- Israel

- /

- Oil and Gas

- /

- TASE:DLEKG

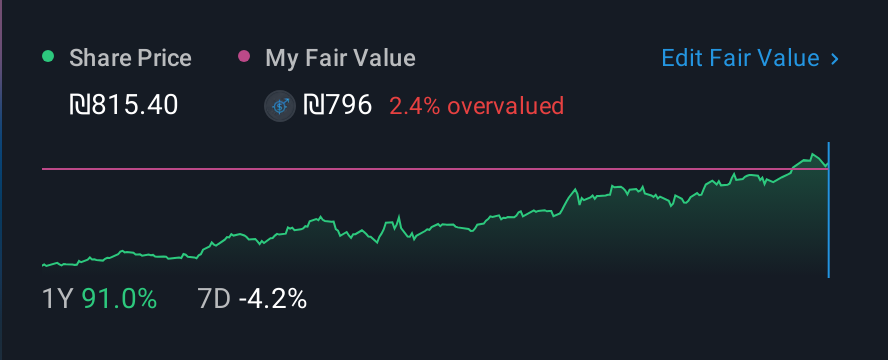

Investors Continue Waiting On Sidelines For Delek Group Ltd. (TLV:DLEKG)

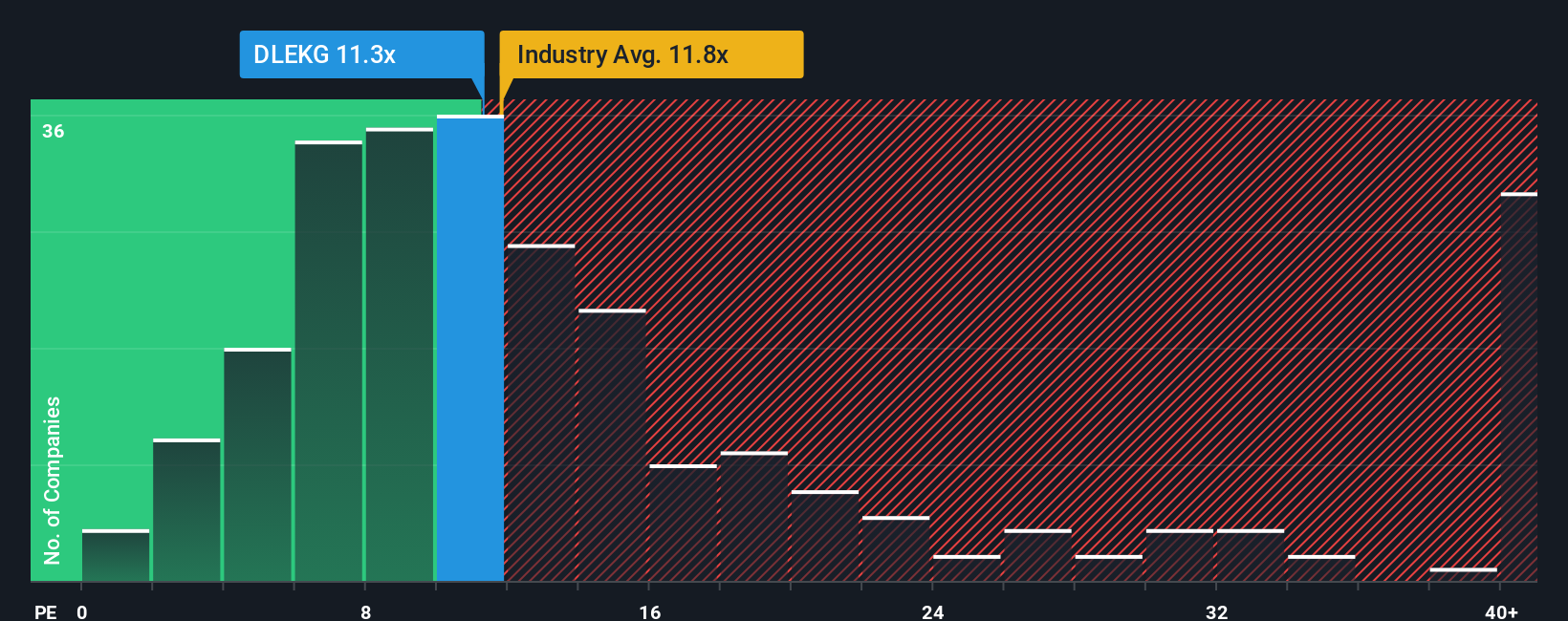

When close to half the companies in Israel have price-to-earnings ratios (or "P/E's") above 16x, you may consider Delek Group Ltd. (TLV:DLEKG) as an attractive investment with its 11.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Delek Group's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Delek Group

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Delek Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 71% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the covering the company suggest earnings should grow by 24% each year over the next three years. With the market only predicted to deliver 10% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Delek Group is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Delek Group's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Delek Group currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Delek Group that you need to be mindful of.

If these risks are making you reconsider your opinion on Delek Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:DLEKG

Delek Group

An energy company, engages in the exploration, development, production, and marketing of oil and natural gas in Israel and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026