- Israel

- /

- Medical Equipment

- /

- TASE:BWAY

After Leaping 25% BrainsWay Ltd. (TLV:BWAY) Shares Are Not Flying Under The Radar

Those holding BrainsWay Ltd. (TLV:BWAY) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 97% in the last year.

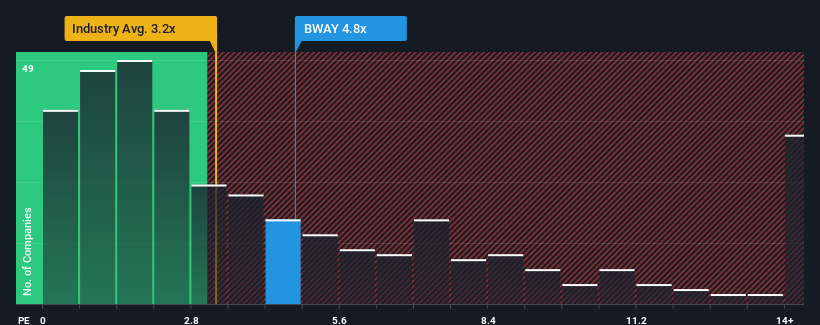

After such a large jump in price, you could be forgiven for thinking BrainsWay is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.8x, considering almost half the companies in Israel's Medical Equipment industry have P/S ratios below 3.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in BrainsWay. Read for free now.View our latest analysis for BrainsWay

What Does BrainsWay's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, BrainsWay has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on BrainsWay will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

BrainsWay's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Pleasingly, revenue has also lifted 38% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 21% over the next year. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

With this information, we can see why BrainsWay is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does BrainsWay's P/S Mean For Investors?

BrainsWay shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into BrainsWay shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with BrainsWay, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BrainsWay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BWAY

BrainsWay

Develops and sells noninvasive neurostimulation treatments for mental health disorders in the United States, East Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026