I.D.I. Insurance (TASE:IDIN) Margin Decline Challenges Bull Case Despite Strong Q3 Earnings Growth

Reviewed by Simply Wall St

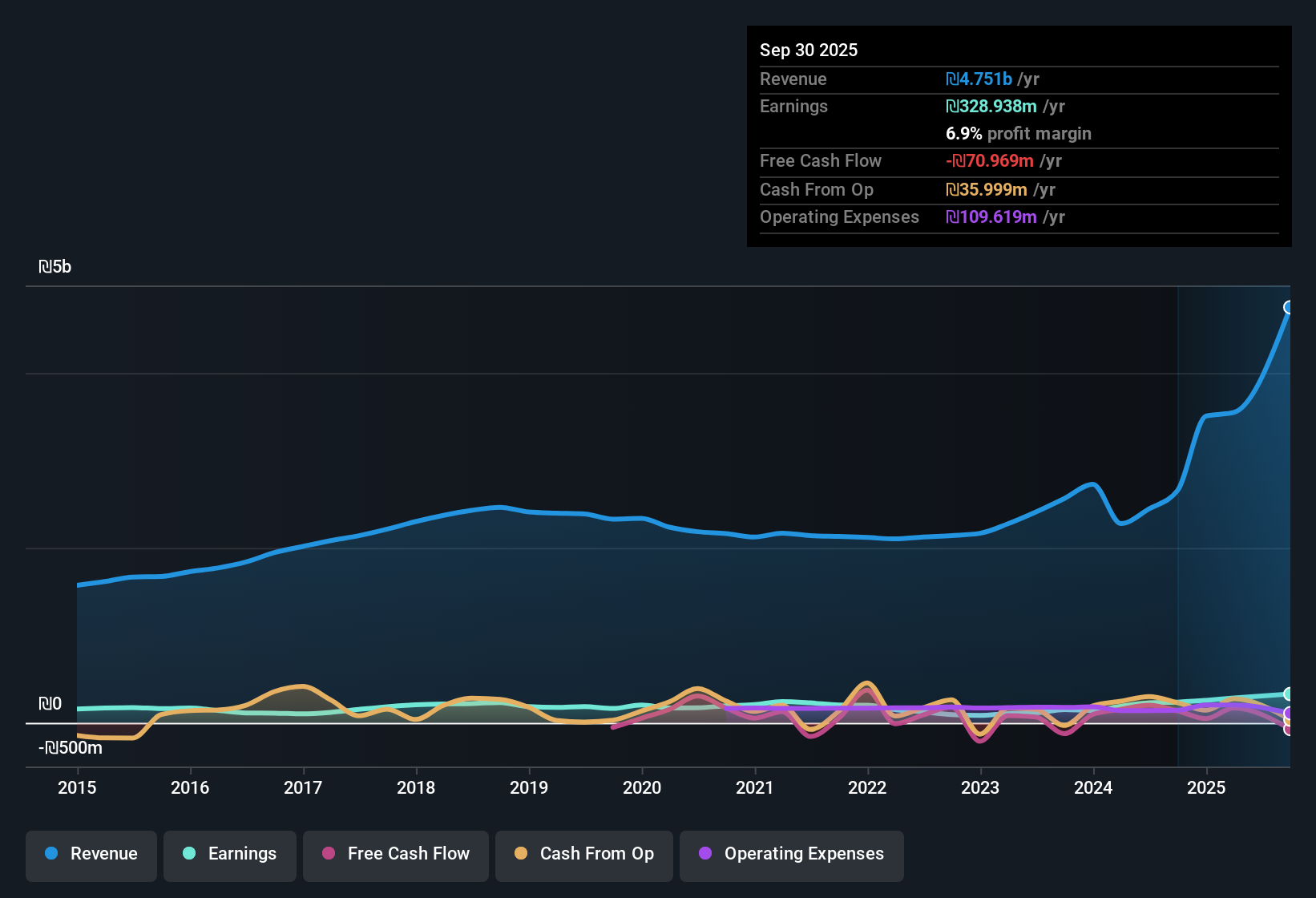

I.D.I. Insurance (TASE:IDIN) has just posted its Q3 2025 results, reporting total revenue of ₪1.08 billion and basic EPS of ₪5.6. The company’s net income for the period came in at ₪82.7 million. Looking back, total revenue has climbed steadily over the last year, with trailing twelve month revenue reaching ₪4.8 billion and net income of ₪328.9 million, while EPS moved up from ₪16.10 to ₪22.33. Margins have seen some pressure this period, shifting investor attention towards how profitability may trend from here.

See our full analysis for I.D.I. Insurance.With the numbers on the table, it’s time to weigh how they align with or disrupt the main investor narratives around I.D.I. Insurance. Let’s see which stories get a boost and what’s up for debate in light of these latest results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Dip as Net Profit Growth Surges

- Net profit margins slipped to 6.9%, down from last year’s 8.9%, even as net income over the trailing twelve months reached ₪328.9 million.

- Despite the margin slide, prevailing market opinion sees the company’s rapid 39.2% earnings growth as a strong positive. This is contrasted with the caution that such margin compression could limit upside if expenses stay elevated.

- The high earnings quality rating and a solid track record help counter worries about temporary margin weakness. However, the dip in profitability may restrain bullish sentiment as investors watch for margin recovery.

- Consensus narrative notes stable profit growth but acknowledges that lower margins and recent volatility keep risk in play, especially for income-focused investors.

- Bears remain skeptical of a full rebound in profitability without evidence of margin stabilization, while bulls believe earnings momentum will outweigh near-term pressures.

Valuation Looks Attractive vs. Peers

- The Price-to-Earnings ratio stands at 11x, lower than both the Israeli market’s 15.1x and peers’ 13x, signaling a value-oriented multiple that many investors find appealing.

- Prevailing market commentary credits this below-market valuation as a key reason value-oriented investors remain interested. However, the DCF fair value of ₪182.99 is below the current share price of ₪245.

- The valuation gap stands out: although the share trades at a discount to peers, it sits above calculated fair value. Future returns may depend more on additional earnings growth or rerating.

- Consensus narrative critics highlight that attractive multiples can coexist with risks, especially when margins are trending lower and the dividend coverage is under pressure.

Dividend Yield Draws Attention, but Coverage Concerns Persist

- The 5.36% dividend yield outpaces most peers, yet is not fully covered by free cash flows, according to the recent risk summary.

- Prevailing market view emphasizes the duality here: income-seekers might be drawn by the headline yield, while more cautious investors point to the lack of reliable free cash flow coverage as a lingering red flag.

- Critics highlight that high share price volatility over the recent three months, above the broader Israeli market, makes the stock more sensitive to any dividend disappointment.

- Consensus narrative flags that consistent profit growth and attractive valuation are somewhat counterbalanced by coverage risks, keeping the stock in “watchlist” territory for yield-focused buyers.

- Want to see if analysts expect margin improvements or continuing risks? The full consensus narrative breaks down both sides. 📊 Read the full I.D.I. Insurance Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on I.D.I. Insurance's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

I.D.I. Insurance’s falling margins and uncovered dividend raise red flags for investors relying on resilient income and financial stability.

If you prefer dividend payouts that are better protected by cash flow and lower risk of disappointment, check out these 1927 dividend stocks with yields > 3% now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:IDIN

I.D.I. Insurance

Provides insurance products and services to individuals and corporate customers in Israel.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success