- Israel

- /

- Oil and Gas

- /

- TASE:ORL

Middle Eastern Penny Stocks With Market Caps Over US$20M

Reviewed by Simply Wall St

Most Gulf markets have recently ended higher, buoyed by cooler-than-expected U.S. inflation data, though uncertainties around tariffs continue to pose challenges. Penny stocks, while a term from earlier market days, still represent an intriguing investment area for those interested in smaller or newer companies. By focusing on those with strong financial health and potential for growth, investors can uncover opportunities that might offer both stability and upside in the evolving Middle Eastern market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Financial Health Rating |

| Alarum Technologies (TASE:ALAR) | ₪2.519 | ₪174.67M | ★★★★★★ |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.69 | AED419.7M | ★★★★★★ |

| Oil Refineries (TASE:ORL) | ₪1.01 | ₪3.14B | ★★★★★☆ |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.665 | ₪17.67M | ★★★★★★ |

| Loras Holding (IBSE:LRSHO) | TRY2.39 | TRY1.9B | ★★★★★★ |

| Thob Al Aseel (SASE:4012) | SAR3.97 | SAR1.59B | ★★★★★★ |

| Tgi Infrastructures (TASE:TGI) | ₪2.146 | ₪159.54M | ★★★★★☆ |

| Tectona (TASE:TECT) | ₪3.60 | ₪83.47M | ★★★★★★ |

| Dubai Investments PJSC (DFM:DIC) | AED2.27 | AED9.69B | ★★★★★☆ |

| Almeda Ventures Limited Partnership (TASE:AMDA) | ₪1.551 | ₪24.86M | ★★★★★★ |

Click here to see the full list of 96 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Güler Yatirim Holding (IBSE:GLRYH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Güler Yatirim Holding A.S. is involved in investment activities in Turkey and has a market capitalization of TRY1.05 billion.

Operations: Güler Yatirim Holding A.S. has not reported any specific revenue segments.

Market Cap: TRY1.05B

Güler Yatirim Holding A.S., with a market capitalization of TRY1.05 billion, has demonstrated strong earnings growth, increasing by 68.2% over the past year, surpassing its five-year average growth rate of 35.8%. Despite this impressive performance, the company's return on equity remains low at 4.4%, and its net profit margin has decreased to 0.5% from last year's 0.7%. The company maintains a robust financial position with short-term assets of TRY8.3 billion exceeding both long-term liabilities and short-term liabilities significantly, and it holds more cash than total debt, although interest coverage is slightly below optimal levels at 2.9x EBIT coverage.

- Unlock comprehensive insights into our analysis of Güler Yatirim Holding stock in this financial health report.

- Review our historical performance report to gain insights into Güler Yatirim Holding's track record.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tukas Gida Sanayi ve Ticaret A.S. manufactures and sells food products in Turkey and internationally, with a market cap of TRY9.85 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: TRY9.85B

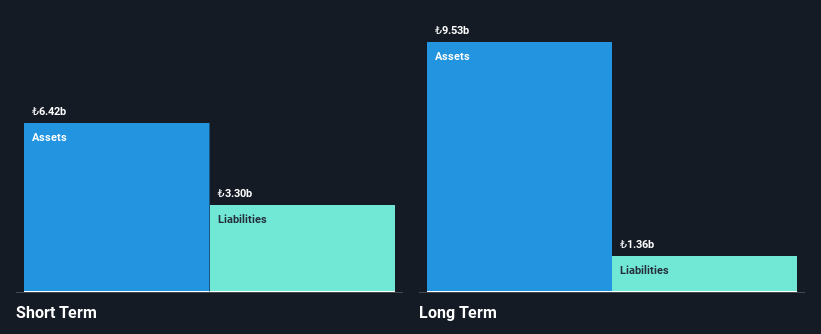

Tukas Gida Sanayi ve Ticaret, with a market cap of TRY9.85 billion, has seen its debt to equity ratio decrease from 129.6% to 28.2% over five years, reflecting improved financial stability. However, the company's net profit margin declined from 17.9% to 11.4%, and earnings growth was negative at -32.7%. Despite this, Tukas's short-term assets (TRY6.6 billion) cover both short-term and long-term liabilities comfortably, indicating sound liquidity management. The Price-To-Earnings ratio is favorable at 12.6x compared to the TR market average of 18.3x, suggesting potential undervaluation amidst declining sales and net income in the recent year-end results.

