- Israel

- /

- Oil and Gas

- /

- TASE:NWMD

Delek Drilling - Limited Partnership (TLV:DEDR.L) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Delek Drilling - Limited Partnership (TLV:DEDR.L) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Delek Drilling - Limited Partnership

How Much Debt Does Delek Drilling - Limited Partnership Carry?

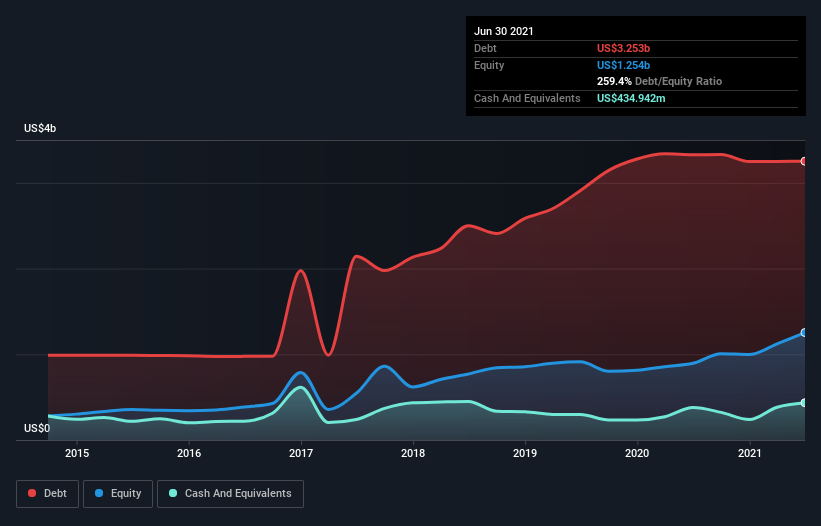

The chart below, which you can click on for greater detail, shows that Delek Drilling - Limited Partnership had US$3.25b in debt in June 2021; about the same as the year before. However, it also had US$434.9m in cash, and so its net debt is US$2.82b.

A Look At Delek Drilling - Limited Partnership's Liabilities

According to the last reported balance sheet, Delek Drilling - Limited Partnership had liabilities of US$1.23b due within 12 months, and liabilities of US$2.30b due beyond 12 months. Offsetting this, it had US$434.9m in cash and US$211.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.88b.

When you consider that this deficiency exceeds the company's US$1.93b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Delek Drilling - Limited Partnership has a debt to EBITDA ratio of 3.6 and its EBIT covered its interest expense 2.9 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. The silver lining is that Delek Drilling - Limited Partnership grew its EBIT by 163% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Delek Drilling - Limited Partnership will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, Delek Drilling - Limited Partnership actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

To be frank both Delek Drilling - Limited Partnership's level of total liabilities and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, it seems to us that Delek Drilling - Limited Partnership's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Delek Drilling - Limited Partnership has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NewMed Energy - Limited Partnership might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:NWMD

NewMed Energy - Limited Partnership

Engages in the exploration, development, production, and sale of petroleum, natural gas, and condensate in Israel and Cyprus.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives