- Turkey

- /

- Industrials

- /

- IBSE:IHLAS

3 Middle Eastern Penny Stocks With Under US$100M Market Cap

Reviewed by Simply Wall St

As Gulf stocks remain steady amid investor anticipation of U.S. trade policy clarity, the Middle East market continues to present intriguing investment opportunities. Penny stocks, despite their outdated name, still represent a valuable segment for those interested in smaller or newer companies with potential upside. By focusing on financial strength and growth prospects, investors can uncover promising opportunities within this category.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Big Tech 50 R&D-Limited Partnership (TASE:BIGT) | ₪1.399 | ₪14.85M | ✅ 0 ⚠️ 5 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.20 | SAR1.68B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.08 | AED2.69B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.32 | ₪303.83M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.16 | AED2.32B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.98 | TRY2.13B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.19 | AED368.44M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.76 | AED11.78B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.802 | AED487.82M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.616 | ₪194.48M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ihlas Holding (IBSE:IHLAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Holding A.S. operates in construction and real estate, media, manufacturing and trading, as well as healthcare and education sectors in Turkey and internationally, with a market cap of TRY3.72 billion.

Operations: The company's revenue is primarily derived from its marketing segment at TRY4.51 billion, followed by media at TRY2.23 billion and construction at TRY1.01 billion.

Market Cap: TRY3.72B

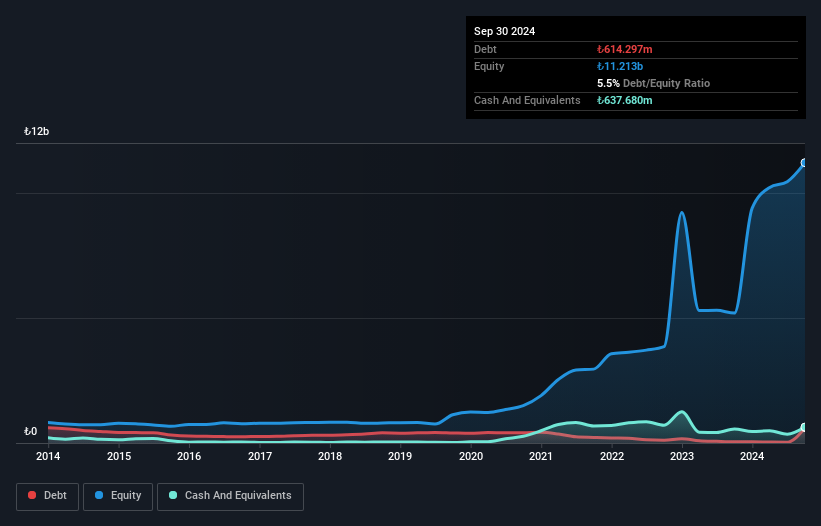

Ihlas Holding A.S. operates across diverse sectors, with a market cap of TRY3.72 billion and significant revenue from marketing (TRY4.51 billion). Despite being unprofitable, it has reduced losses at 9.6% annually over five years and improved its debt-to-equity ratio significantly to 4.8%. The management team is seasoned with an average tenure of 13.5 years, while the board averages 8.8 years, indicating stability in leadership. Although Ihlas's share price has been highly volatile recently and its operating cash flow remains negative, the company maintains more cash than total debt and covers both short- and long-term liabilities effectively with assets.

- Click to explore a detailed breakdown of our findings in Ihlas Holding's financial health report.

- Gain insights into Ihlas Holding's past trends and performance with our report on the company's historical track record.

Imed Infinity Medical-Limited Partnership (TASE:IMED)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imed Infinity Medical-Limited Partnership is a research and development entity that invests in medical and digital health projects, with a market cap of ₪5.36 million.

Operations: The company generates revenue from its venture capital activities, amounting to $0.041 million.

Market Cap: ₪5.36M

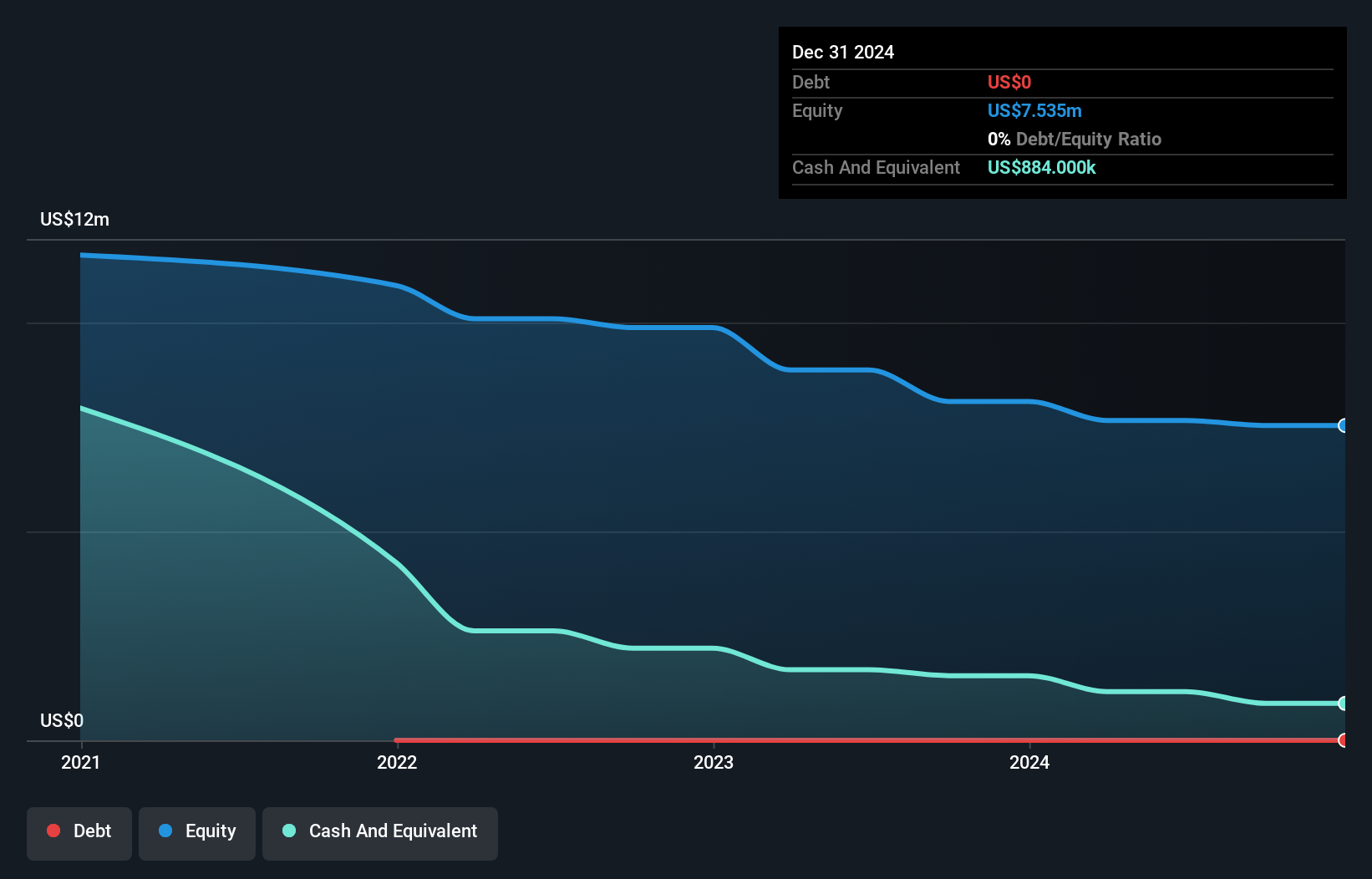

Imed Infinity Medical-Limited Partnership, with a market cap of ₪5.36 million, is a pre-revenue entity focused on medical and digital health projects. Despite generating minimal revenue (US$0.041 million), it remains debt-free and has sufficient cash runway for over a year based on current free cash flow trends. The management team and board are experienced, with average tenures of 2.1 and 4.1 years respectively, providing stability in leadership amidst its unprofitable status. However, the company's share price has been highly volatile recently, reflecting uncertainty in investor sentiment towards its future prospects.

- Unlock comprehensive insights into our analysis of Imed Infinity Medical-Limited Partnership stock in this financial health report.

- Review our historical performance report to gain insights into Imed Infinity Medical-Limited Partnership's track record.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oil Refineries Ltd., along with its subsidiaries, focuses on producing and selling fuel products, intermediate materials, and aromatic products both in Israel and internationally, with a market cap of ₪2.90 billion.

Operations: The company generates revenue primarily from its refining segment, which accounts for $6.19 billion, and its polymers segment, contributing $806 million.

Market Cap: ₪2.9B

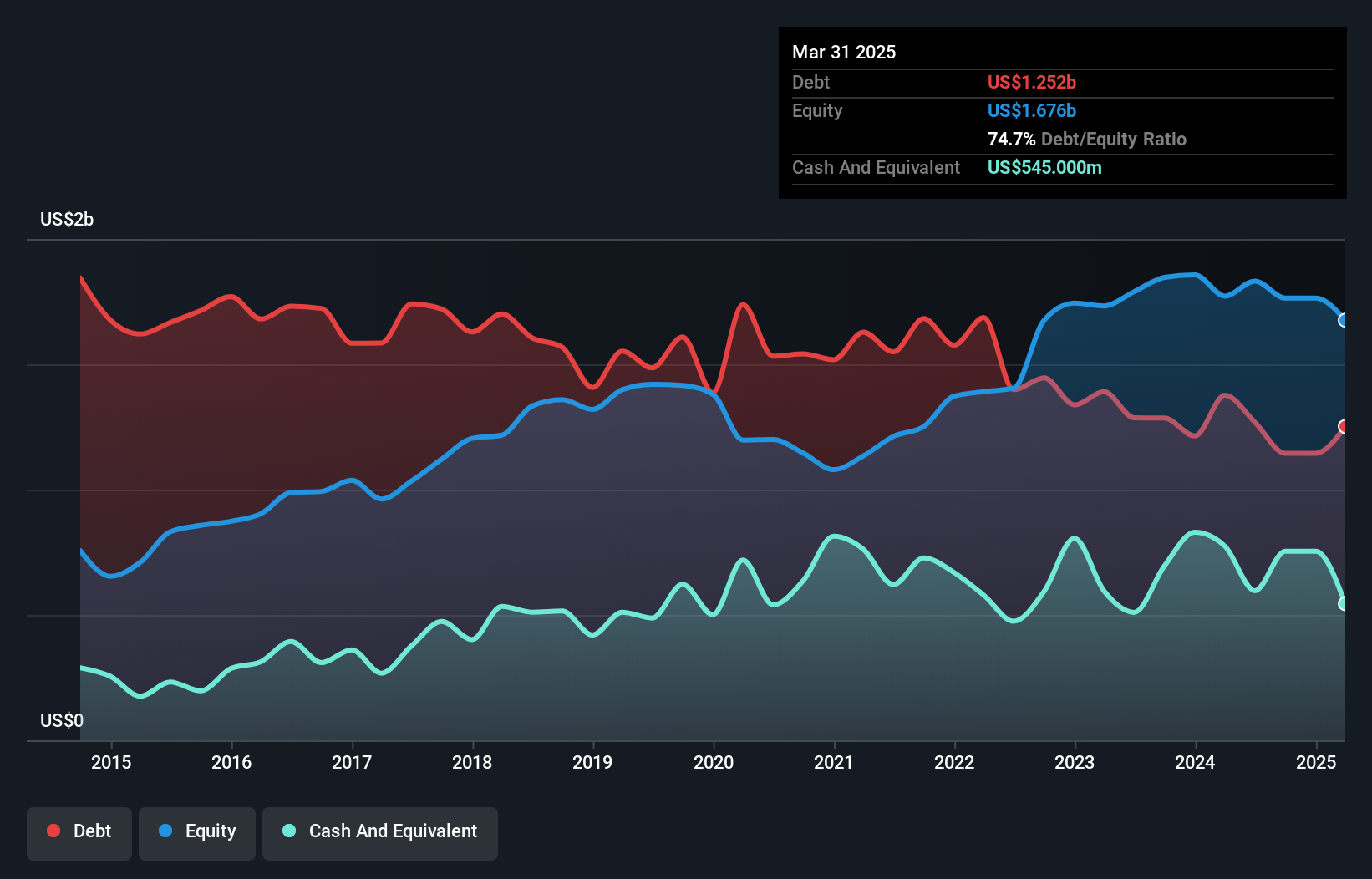

Oil Refineries Ltd., with a market cap of ₪2.90 billion, faces challenges as its recent earnings report revealed a net loss of US$31 million for Q1 2025, contrasting with a profit the previous year. The company's profit margins have declined to 0.5% from last year's 3%, and interest payments are not well covered by EBIT, indicating financial strain. Despite this, the company has reduced its debt-to-equity ratio significantly over five years and maintains sufficient short-term assets to cover liabilities. Trading below estimated fair value suggests potential investment appeal if operational improvements are realized.

- Click here to discover the nuances of Oil Refineries with our detailed analytical financial health report.

- Explore historical data to track Oil Refineries' performance over time in our past results report.

Key Takeaways

- Click this link to deep-dive into the 77 companies within our Middle Eastern Penny Stocks screener.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHLAS

Ihlas Holding

Engages in the construction and real estate, media, manufacturing and trading, and healthcare and education businesses in Turkey and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives