- Israel

- /

- Oil and Gas

- /

- TASE:ORL

Middle Eastern Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a boost, with most Gulf shares gaining following the US-China tariff deal and positive economic developments in the region. Investing in penny stocks, while an older term, remains relevant as these stocks often represent smaller or newer companies that can offer significant growth opportunities at lower price points. When these companies boast strong financial health and solid fundamentals, they may provide investors with attractive upside potential without many of the typical risks associated with this market segment.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.20 | SAR1.68B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.92 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.597 | ₪181.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.898 | ₪2.79B | ✅ 1 ⚠️ 2 View Analysis > |

| Tarya Israel (TASE:TRA) | ₪0.565 | ₪167.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.222 | ₪165.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.69 | AED419.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.38 | AED390.39M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.06B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED10.08B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 93 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Tukas Gida Sanayi ve Ticaret (IBSE:TUKAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tukas Gida Sanayi ve Ticaret A.S. manufactures and sells food products both in Turkey and internationally, with a market cap of TRY11.97 billion.

Operations: Tukas Gida Sanayi ve Ticaret A.S. does not report specific revenue segments.

Market Cap: TRY11.97B

Tukas Gida Sanayi ve Ticaret A.S. has demonstrated significant earnings growth over the past five years, with a notable annual increase of 38.8%. Despite a recent slowdown to 5.1% growth last year, it still outpaced the broader food industry decline. The company is debt-free, enhancing its financial stability and reducing interest payment concerns. Tukas's net profit margins have improved slightly from last year, and its price-to-earnings ratio suggests good value compared to the Turkish market average. Recent earnings reports show a return to profitability with TRY488.15 million in net income for Q1 2025 after a loss in the previous year’s quarter.

- Click here to discover the nuances of Tukas Gida Sanayi ve Ticaret with our detailed analytical financial health report.

- Understand Tukas Gida Sanayi ve Ticaret's track record by examining our performance history report.

Alinma Retail REIT Fund (SASE:4345)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alinma Retail REIT Fund is a real estate investment fund with a market cap of SAR 547.52 million.

Operations: The fund's revenue is primarily derived from real estate rental, totaling SAR 187.74 million.

Market Cap: SAR547.52M

Alinma Retail REIT Fund, with a market cap of SAR 547.52 million, has shown financial improvement by becoming profitable in the last year. Its revenue from real estate rental reached SAR 187.74 million, marking a significant increase from the previous year. The fund's debt management appears solid, with interest payments well-covered by EBIT and operating cash flow effectively covering debt levels. However, short-term assets do not cover long-term liabilities fully. Recent dividend distributions indicate an unstable track record but provide some return to investors at SAR 0.32 per unit for the year ending December 2024.

- Dive into the specifics of Alinma Retail REIT Fund here with our thorough balance sheet health report.

- Evaluate Alinma Retail REIT Fund's historical performance by accessing our past performance report.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oil Refineries Ltd., with a market cap of ₪2.79 billion, primarily produces and sells fuel products, intermediate materials, and aromatic products both in Israel and internationally.

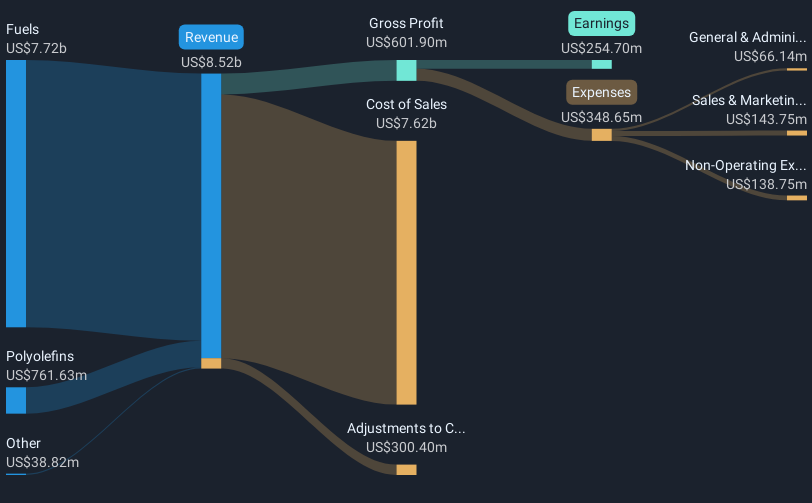

Operations: The company's revenue is primarily derived from its Refining segment, which generated $6.73 billion, followed by the Polymers segment with $806 million.

Market Cap: ₪2.79B

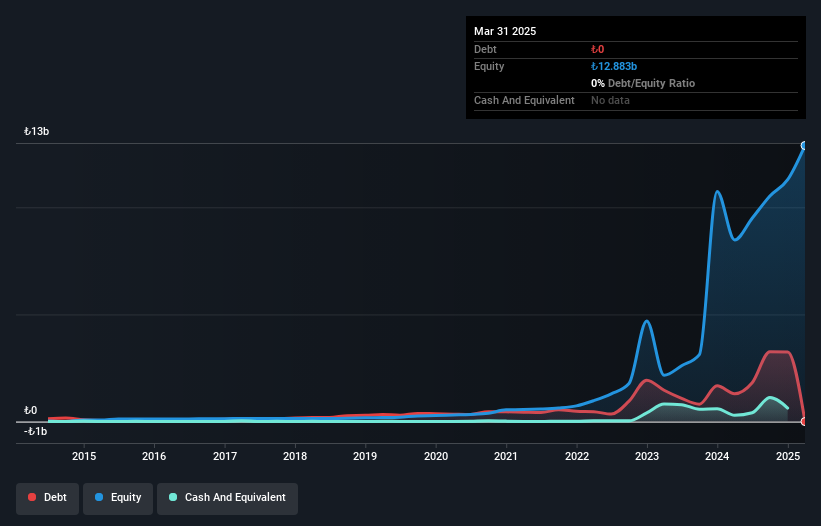

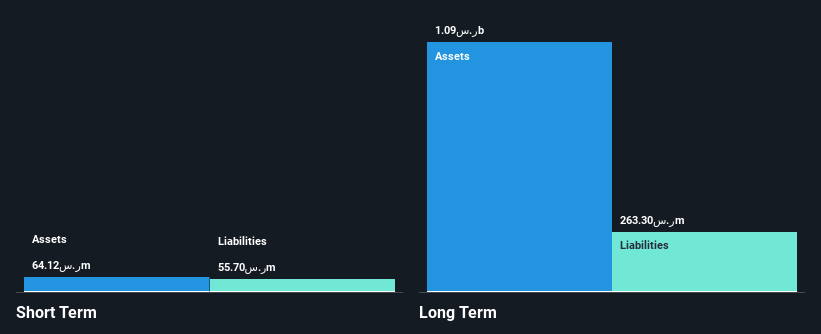

Oil Refineries Ltd., with a market cap of ₪2.79 billion, has seen its earnings decline significantly over the past year, with net income dropping to US$113 million from US$408 million. Despite this, the company maintains strong liquidity, as short-term assets exceed both short-term and long-term liabilities. The company's debt management shows improvement, with a satisfactory net debt to equity ratio of 22.2% and operating cash flow effectively covering debt obligations. However, profit margins have decreased to 1.5%, and interest payments are not well covered by EBIT at 2.4 times coverage, indicating potential financial strain despite high-quality earnings and experienced leadership.

- Navigate through the intricacies of Oil Refineries with our comprehensive balance sheet health report here.

- Assess Oil Refineries' previous results with our detailed historical performance reports.

Seize The Opportunity

- Explore the 93 names from our Middle Eastern Penny Stocks screener here.

- Interested In Other Possibilities? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oil Refineries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ORL

Oil Refineries

Primarily engages in the production and sale of fuel products, intermediate materials, and aromatic products in Israel and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives