Unveiling 3 Undiscovered Gems In The Middle East With Promising Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently experienced a notable surge, with Saudi Arabia's benchmark index achieving its largest intraday rise since March 2020, driven by a temporary pause on tariffs by the U.S. This vibrant market environment presents an opportune moment to explore stocks that exhibit strong fundamentals and growth potential, which are essential qualities for investors seeking promising opportunities in this dynamic region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Investco Holding (IBSE:INVES)

Simply Wall St Value Rating: ★★★★★★

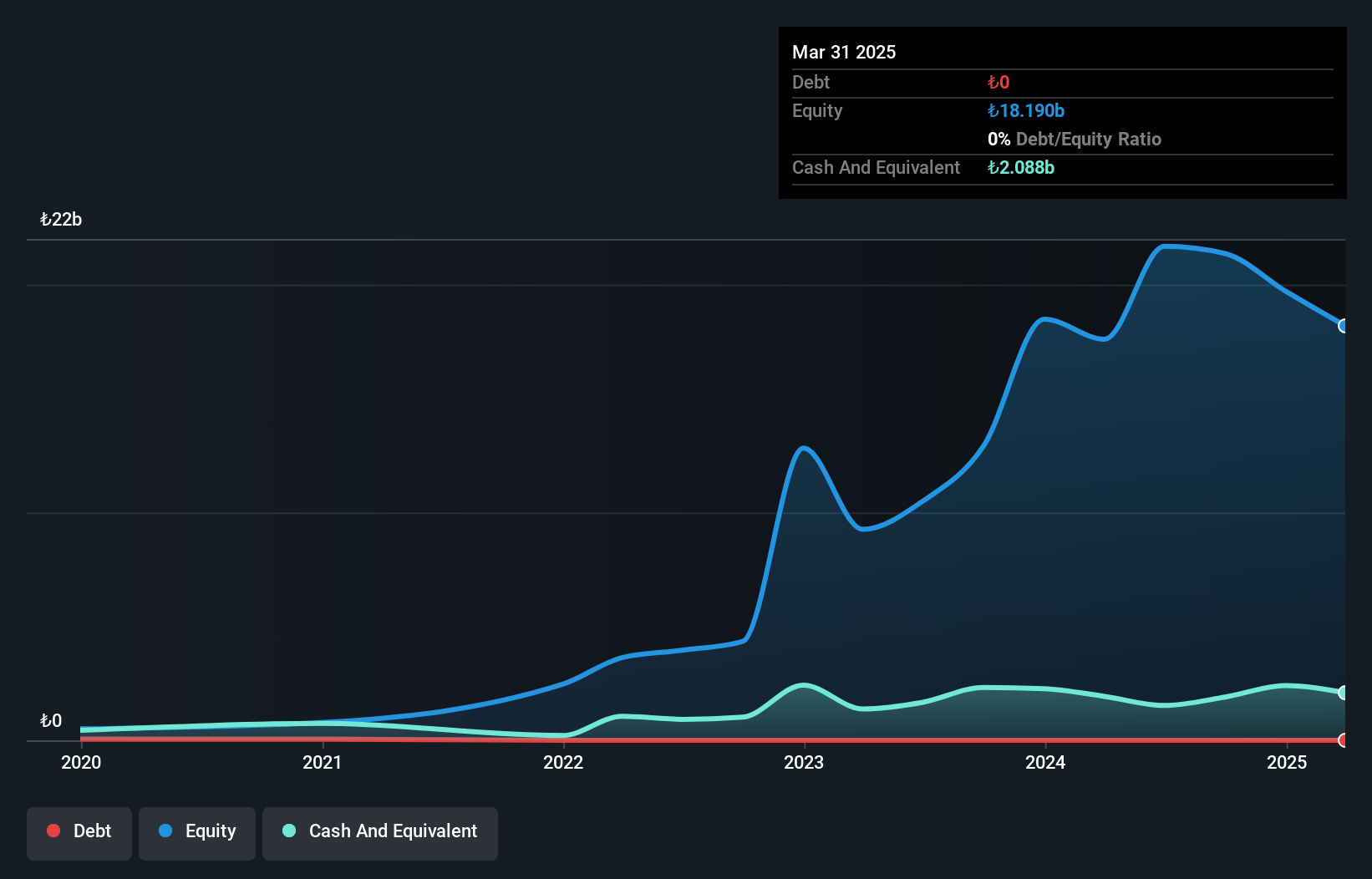

Overview: Investco Holding A.S. is an investment company based in Turkey with a market capitalization of TRY44.87 billion.

Operations: Investco generates revenue primarily through its investment activities in Turkey. The company reported a gross profit margin of 35% in the most recent period.

Investco Holding, a smaller player in the financial sector, has shown remarkable earnings growth of 2104.9% over the past year, significantly outpacing the industry's 37.6%. The company reported sales of TRY 3.19 billion and net income of TRY 1.46 billion for the full year ending December 2024, marking a substantial increase from previous figures. Despite its highly volatile share price recently, Investco is debt-free now compared to five years ago when it had a debt-to-equity ratio of 10.4%. These factors suggest strong earnings quality and potential resilience in its financial performance amidst market fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Investco Holding.

Assess Investco Holding's past performance with our detailed historical performance reports.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individual and corporate clients in Israel, with a market capitalization of approximately ₪2.47 billion.

Operations: The company generates revenue primarily from its general insurance segment, with automobile property insurance contributing ₪1.95 billion and compulsory vehicle insurance adding ₪642.83 million. Life insurance and long-term savings provide an additional revenue stream of ₪373.32 million, while health insurance contributes ₪279 million.

