- United Arab Emirates

- /

- Real Estate

- /

- ADX:RAKPROP

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

The Middle East market has recently experienced mixed performance, with Saudi Arabia's index hitting its lowest point since early April while Dubai and Abu Dhabi indices have shown modest gains. In this fluctuating environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

RAK Properties PJSC (ADX:RAKPROP)

Simply Wall St Value Rating: ★★★★★★

Overview: RAK Properties PJSC, along with its subsidiaries, focuses on the investment, development, and management of real estate properties in the United Arab Emirates and has a market capitalization of approximately AED3.91 billion.

Operations: The company's primary revenue streams include real estate sales, generating AED1.22 billion, and hotel operations contributing AED206.93 million. Property leasing adds an additional AED63.54 million to the revenue mix.

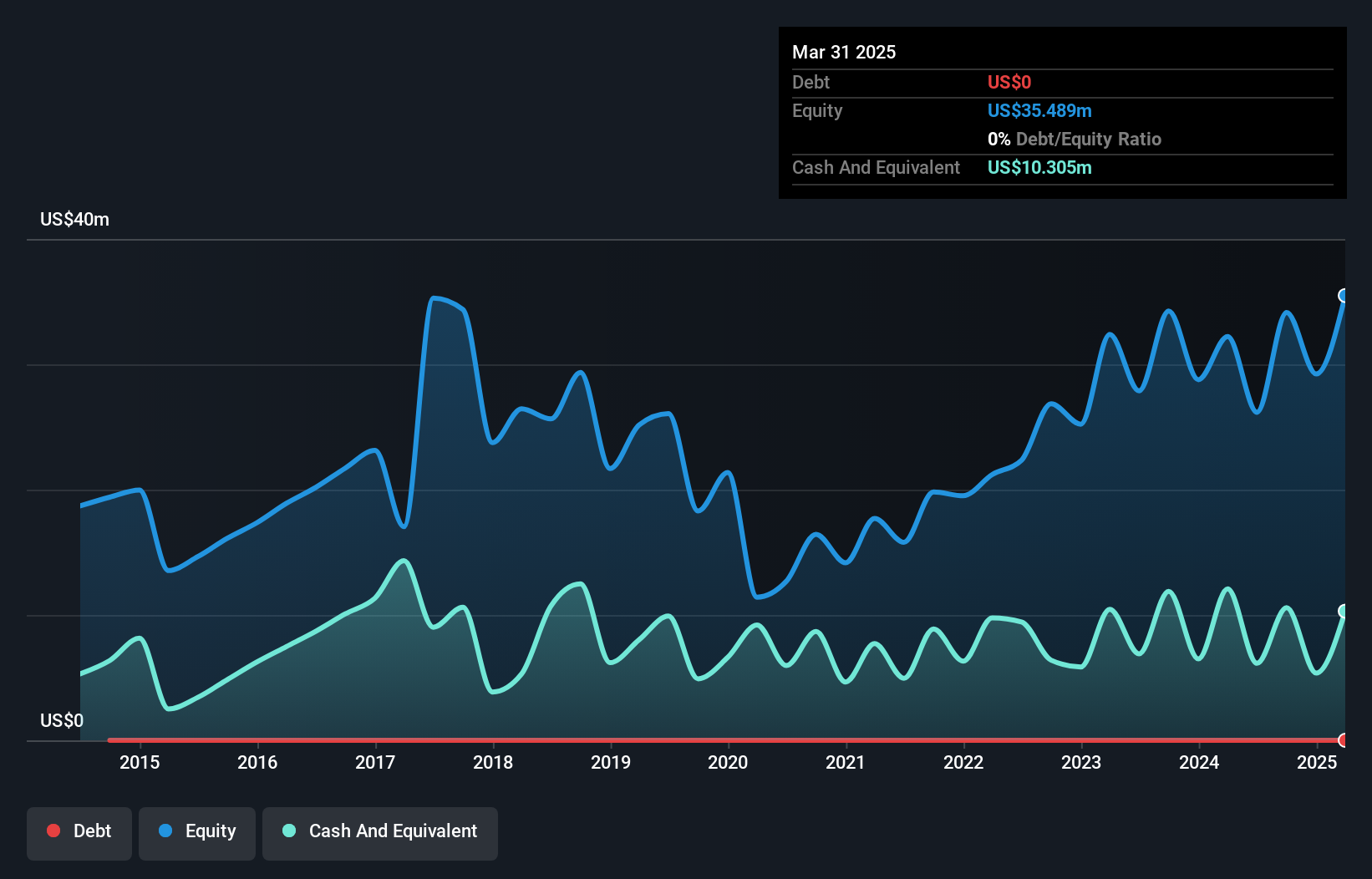

RAK Properties, a prominent player in the UAE's real estate scene, has demonstrated robust earnings growth of 54.7% over the past year, surpassing industry averages. The company's net debt to equity ratio stands at a satisfactory 13.2%, indicating prudent financial management. Recent launches like ENTA MINA and Anantara Mina Residences highlight its strategic focus on luxury and design-forward offerings, catering to modern lifestyles. Despite a significant AED62.7 million one-off gain affecting recent results, RAK Properties maintains strong interest coverage with EBIT covering interest payments five times over, showcasing its financial resilience amidst expansion efforts.

- Dive into the specifics of RAK Properties PJSC here with our thorough health report.

Assess RAK Properties PJSC's past performance with our detailed historical performance reports.

Cohen Development Gas & Oil (TASE:CDEV)

Simply Wall St Value Rating: ★★★★★★

Overview: Cohen Development Gas & Oil Ltd. is involved in the exploration, development, production, and marketing of natural gas, condensate, and oil across Israel, Cyprus, and Morocco with a market capitalization of ₪1.09 billion.

Operations: Cohen Development Gas & Oil generates revenue primarily from the exploration, production, and marketing of natural gas, condensate, and oil. The company operates in Israel, Cyprus, and Morocco.

Cohen Development Gas & Oil, a nimble player in the energy sector, is trading at 24.5% below its estimated fair value, offering potential upside for investors. Despite facing a slight earnings dip of 0.7% last year compared to the industry average growth of 4.3%, it remains debt-free for over five years and boasts high-quality past earnings. With free cash flow reaching US$19 million as of September 2024, Cohen's financial health seems robust despite modest net income changes from US$22 million to US$21.94 million annually. The company’s strategic positioning without debt enhances its stability in volatile markets.

- Click here to discover the nuances of Cohen Development Gas & Oil with our detailed analytical health report.

Learn about Cohen Development Gas & Oil's historical performance.

Keystone Infra (TASE:KSTN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Keystone REIT Ltd. is involved in the asset management and custody banks industry with a market capitalization of ₪1.31 billion.

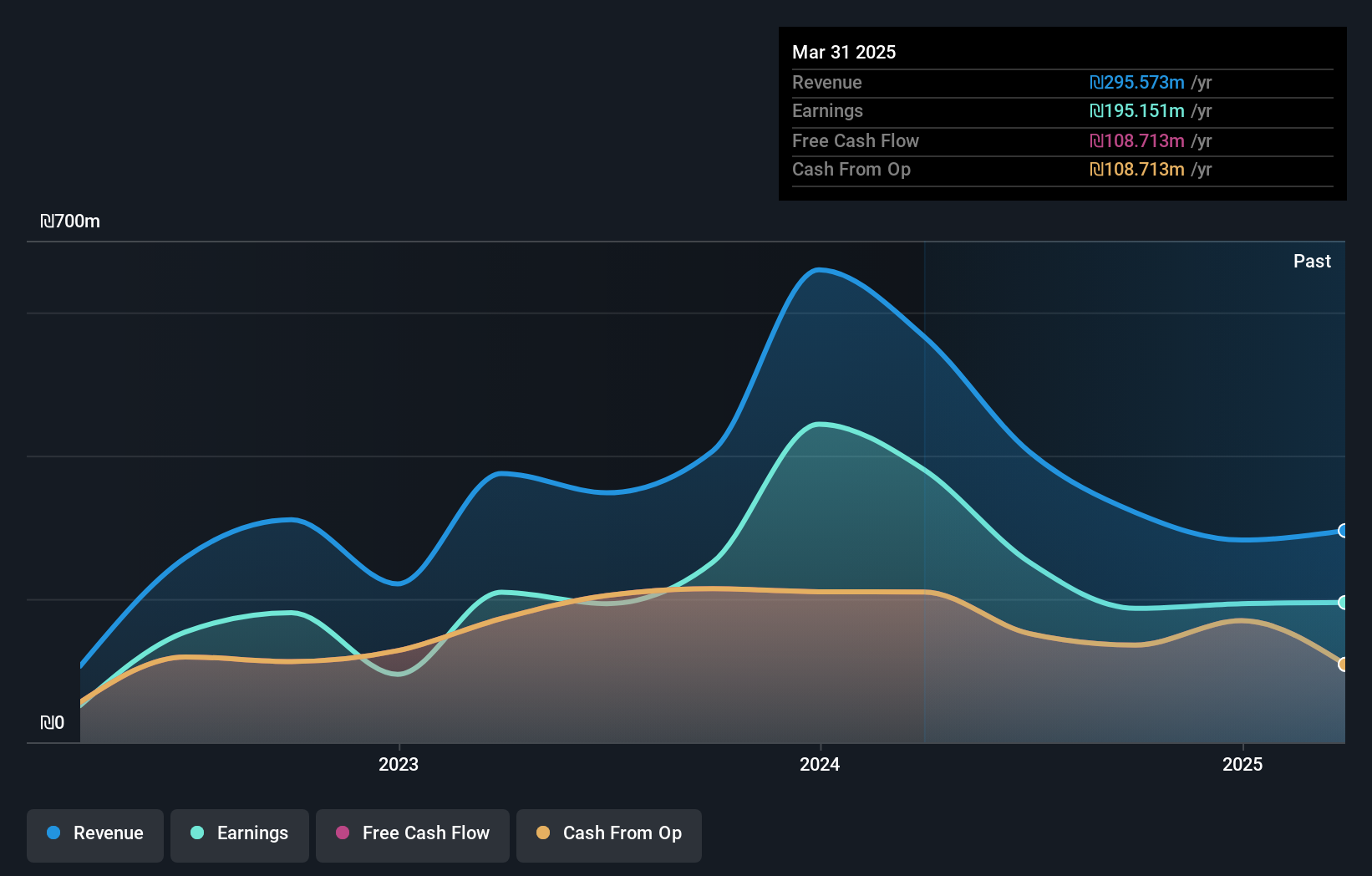

Operations: Keystone Infra generates revenue primarily from its unclassified services, amounting to ₪282.19 million. The company has a market capitalization of ₪1.31 billion, reflecting its position within the asset management and custody banks industry.

Keystone Infra, a small-cap player in the Middle East, shows potential despite some challenges. Its net debt to equity ratio stands at 34.9%, which is satisfactory, and interest payments are well covered by EBIT at 13.4 times. The company trades at 30% below its estimated fair value, suggesting an attractive entry point for investors seeking undervalued opportunities. However, earnings growth has been negative over the past year (-56.4%), contrasting with the industry average of 22%. Recent results reveal revenue of ILS 84.67 million and net income of ILS 49.35 million for Q1 2025, indicating stable profitability amidst market fluctuations.

- Take a closer look at Keystone Infra's potential here in our health report.

Evaluate Keystone Infra's historical performance by accessing our past performance report.

Make It Happen

- Unlock our comprehensive list of 228 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:RAKPROP

RAK Properties PJSC

Engages in the investment, development, and management of real estate properties in the United Arab Emirates.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives