- Israel

- /

- Oil and Gas

- /

- TASE:ISRA

Isramco Negev 2 Limited Partnership's (TLV:ISRA.L) Stock Is Going Strong: Have Financials A Role To Play?

Isramco Negev 2 Limited Partnership (TLV:ISRA.L) has had a great run on the share market with its stock up by a significant 22% over the last month. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Particularly, we will be paying attention to Isramco Negev 2 Limited Partnership's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Isramco Negev 2 Limited Partnership

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Isramco Negev 2 Limited Partnership is:

48% = US$292m ÷ US$605m (Based on the trailing twelve months to June 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every ₪1 of its shareholder's investments, the company generates a profit of ₪0.48.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Isramco Negev 2 Limited Partnership's Earnings Growth And 48% ROE

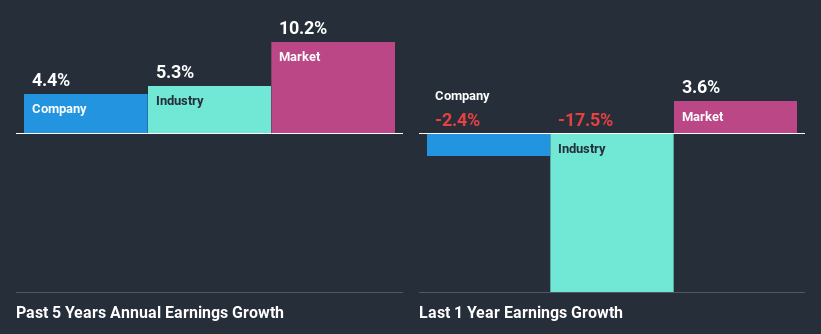

Firstly, we acknowledge that Isramco Negev 2 Limited Partnership has a significantly high ROE. Additionally, the company's ROE is higher compared to the industry average of 25% which is quite remarkable. However, for some reason, the higher returns aren't reflected in Isramco Negev 2 Limited Partnership's meagre five year net income growth average of 4.4%. That's a bit unexpected from a company which has such a high rate of return. A few likely reasons why this could happen is that the company could have a high payout ratio or the business has allocated capital poorly, for instance.

As a next step, we compared Isramco Negev 2 Limited Partnership's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 5.3% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Isramco Negev 2 Limited Partnership's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Isramco Negev 2 Limited Partnership Making Efficient Use Of Its Profits?

With a high three-year median payout ratio of 79% (or a retention ratio of 21%), most of Isramco Negev 2 Limited Partnership's profits are being paid to shareholders. This definitely contributes to the low earnings growth seen by the company.

Additionally, Isramco Negev 2 Limited Partnership has paid dividends over a period of three years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

In total, it does look like Isramco Negev 2 Limited Partnership has some positive aspects to its business. The company has grown its earnings moderately as previously discussed. Still, the high ROE could have been even more beneficial to investors had the company been reinvesting more of its profits. As highlighted earlier, the current reinvestment rate appears to be quite low. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 2 risks we have identified for Isramco Negev 2 Limited Partnership.

When trading Isramco Negev 2 Limited Partnership or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:ISRA

Isramco Negev 2 Limited Partnership

Engages in the exploration, development, and production of oil, natural gas, and condensate in Israel, Jordan, and Egypt.

Proven track record average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.