- Take a closer look at Tukas Gida Sanayi ve Ticaret's potential here in our financial health report.

- Examine Tukas Gida Sanayi ve Ticaret's past performance report to understand how it has performed in prior years.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★★☆

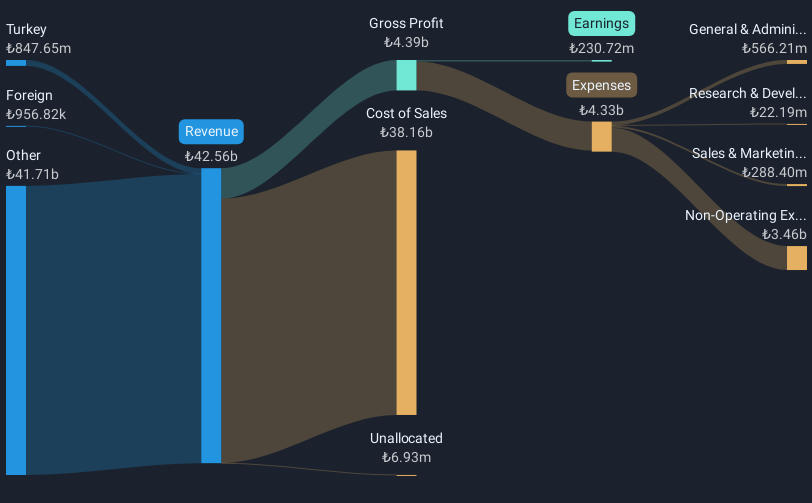

Overview: Oil Refineries Ltd. operates in the production and sale of fuel products, intermediate materials, and aromatic products both in Israel and internationally, with a market cap of ₪3.14 billion.

Operations: The company does not report specific revenue segments.

Market Cap: ₪3.14B

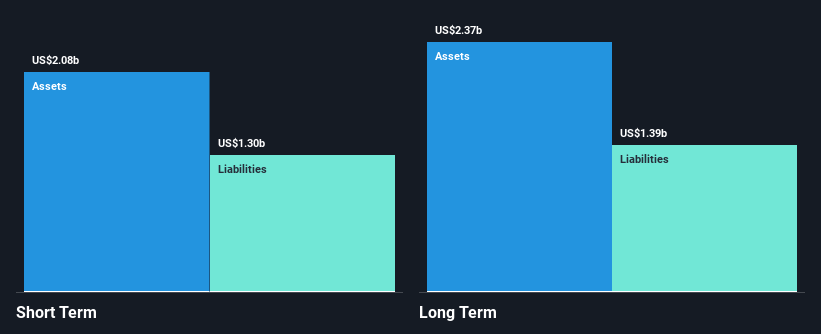

Oil Refineries Ltd., with a market cap of ₪3.14 billion, reported a decline in sales to US$7.54 billion and net income to US$113 million for 2024, compared to the previous year. Despite this, the company trades at 46.2% below its estimated fair value and maintains stable weekly volatility at 4%. Its short-term assets of $2.1 billion exceed both short-term and long-term liabilities, indicating robust liquidity management. The debt-to-equity ratio has improved from over 100% to 71% in five years, though interest coverage remains low at twice EBIT, signaling potential financial strain amidst declining profit margins and earnings growth challenges.

- Jump into the full analysis health report here for a deeper understanding of Oil Refineries.

- Gain insights into Oil Refineries' historical outcomes by reviewing our past performance report.

Where To Now?

- Reveal the 96 hidden gems among our Middle Eastern Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ORL

Oil Refineries

Primarily engages in the production and sale of fuel products, intermediate materials, and aromatic products in Israel and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives