- Israel

- /

- Consumer Finance

- /

- TASE:NAWI

How Much Did Nawi Brothers Group's(TLV:NAWI) Shareholders Earn From Share Price Movements Over The Last Year?

Nawi Brothers Group Ltd (TLV:NAWI) shareholders should be happy to see the share price up 18% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 32% in one year, under-performing the market.

View our latest analysis for Nawi Brothers Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

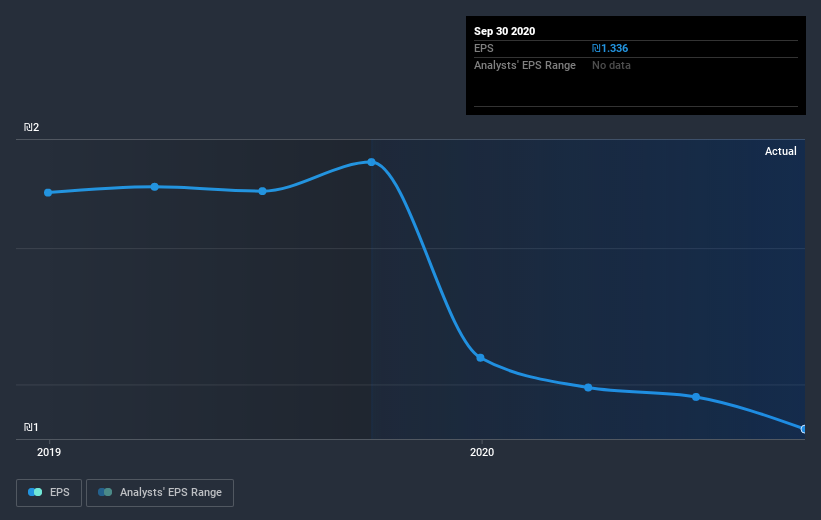

Unfortunately Nawi Brothers Group reported an EPS drop of 42% for the last year. The share price fall of 32% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Nawi Brothers Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Nawi Brothers Group shareholders are down 31% for the year (even including dividends), but the market itself is up 1.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 1.3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Nawi Brothers Group has 3 warning signs (and 1 which is significant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

If you’re looking to trade Nawi Brothers Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Nawi Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nawi Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:NAWI

Nawi Group

Provides financial solutions based on financing and non-bank credit in Israel.

Second-rate dividend payer low.

Market Insights

Community Narratives