- Japan

- /

- Entertainment

- /

- TSE:3932

Unearthing Hidden Gems: Promising Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with major indices like the Russell 2000 experiencing underperformance compared to their larger-cap counterparts, investors are keenly observing the Federal Reserve's anticipated rate cut and its potential impact on market dynamics. Amidst this backdrop, small-cap stocks present intriguing opportunities for those willing to explore beyond the mainstream; these companies often offer unique growth prospects that can be particularly appealing when broader market sentiment is cautious.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.86% | 6.39% | 4.69% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

I.D.I. Insurance (TASE:IDIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.D.I. Insurance Company Ltd. offers a range of insurance products and services to both individuals and corporate clients in Israel, with a market capitalization of approximately ₪1.97 billion.

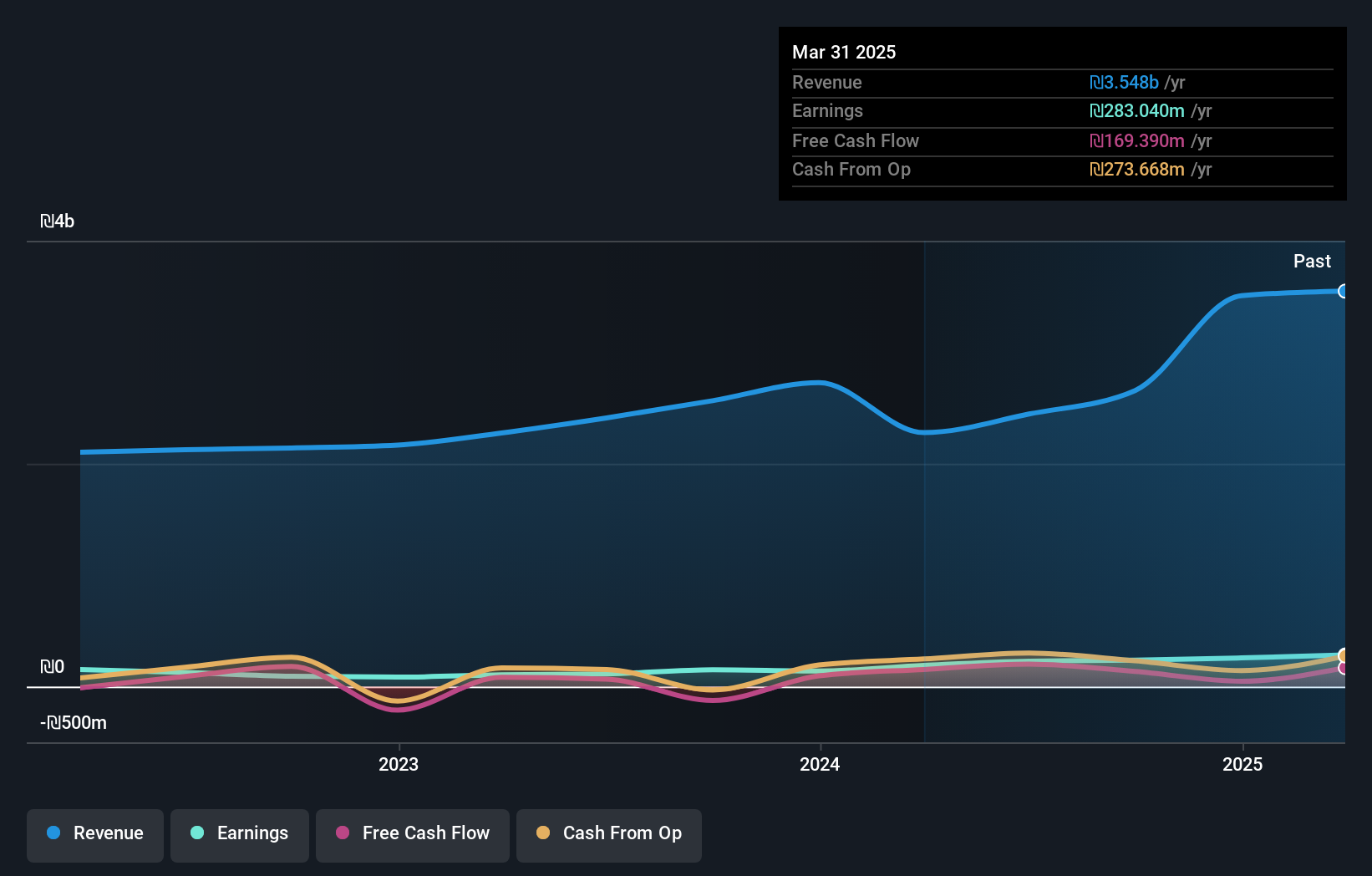

Operations: I.D.I. Insurance's primary revenue stream is from General Insurance, with Automobile Property Insurance contributing ₪1.80 billion and Compulsory Vehicle Insurance adding ₪596 million. Life Insurance and Long-Term Savings generate additional revenue of ₪363.24 million, while Health insurance contributes ₪276.86 million.

I.D.I. Insurance, a smaller player in the insurance industry, has shown some intriguing financial dynamics recently. Despite a 4.6% annual earnings decline over the past five years, it reported significant revenue growth for Q3 2024 at ILS 918 million compared to ILS 708 million last year. The net income also rose to ILS 59.6 million from ILS 51.3 million previously, with basic EPS increasing to ILS 4.06 from ILS 3.5 a year ago, suggesting improved profitability metrics despite broader challenges in outperforming industry growth rates of up to nearly triple its own pace last year at around 186%.

- Navigate through the intricacies of I.D.I. Insurance with our comprehensive health report here.

Understand I.D.I. Insurance's track record by examining our Past report.

Isrotel (TASE:ISRO)

Simply Wall St Value Rating: ★★★★☆☆

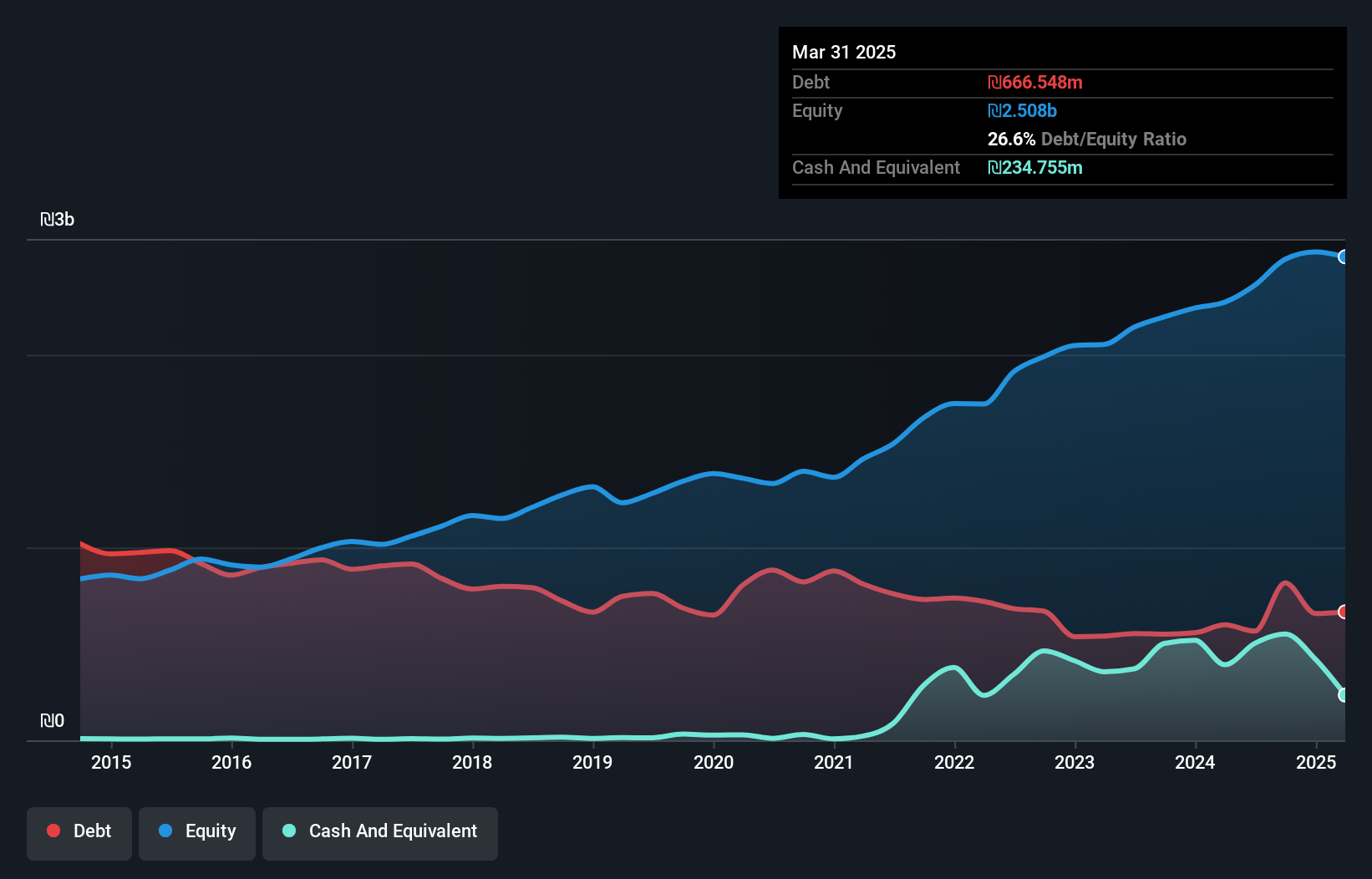

Overview: Isrotel Ltd. operates and manages a chain of hotels in Israel with a market cap of ₪4.84 billion.

Operations: Revenue from hotels and motels is ₪1.77 billion.

Isrotel, a notable player in the hospitality sector, has demonstrated robust earnings growth of 26.3% annually over the last five years, although recent growth at 17.9% lagged behind the industry's 28.4%. The company boasts high-quality earnings and a satisfactory net debt to equity ratio of 10.6%, with interest payments well covered by EBIT at 24.6x coverage. However, shareholders faced dilution recently and free cash flow remains negative. Recent financials reveal improved performance with third-quarter net income rising to ILS 129.53 million from ILS 102.04 million year-on-year, reflecting increased basic earnings per share from continuing operations at ILS 2.31 compared to ILS 1.83 previously.

- Get an in-depth perspective on Isrotel's performance by reading our health report here.

Assess Isrotel's past performance with our detailed historical performance reports.

Akatsuki (TSE:3932)

