- Israel

- /

- Medical Equipment

- /

- TASE:SOFW

Loss-making SofWave Medical (TLV:SOFW) has seen earnings and shareholder returns follow the same downward trajectory over past -50%

SofWave Medical Ltd. (TLV:SOFW) shareholders will doubtless be very grateful to see the share price up 50% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 50% in the last year, significantly under-performing the market.

On a more encouraging note the company has added ₪49m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for SofWave Medical

Because SofWave Medical made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year SofWave Medical saw its revenue grow by 63%. That's well above most other pre-profit companies. Given the revenue growth, the share price drop of 50% seems quite harsh. Our sympathies to shareholders who are now underwater. On the bright side, if this company is moving profits in the right direction, top-line growth like that could be an opportunity. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

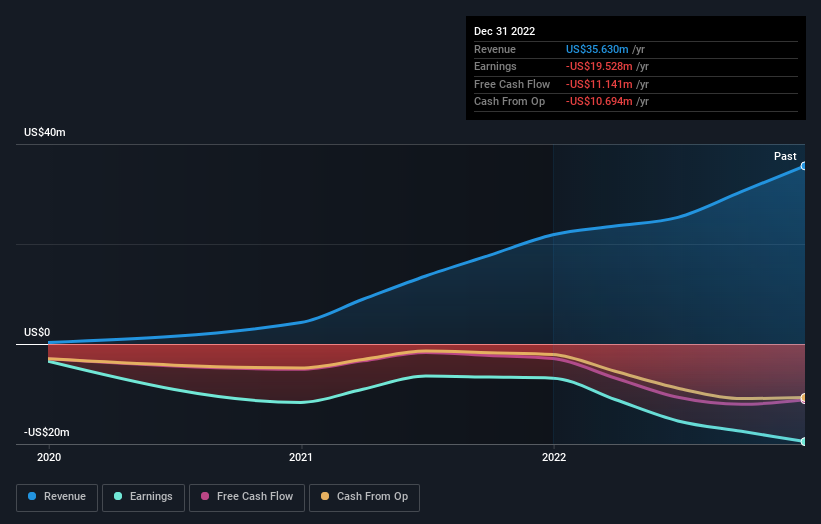

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on SofWave Medical's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

SofWave Medical shareholders are down 50% for the year, even worse than the market loss of 22%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 50% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that SofWave Medical is showing 1 warning sign in our investment analysis , you should know about...

But note: SofWave Medical may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:SOFW

SofWave Medical

Engages in the development, production, marketing, support, and distribution of ultrasound technology for non-invasive skin rejuvenation and firming treatment in Israel and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives