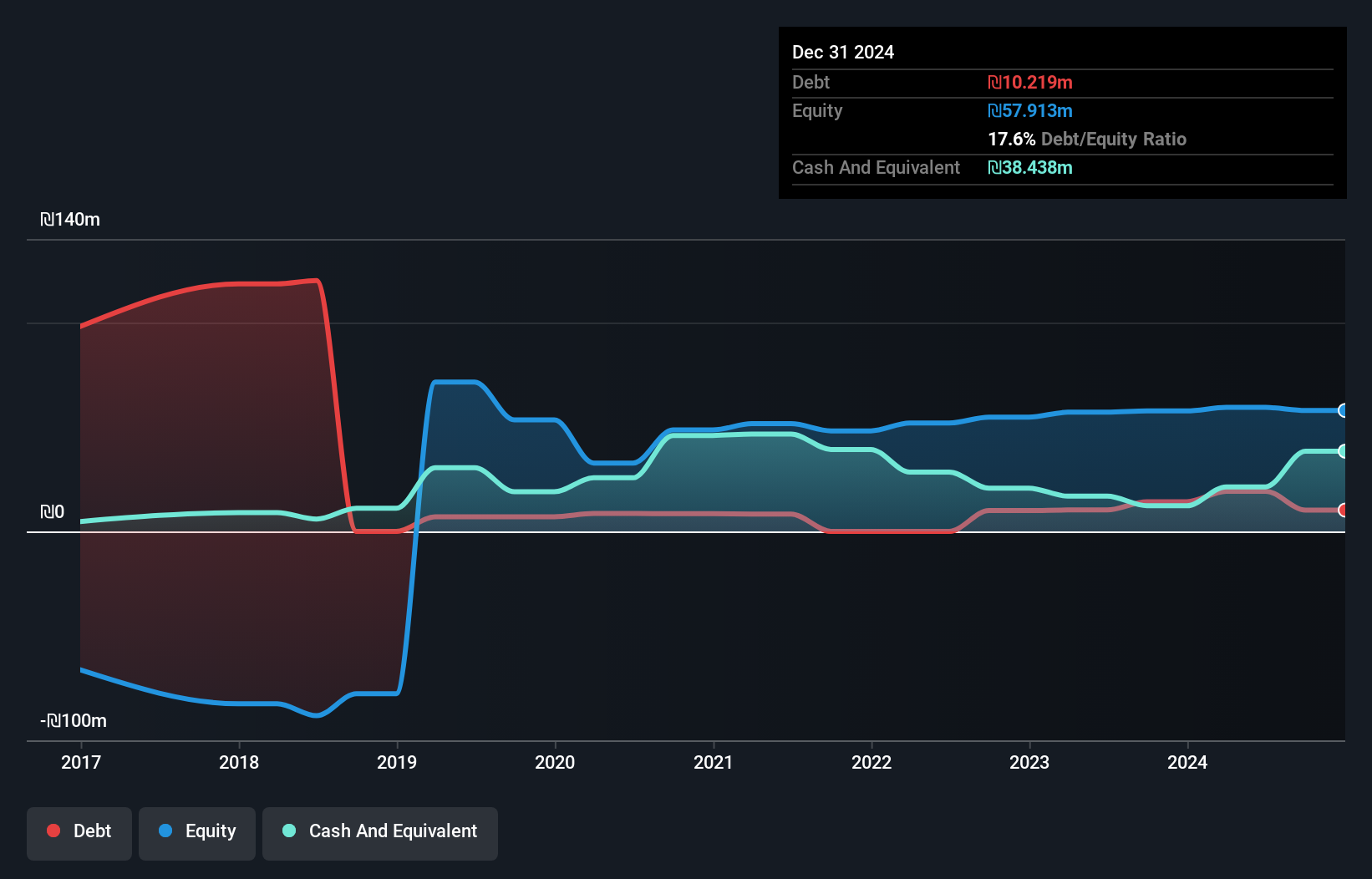

Utron Ltd., with a market cap of ₪102.75 million, demonstrates financial stability in the autonomous parking solutions sector. The company has reduced its debt to equity ratio significantly over five years and maintains more cash than total debt, ensuring robust liquidity. Utron's earnings growth of 71.6% last year outpaced the industry average, although it is below its impressive 5-year growth rate of 86.2% annually. Despite low return on equity at 2.6%, Utron's profit margins have improved from 0.9% to 1.4%. The management and board are experienced, supporting strategic decision-making for future growth prospects.

- Take a closer look at Utron's potential here in our financial health report.

- Gain insights into Utron's historical outcomes by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 77 Middle Eastern Penny Stocks.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bram Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:BRAM

Bram Industries

Through its subsidiaries, engages in the development, production, and marketing of plastic products using injection-molding technology in Israel.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026