Simply Wall St Value Rating: ★★★★★★

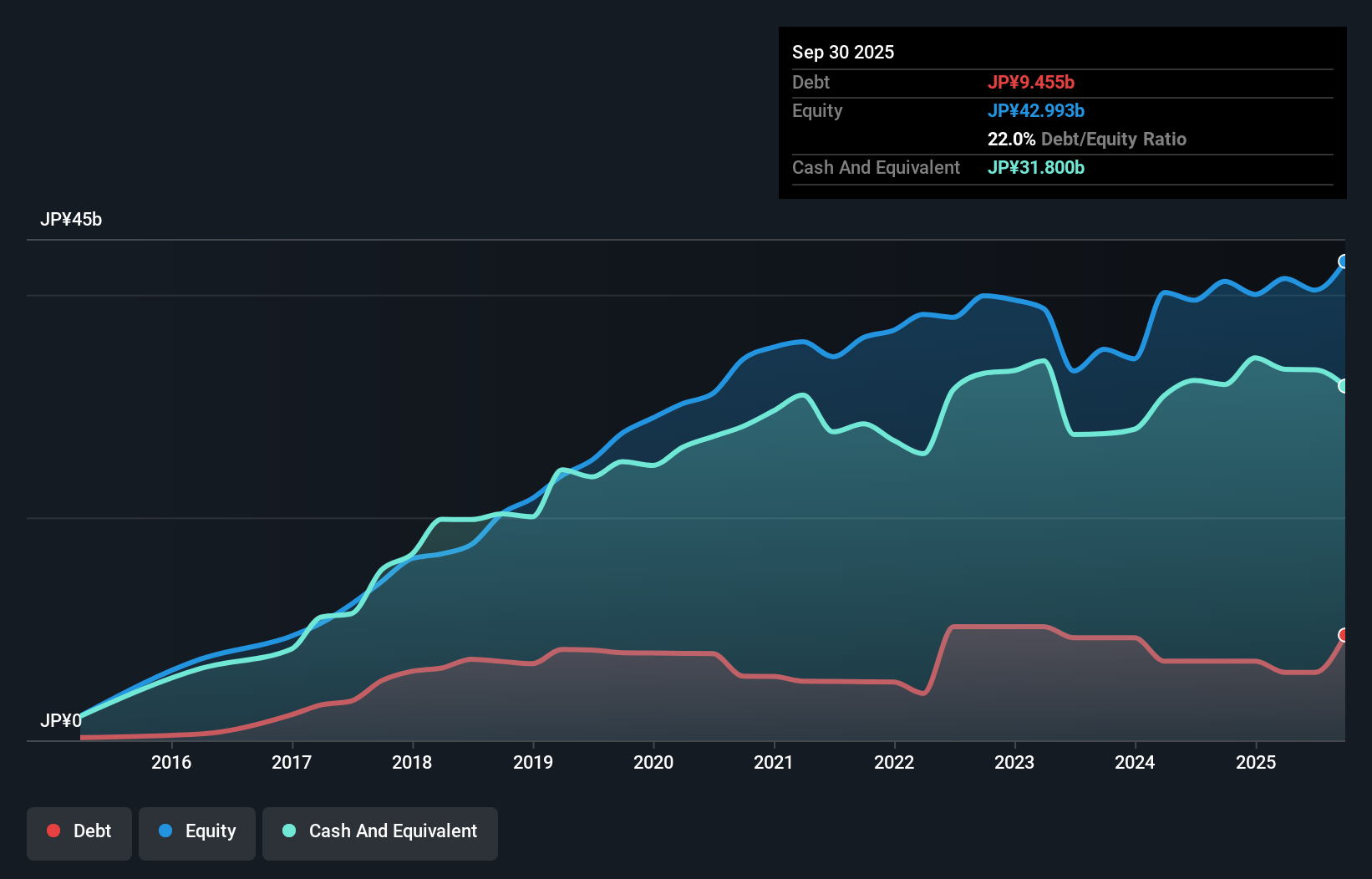

Overview: Akatsuki Inc. is a Japanese company that operates in the gaming, comic, and other sectors with a market cap of ¥39.16 billion.

Operations: Akatsuki generates revenue primarily from its game segment, contributing ¥23.07 billion, and a smaller portion from comics at ¥1.03 billion. The company's net profit margin reflects its financial performance dynamics without specific percentage details provided in the data available.

Akatsuki shines with a robust earnings growth of 172% over the past year, significantly outpacing the Entertainment sector's -7% performance. The company seems to be trading at an attractive valuation, reportedly 58% below its estimated fair value. Over five years, it has improved its financial health by reducing its debt-to-equity ratio from 28.5 to 17.2, indicating prudent management of liabilities. Although shareholders faced dilution recently, Akatsuki's high-quality earnings and projected annual growth rate of 42% suggest promising potential in the coming years within its industry context.

- Unlock comprehensive insights into our analysis of Akatsuki stock in this health report.

Examine Akatsuki's past performance report to understand how it has performed in the past.

Taking Advantage

- Delve into our full catalog of 4507 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3932

Akatsuki

Engages in the entertainment, lifestyle, and solutions businesses in Japan.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success