- Israel

- /

- Diversified Financial

- /

- TASE:PEN

Three Prominent Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and mixed economic signals, investors are carefully reassessing their strategies, particularly in light of recent fluctuations in major indices like the S&P 500 and Nasdaq Composite. Amidst this backdrop, dividend stocks emerge as a compelling option for those seeking stability and income potential; these investments can offer a steady stream of returns even when market conditions are uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.30% | ★★★★★★ |

| Globeride (TSE:7990) | 4.26% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.14% | ★★★★★★ |

| Innotech (TSE:9880) | 4.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

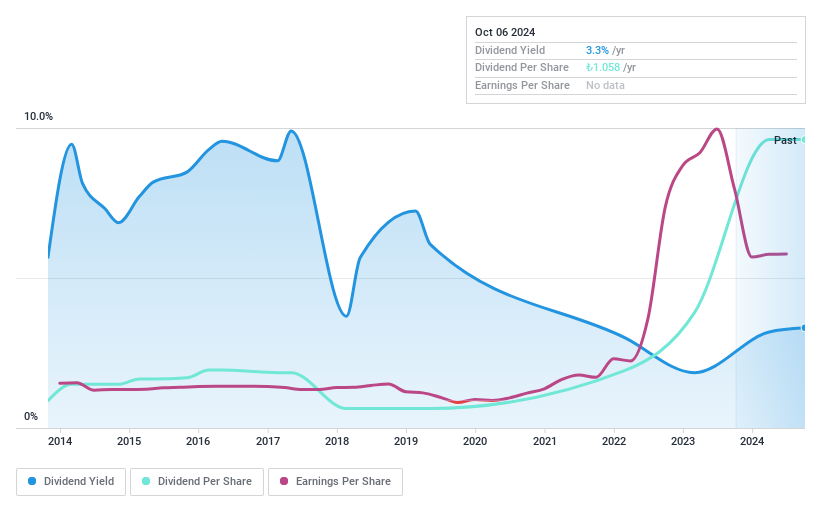

Çimsa Çimento Sanayi ve Ticaret (IBSE:CIMSA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Çimsa Çimento Sanayi ve Ticaret A.S. is a Turkish company involved in the production and sale of cement and building materials, with a market capitalization of TRY32.74 billion.

Operations: Çimsa Çimento Sanayi ve Ticaret generates its revenue primarily from Cement, contributing TRY14.78 billion, and Ready-Mixed Concrete, accounting for TRY4.20 billion.

Dividend Yield: 3.1%

Çimsa Çimento Sanayi ve Ticaret's dividend yield of 3.05% ranks in the top 25% among Turkish dividend payers, supported by a low payout ratio of 26.9%, indicating sustainability through earnings and cash flows. Despite this, its dividend history is marked by volatility over the past decade. Recent financials show robust net income growth to TRY 1,163.43 million for Q3 2024, reflecting improved profitability despite a decline in sales compared to last year.

- Unlock comprehensive insights into our analysis of Çimsa Çimento Sanayi ve Ticaret stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Çimsa Çimento Sanayi ve Ticaret shares in the market.

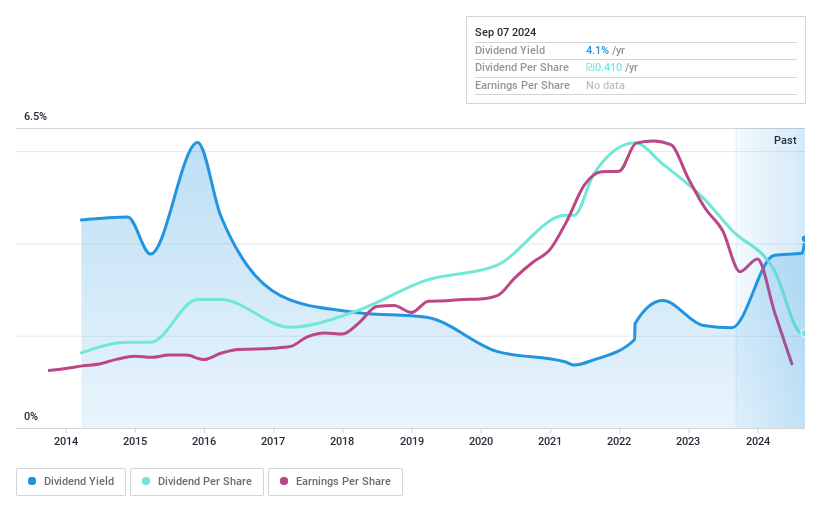

Maytronics (TASE:MTRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Maytronics Ltd. develops, produces, markets, distributes, and provides technical support for swimming pool equipment globally and has a market cap of ₪998.37 million.

Operations: Maytronics Ltd. generates revenue from three main segments: Safety Products and Related Pool Products (₪351.20 million), Manufacture of Robots for Cleaning Public Pools (₪99.28 million), and Manufacture of Robots for Cleaning Private Pools (₪1.25 billion).