I.D.I. Insurance, a smaller player in the Middle East insurance sector, has shown resilience with its debt to equity ratio dropping from 81.4% to 48.7% over five years, indicating improved financial health. Although earnings have decreased by 2.1% annually over the past five years, recent performance is promising with net income rising to ILS 257 million from ILS 139 million last year and basic earnings per share increasing to ILS 17.49 from ILS 9.48. The company’s interest payments are well covered by EBIT at a robust coverage of 21 times, suggesting strong operational efficiency and stability in servicing its obligations.

- Unlock comprehensive insights into our analysis of I.D.I. Insurance stock in this health report.

Evaluate I.D.I. Insurance's historical performance by accessing our past performance report.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★★

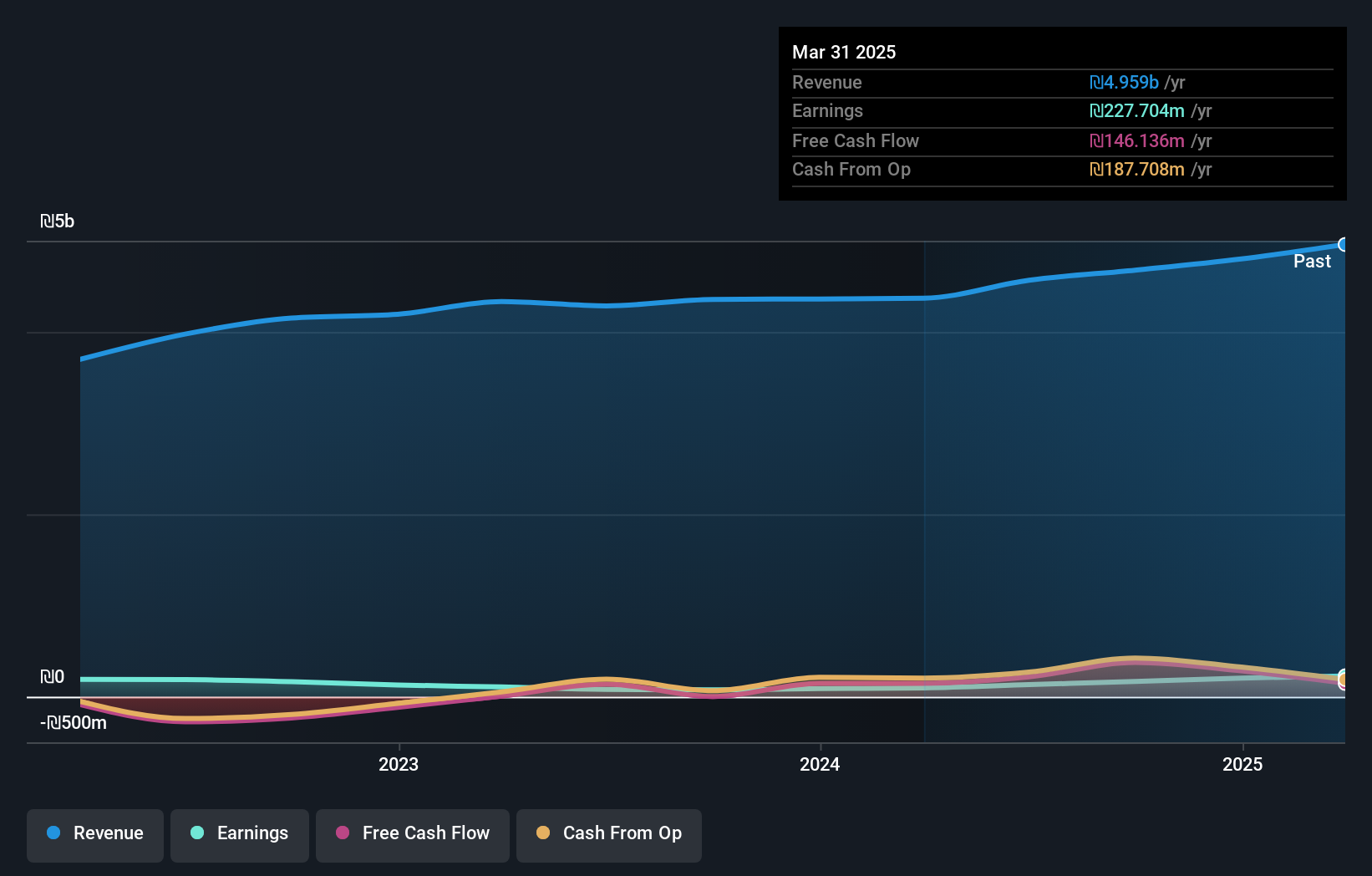

Overview: Neto Malinda Trading Ltd. is engaged in the manufacturing, importing, marketing, and distribution of kosher food products with a market cap of ₪2.09 billion.

Operations: Neto Malinda Trading generates revenue primarily through the sale of kosher food products. The company has a market cap of ₪2.09 billion and focuses on manufacturing, importing, marketing, and distribution activities within its sector.

Neto Malinda Trading, a small cap in the Middle East, has shown impressive financial performance with earnings growth of 131% over the past year, outpacing its industry. The firm trades at 82% below its estimated fair value and boasts a robust debt-to-equity ratio improvement from 3.9% to 2.6% over five years. With net income rising to ILS 204 million from ILS 88 million year-on-year, it seems poised for continued success. Additionally, high-quality earnings and positive free cash flow signal strong operational health and potential for future value creation within the food sector.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 244 Middle Eastern Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:IDIN

I.D.I. Insurance

Provides insurance products and services to individuals and corporate customers in Israel.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives