As global markets continue to navigate geopolitical tensions and economic uncertainties, U.S. indices are approaching record highs with broad-based gains, driven by a strong labor market and positive sentiment from housing reports. In this dynamic environment, dividend stocks remain an attractive option for investors seeking steady income streams; they can offer stability amid market fluctuations while potentially benefiting from favorable economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.78% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Aboitiz Power (PSE:AP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aboitiz Power Corporation, with a market cap of ₱272.74 billion, operates in the Philippines through its subsidiaries in power generation, distribution, and electricity retail businesses.

Operations: Aboitiz Power Corporation generates revenue primarily from its power generation segment, which accounts for ₱126.49 billion, and its power distribution segment, contributing ₱55.87 billion.

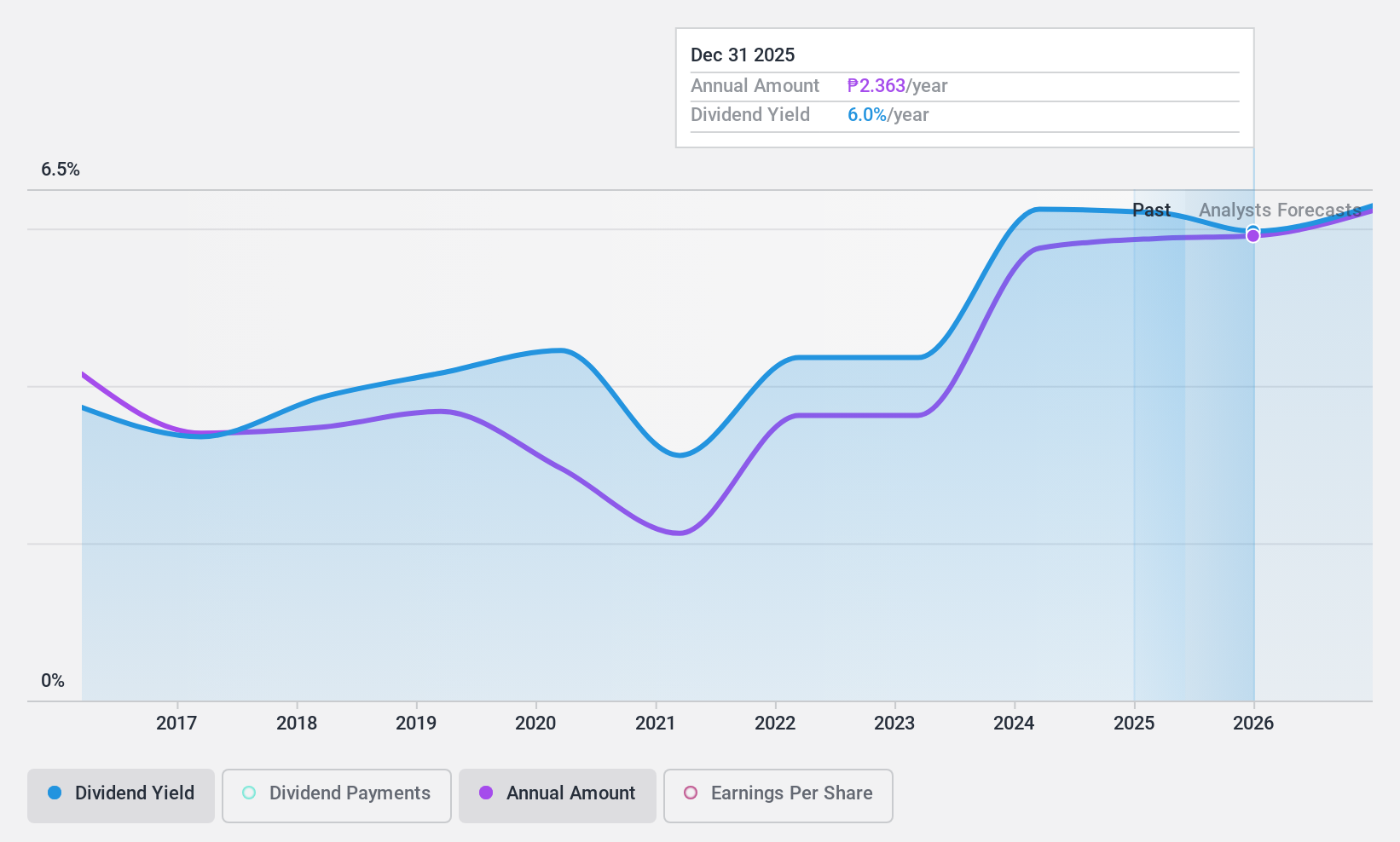

Dividend Yield: 6.1%

Aboitiz Power has shown a steady increase in dividend payments over the past decade, though these have been volatile. Its current dividend yield of 6.08% is slightly below the top 25% of Philippine market payers. The company maintains a sustainable payout ratio with dividends covered by both earnings (49.5%) and cash flows (59.8%). Despite having high debt levels, it trades at good value relative to peers and industry benchmarks, with recent earnings growth supporting its financial position.

- Click here and access our complete dividend analysis report to understand the dynamics of Aboitiz Power.

- In light of our recent valuation report, it seems possible that Aboitiz Power is trading behind its estimated value.

Gan Shmuel Foods (TASE:GSFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gan Shmuel Foods Ltd. is an Israeli company that produces and sells citrus fruits for the beverage and food industry, with a market cap of ₪583 million.

Operations: Gan Shmuel Foods Ltd. generates its revenue from two main segments: Retailer, contributing $49.29 million, and Industrial, contributing $241.36 million.

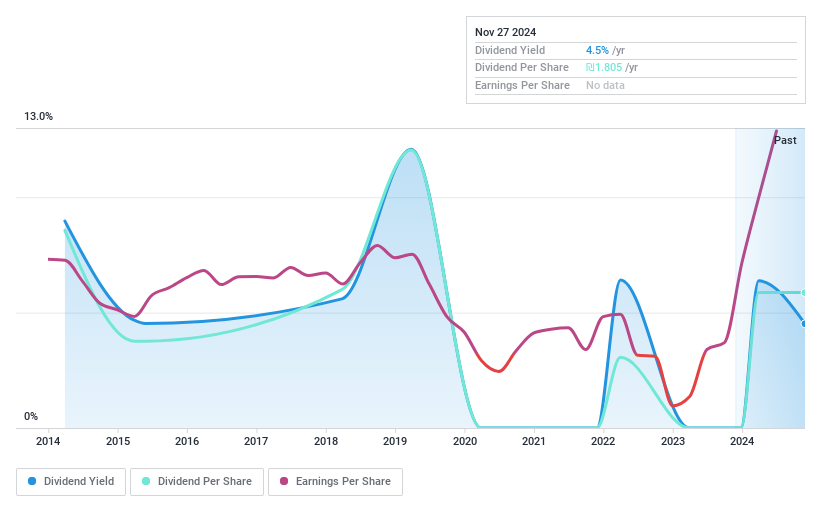

Dividend Yield: 4.7%

Gan Shmuel Foods' dividends are well covered by earnings and cash flows, with payout ratios of 21.6% and 18.4%, respectively. Despite this strong coverage, its dividend payments have been unreliable and volatile over the past decade. The company's dividend yield of 4.72% is lower than the top 25% in the IL market, though it has seen growth in dividends over ten years. Trading significantly below estimated fair value suggests potential for capital appreciation alongside income returns.

- Click to explore a detailed breakdown of our findings in Gan Shmuel Foods' dividend report.

- The analysis detailed in our Gan Shmuel Foods valuation report hints at an deflated share price compared to its estimated value.

Nichimo (TSE:8091)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nichimo Co., Ltd., with a market cap of ¥15.79 billion, primarily manufactures and sells fish products both in Japan and internationally through its subsidiaries.

Operations: Nichimo Co., Ltd. generates revenue through its core business of manufacturing and selling fish products across domestic and international markets via its subsidiaries.

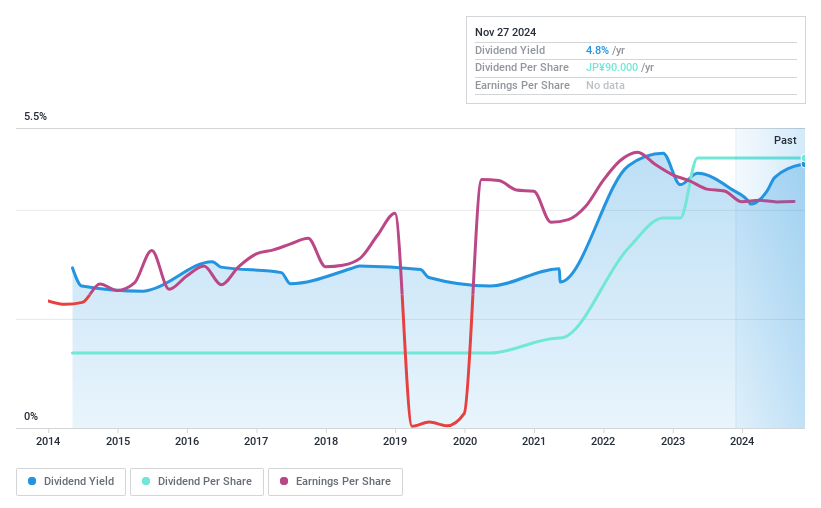

Dividend Yield: 4.7%

Nichimo's dividends have been reliable and stable over the past decade, with consistent growth. The dividend yield of 4.75% places it in the top 25% of JP market payers, although it's not well covered by free cash flows and lacks free cash flow support. Despite trading at a discount to estimated fair value, debt coverage by operating cash flow is weak and financial results are impacted by large one-off items.

- Navigate through the intricacies of Nichimo with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Nichimo shares in the market.

Where To Now?

- Gain an insight into the universe of 1960 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichimo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8091

Nichimo

Primarily manufactures and sells fish products in Japan and internationally.

Established dividend payer with adequate balance sheet.