Dividend Yield: 4.5%

Maytronics' dividend yield of 4.51% is below the top 25% of Israeli dividend payers, with a high payout ratio of 80%, yet cash flow coverage remains solid at 35.5%. Despite a decade-long increase in dividends, their reliability and stability are questionable due to volatility. Recent earnings show decreased profitability, with net income dropping to ILS 42.11 million for Q2 2024 from ILS 87.33 million last year, reflecting financial challenges impacting its dividend sustainability.

- Get an in-depth perspective on Maytronics' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Maytronics is trading beyond its estimated value.

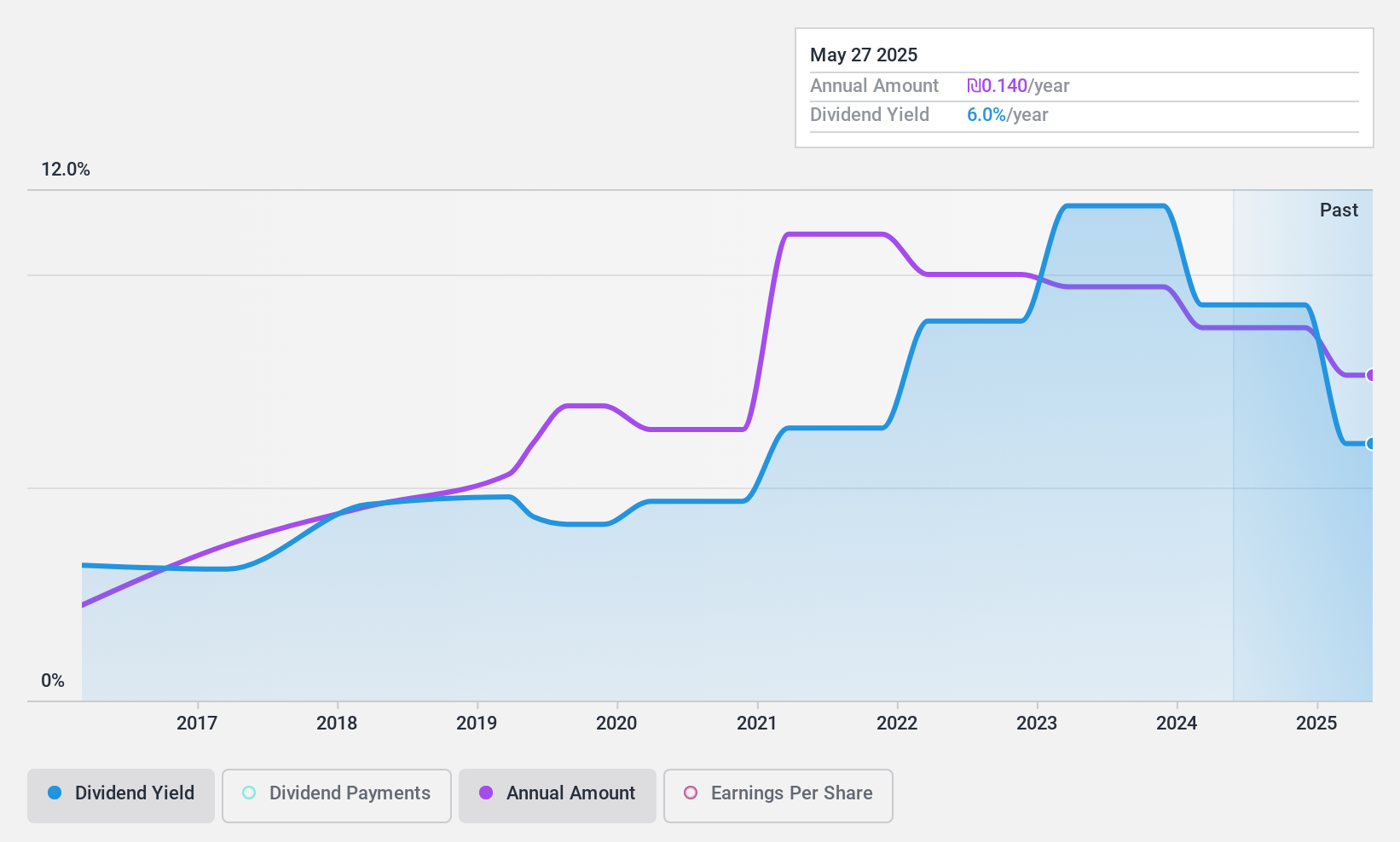

Peninsula Group (TASE:PEN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Peninsula Group Ltd offers credit solutions in Israel and has a market cap of ₪417.35 million.

Operations: Peninsula Group Ltd generates revenue from its Financial Services - Commercial segment, amounting to ₪95.93 million.

Dividend Yield: 8.6%

Peninsula Group's dividend yield of 8.55% ranks in the top 25% of Israeli dividend payers, supported by a reasonable payout ratio of 63.4% and a low cash payout ratio of 13.7%, indicating solid coverage by both earnings and cash flows. Despite recent declines in net income to ILS 11.08 million for Q2, dividends have been stable and growing over the past decade, though high debt levels warrant consideration for future sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Peninsula Group.

- In light of our recent valuation report, it seems possible that Peninsula Group is trading behind its estimated value.

Taking Advantage

- Unlock our comprehensive list of 2030 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PEN

6 star dividend payer with adequate balance sheet.

Market Insights

Community Narratives