- Israel

- /

- Medical Equipment

- /

- TASE:SOFW

We Think Some Shareholders May Hesitate To Increase SofWave Medical Ltd.'s (TLV:SOFW) CEO Compensation

Key Insights

- SofWave Medical's Annual General Meeting to take place on 17th of September

- Total pay for CEO Louis Scafuri includes US$547.0k salary

- Total compensation is 460% above industry average

- Over the past three years, SofWave Medical's EPS grew by 6.8% and over the past three years, the total loss to shareholders 26%

In the past three years, the share price of SofWave Medical Ltd. (TLV:SOFW) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 17th of September. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for SofWave Medical

Comparing SofWave Medical Ltd.'s CEO Compensation With The Industry

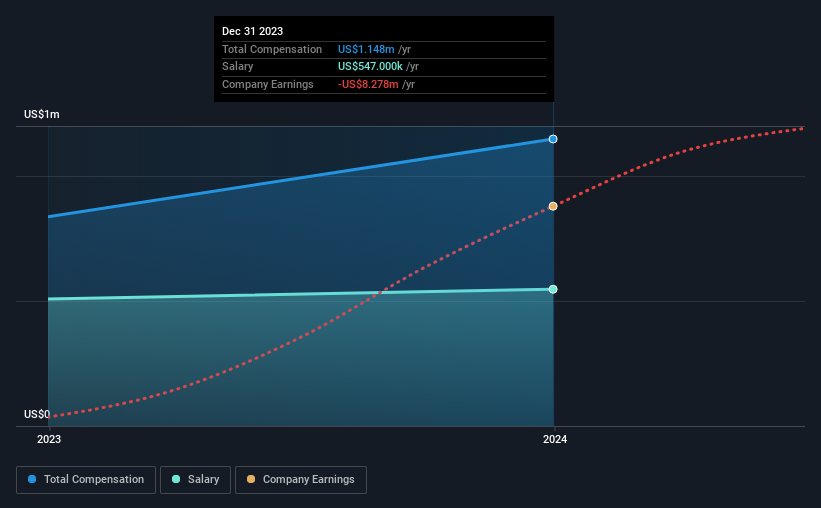

Our data indicates that SofWave Medical Ltd. has a market capitalization of ₪608m, and total annual CEO compensation was reported as US$1.1m for the year to December 2023. That's a notable increase of 37% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$547k.

In comparison with other companies in the Israel Medical Equipment industry with market capitalizations ranging from ₪377m to ₪1.5b, the reported median CEO total compensation was US$205k. Hence, we can conclude that Louis Scafuri is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$547k | US$508k | 48% |

| Other | US$601k | US$329k | 52% |

| Total Compensation | US$1.1m | US$837k | 100% |

Speaking on an industry level, nearly 87% of total compensation represents salary, while the remainder of 13% is other remuneration. In SofWave Medical's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

SofWave Medical Ltd.'s Growth

SofWave Medical Ltd. has seen its earnings per share (EPS) increase by 6.8% a year over the past three years. In the last year, its revenue is up 24%.

We think the revenue growth is good. And, while modest, the EPS growth is noticeable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has SofWave Medical Ltd. Been A Good Investment?

With a three year total loss of 26% for the shareholders, SofWave Medical Ltd. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for SofWave Medical that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SOFW

SofWave Medical

Engages in the development, production, marketing, support, and distribution of ultrasound technology for non-invasive skin rejuvenation and firming treatment in Israel and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives