- Israel

- /

- Capital Markets

- /

- TASE:YBOX

Ybox Real Estate (TLV:YBOX) sheds ₪26m, company earnings and investor returns have been trending downwards for past three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Ybox Real Estate Ltd. (TLV:YBOX) shareholders have had that experience, with the share price dropping 50% in three years, versus a market decline of about 1.6%. Even worse, it's down 15% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 7.3% in the same time period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Ybox Real Estate

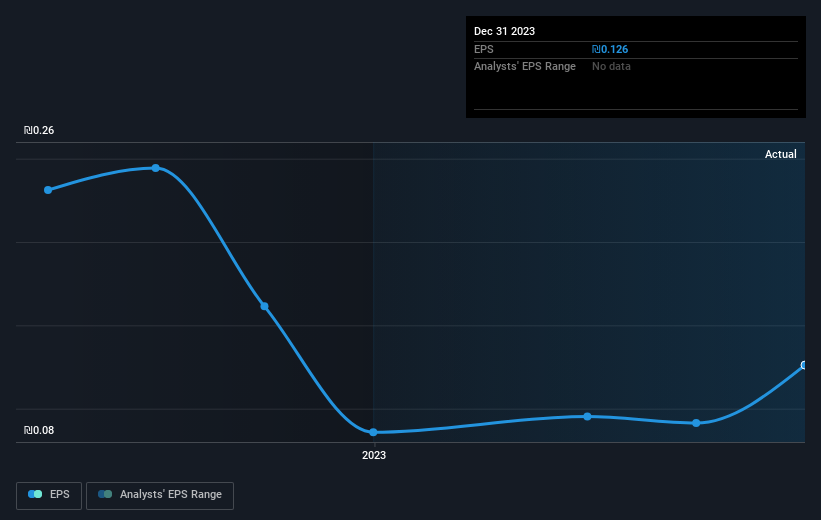

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Ybox Real Estate saw its EPS decline at a compound rate of 5.6% per year, over the last three years. The share price decline of 21% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 6.32.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Ybox Real Estate shareholders are down 1.9% for the year, but the market itself is up 0.03%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Ybox Real Estate better, we need to consider many other factors. Take risks, for example - Ybox Real Estate has 5 warning signs (and 1 which is concerning) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Israeli exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:YBOX

Ybox Real Estate

Ybox Real Estate Ltd., formerly known as Marathon Investments SA., is a real estate investment firm specializing investments in residential projects, commercial and office buildings.

Very low with weak fundamentals.

Market Insights

Community Narratives