- United Arab Emirates

- /

- Building

- /

- ADX:RAKCEC

Middle Eastern Dividend Stocks To Consider In October 2025

Reviewed by Simply Wall St

As Middle Eastern markets show resilience with most Gulf bourses gaining on hopes of U.S. rate cuts and steady oil prices, investors are keeping a close eye on economic indicators and geopolitical developments that influence regional financial dynamics. In such an environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.17% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.15% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.36% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.32% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.49% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.35% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 6.21% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 8.27% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.14% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.39% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

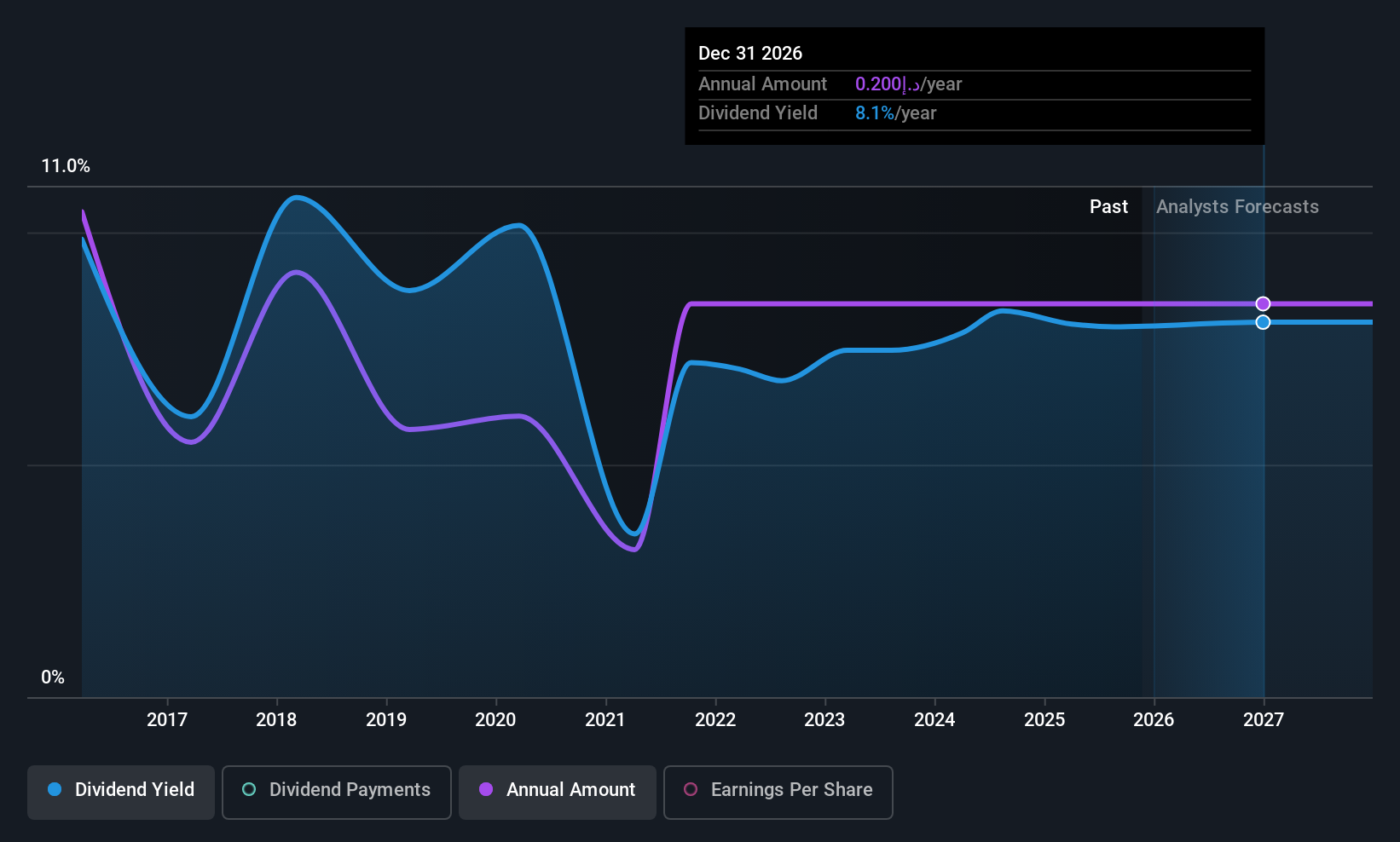

R.A.K. Ceramics P.J.S.C (ADX:RAKCEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: R.A.K. Ceramics P.J.S.C. manufactures and sells ceramic products across the Middle East, Europe, Asia, and internationally with a market cap of AED 2.43 billion.

Operations: R.A.K. Ceramics P.J.S.C. generates its revenue primarily from Ceramic Products (AED 3.27 billion), followed by Faucets (AED 537.73 million), and Other Industrial segments (AED 199.17 million).

Dividend Yield: 8.2%

R.A.K. Ceramics P.J.S.C. has declared an interim cash dividend of 10 fils per share for the first half of 2025, amounting to AED 99.37 million, despite a history of volatile and unreliable dividend payments over the past decade. The company's dividends are covered by earnings with a payout ratio of 88.3% and by cash flows at a ratio of 66.9%. However, its high debt level poses potential risks to financial stability and future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of R.A.K. Ceramics P.J.S.C.

- Our valuation report here indicates R.A.K. Ceramics P.J.S.C may be undervalued.

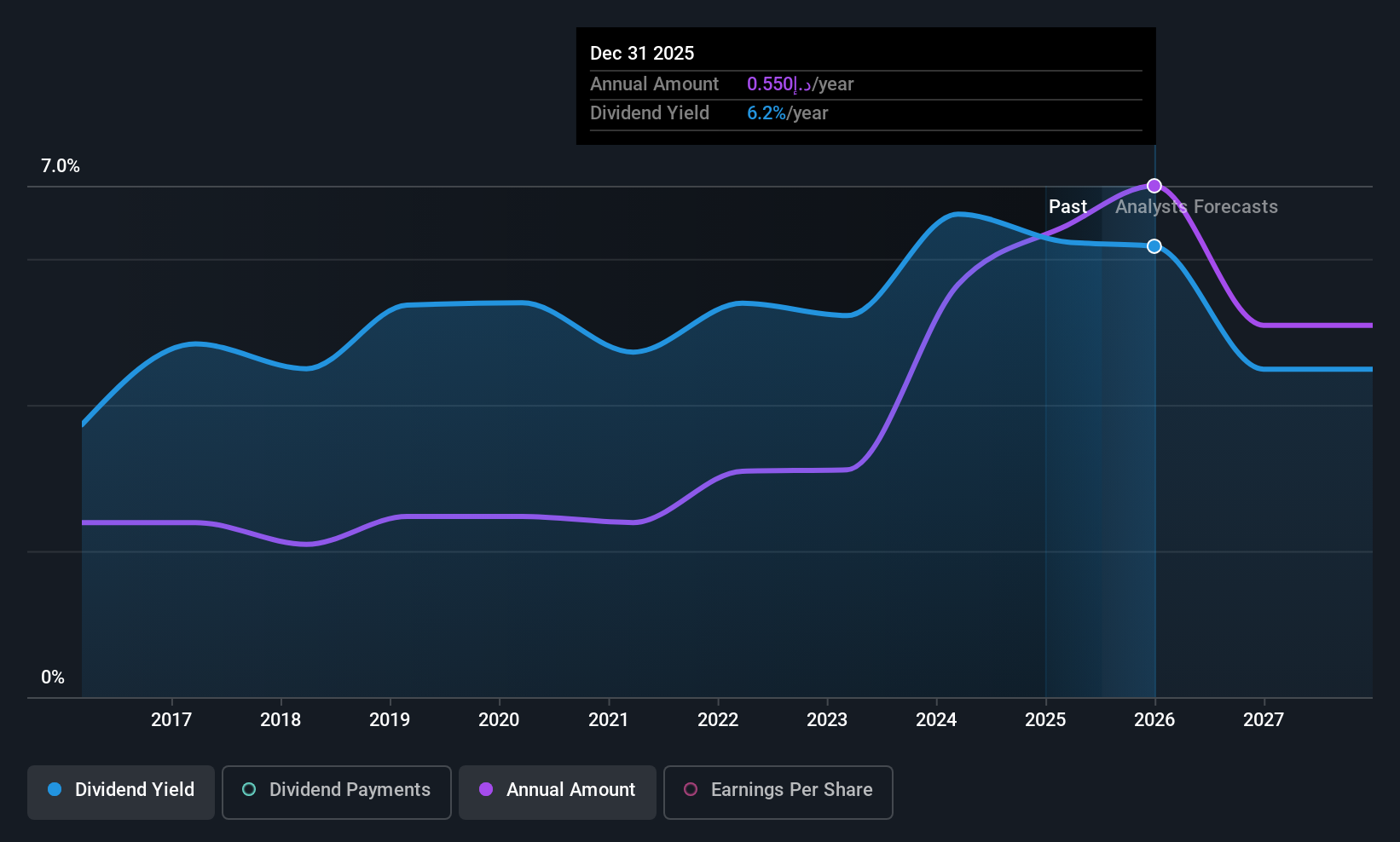

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market capitalization of AED29.14 billion.

Operations: Commercial Bank of Dubai PSC generates revenue from several segments, including Personal Banking (AED1.89 billion), Corporate Banking (AED1.56 billion), and Institutional Banking (AED1.28 billion).

Dividend Yield: 5.2%

Commercial Bank of Dubai PSC offers a stable dividend profile with a current payout ratio of 48.2%, indicating dividends are well covered by earnings. Over the past decade, its dividend payments have been reliable and growing, although the yield of 5.2% is below top-tier levels in the AE market. Despite high bad loans at 4.8%, recent earnings growth supports future dividend sustainability, with net income rising to AED 867.24 million in Q2 2025 from AED 751.46 million year-on-year.

- Get an in-depth perspective on Commercial Bank of Dubai PSC's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Commercial Bank of Dubai PSC is priced higher than what may be justified by its financials.

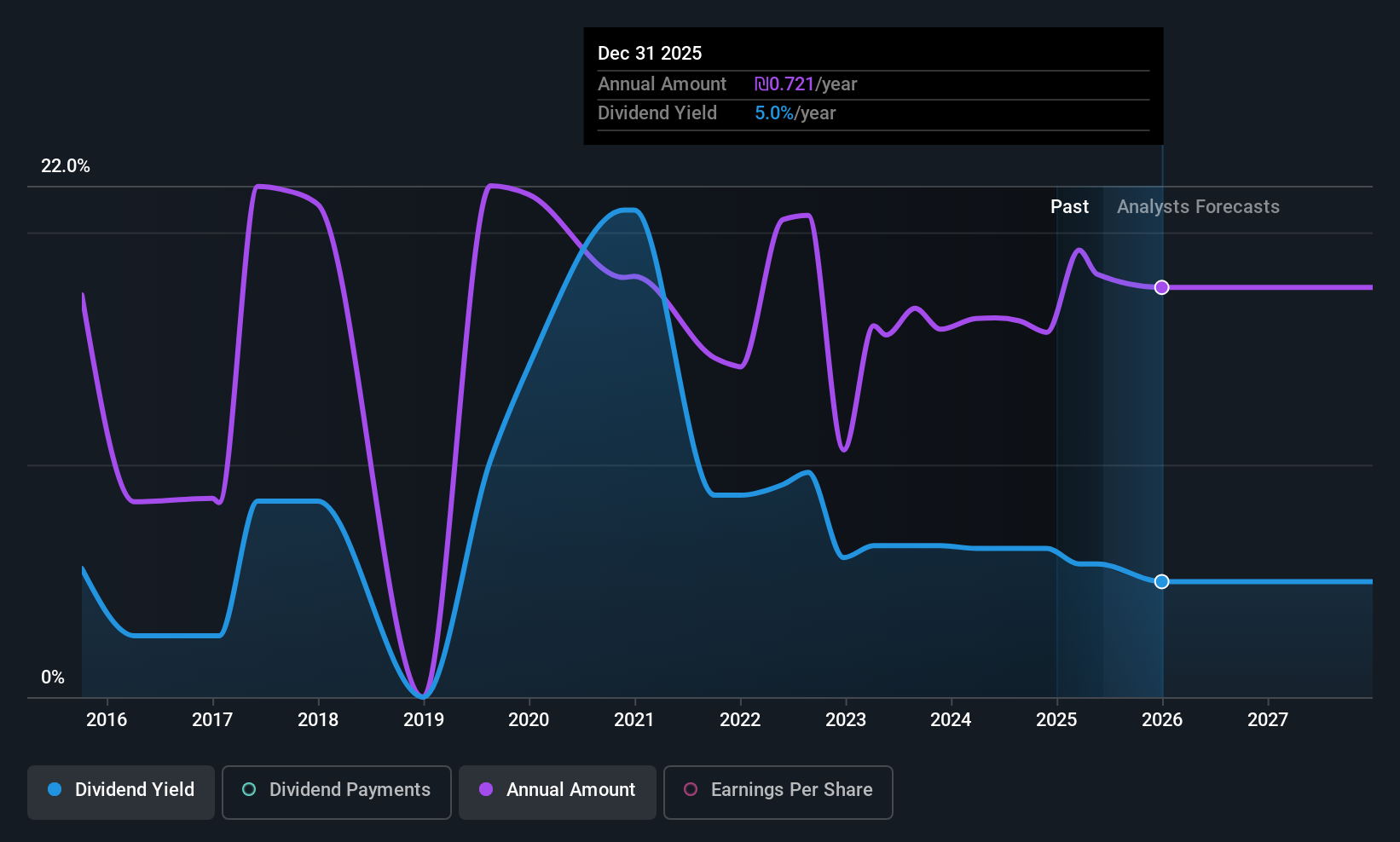

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership is involved in the exploration, development, production, and sale of petroleum, natural gas, and condensate across Israel, Jordan, and Egypt with a market cap of ₪20.66 billion.

Operations: NewMed Energy - Limited Partnership generates revenue primarily from its oil and gas exploration and production activities, amounting to $903.90 million.

Dividend Yield: 4%

NewMed Energy's dividend sustainability is supported by a payout ratio of 79.6%, covered by both earnings and cash flows, with a cash payout ratio at 46.7%. Despite past volatility, dividends have grown over the last decade. The recent landmark $35 billion natural gas export deal to Egypt could bolster future financial stability, though current yields at 3.96% are below top-tier levels in the IL market. Earnings reported declines in Q2 2025 compared to the previous year.

- Take a closer look at NewMed Energy - Limited Partnership's potential here in our dividend report.

- The valuation report we've compiled suggests that NewMed Energy - Limited Partnership's current price could be inflated.

Where To Now?

- Delve into our full catalog of 68 Top Middle Eastern Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKCEC

R.A.K. Ceramics P.J.S.C

Engages in manufacture and sale of various ceramic products in the Middle East, Europe, Asian countries, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives