- Israel

- /

- Oil and Gas

- /

- TASE:GIVO

Givot Olam Oil Exploration - Limited Partnership (1993)'s (TLV:GIVO.L) Shareholders Are Down 52% On Their Shares

Givot Olam Oil Exploration - Limited Partnership (1993) (TLV:GIVO.L) shareholders will doubtless be very grateful to see the share price up 89% in the last month. But in truth the last year hasn't been good for the share price. In fact the stock is down 52% in the last year, well below the market return.

See our latest analysis for Givot Olam Oil Exploration - Limited Partnership (1993)

With just US$2,049,000 worth of revenue in twelve months, we don't think the market considers Givot Olam Oil Exploration - Limited Partnership (1993) to have proven its business plan. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Givot Olam Oil Exploration - Limited Partnership (1993) finds fossil fuels with an exploration program, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Givot Olam Oil Exploration - Limited Partnership (1993) investors might realise.

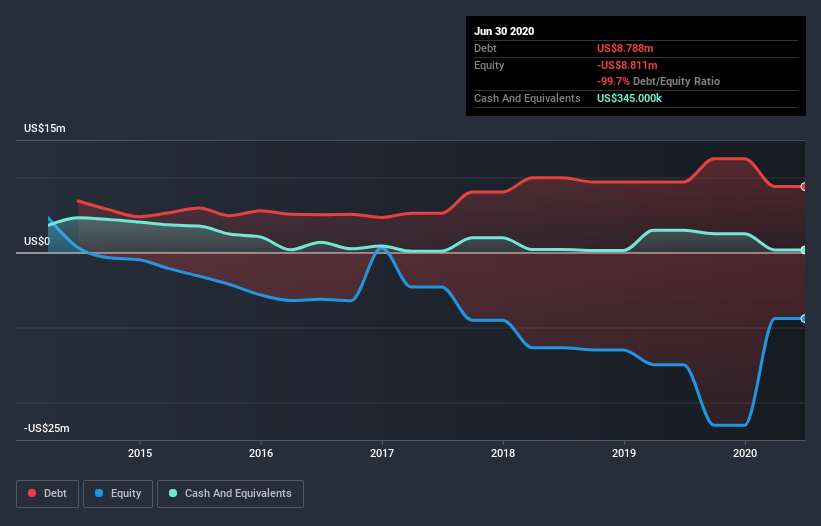

Our data indicates that Givot Olam Oil Exploration - Limited Partnership (1993) had US$13m more in total liabilities than it had cash, when it last reported in June 2020. That makes it extremely high risk, in our view. But since the share price has dived 52% in the last year , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Givot Olam Oil Exploration - Limited Partnership (1993)'s cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? It would bother me, that's for sure. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Givot Olam Oil Exploration - Limited Partnership (1993)'s total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Givot Olam Oil Exploration - Limited Partnership (1993) hasn't been paying dividends, but its TSR of -45% exceeds its share price return of -52%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While Givot Olam Oil Exploration - Limited Partnership (1993) shareholders are down 45% for the year, the market itself is up 3.6%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 83%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. It's always interesting to track share price performance over the longer term. But to understand Givot Olam Oil Exploration - Limited Partnership (1993) better, we need to consider many other factors. Even so, be aware that Givot Olam Oil Exploration - Limited Partnership (1993) is showing 6 warning signs in our investment analysis , and 3 of those don't sit too well with us...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you decide to trade Givot Olam Oil Exploration - Limited Partnership (1993), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Givot Olam Oil Exploration-Limited Partnership(1993), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:GIVO

Givot Olam Oil Exploration-Limited Partnership(1993)

Operates as an oil and gas exploration and production company in Israel.

Moderate with weak fundamentals.