Libra Insurance (TASE:LBRA) Net Profit Margin Reaches 10.1%, Reinforcing Bullish Sentiment

Reviewed by Simply Wall St

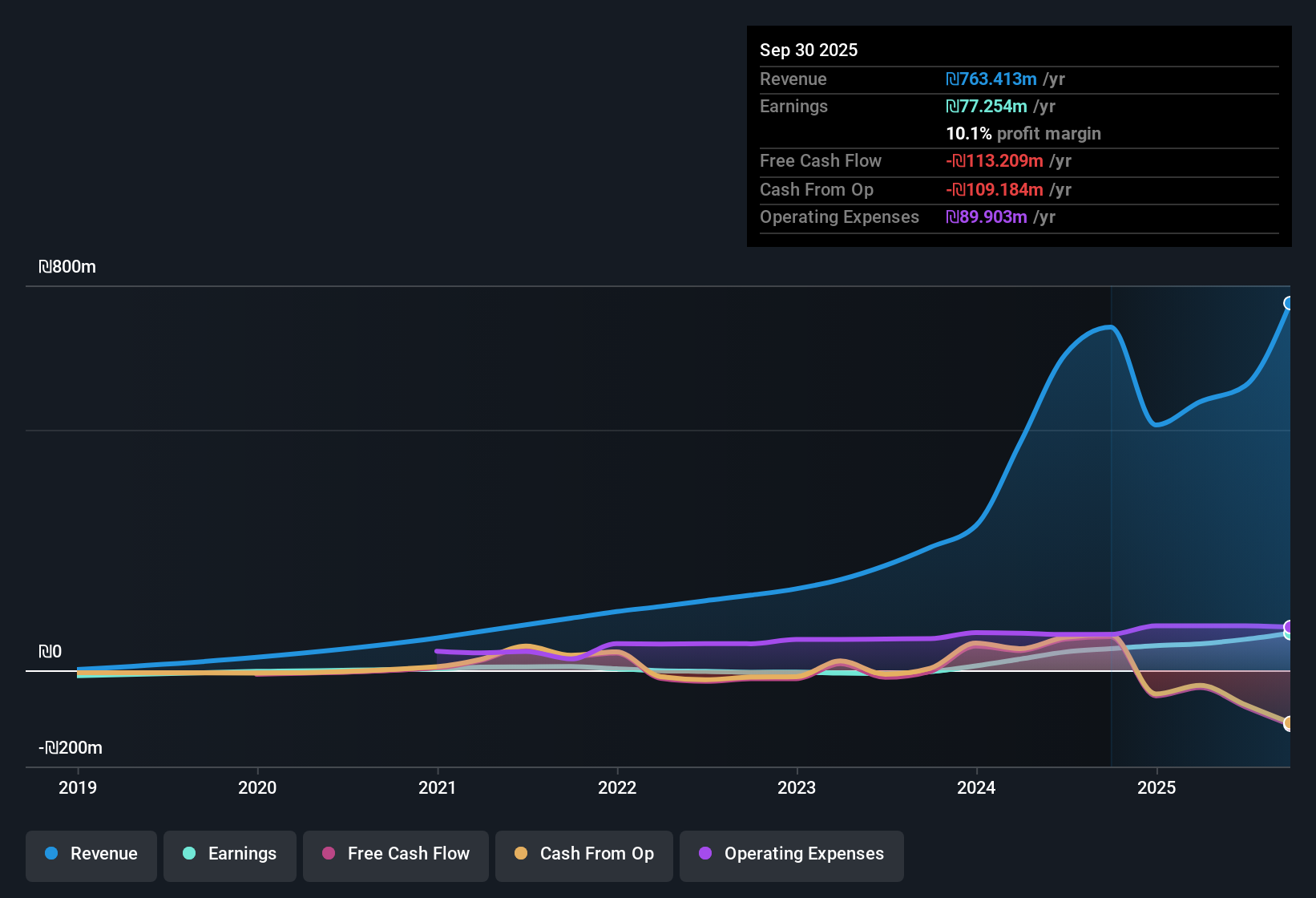

Libra Insurance (TASE:LBRA) just posted Q3 2025 results, booking total revenue of 310.2 million ILS and basic EPS of 0.53 ILS, with net income (excluding extraordinary items) of 24.0 million ILS for the quarter. The company has seen revenue climb from 138.0 million ILS in Q3 last year to its current level. EPS moved from 0.25 ILS to 0.53 ILS over the same period. Margins have held firm, signaling solid profitability as investors digest this quarter’s earnings release.

See our full analysis for Libra Insurance.Now, let’s see how these numbers measure up versus the prominent narratives investors and analysts have been following.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Climbs to 10.1%

- Libra Insurance’s net profit margin reached 10.1% over the past twelve months, up from 6.3% in the previous year. This is a notable improvement considering industry averages are lower.

- The prevailing market opinion suggests margin gains heavily support a stable, reliable business outlook:

- The margin increase aligns with a 71.8% earnings growth rate across the past year, outpacing the company's five-year average growth of 68.1%.

- High earnings quality accompanying these margin gains addresses analysts’ calls for durability in reported profits.

See how the latest margin growth shapes the bigger story for Libra Insurance. 📊 Read the full Libra Insurance Consensus Narrative.

Valuation Below Peers Despite Rally

- The Price-To-Earnings ratio stands at 10.4x, below both the local market average (15.1x) and the Asian insurance industry average (11.1x), even though the share price is trading at ₪17.83.

- Market view highlights an emerging valuation story:

- The lower P/E multiple means Libra is priced more attractively than many peers, even as its share price stays above the DCF fair value estimate of ₪8.96.

- This discount versus industry multiples may provide staying power for bullish investors who see the margin and growth story continuing.

Dividend Coverage Remains a Weak Spot

- Libra pays a 2.48% dividend yield, but this is not fully covered by free cash flows according to recent filings. This potentially puts future payouts at risk for income-focused investors.

- While this risk has not been classified as major, it creates a contrast with the otherwise strong narrative:

- High profitability and improved margins lessen the overall threat for now, but coverage shortfalls could become more of a concern if earnings falter or growth slows.

- Investors watching for income stability will need to weigh this point against margin and valuation strengths.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Libra Insurance's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Libra Insurance’s dividend payments are not fully covered by free cash flows. This raises concerns about the sustainability of future payouts for income-focused investors.

If reliable income matters most to you, consider these 1927 dividend stocks with yields > 3% for opportunities offering better yield coverage and greater confidence in ongoing distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:LBRA

Outstanding track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success