- Israel

- /

- Capital Markets

- /

- TASE:IBI

Market Participants Recognise I.B.I. Investment House Ltd's (TLV:IBI) Earnings Pushing Shares 27% Higher

I.B.I. Investment House Ltd (TLV:IBI) shareholders have had their patience rewarded with a 27% share price jump in the last month. The annual gain comes to 164% following the latest surge, making investors sit up and take notice.

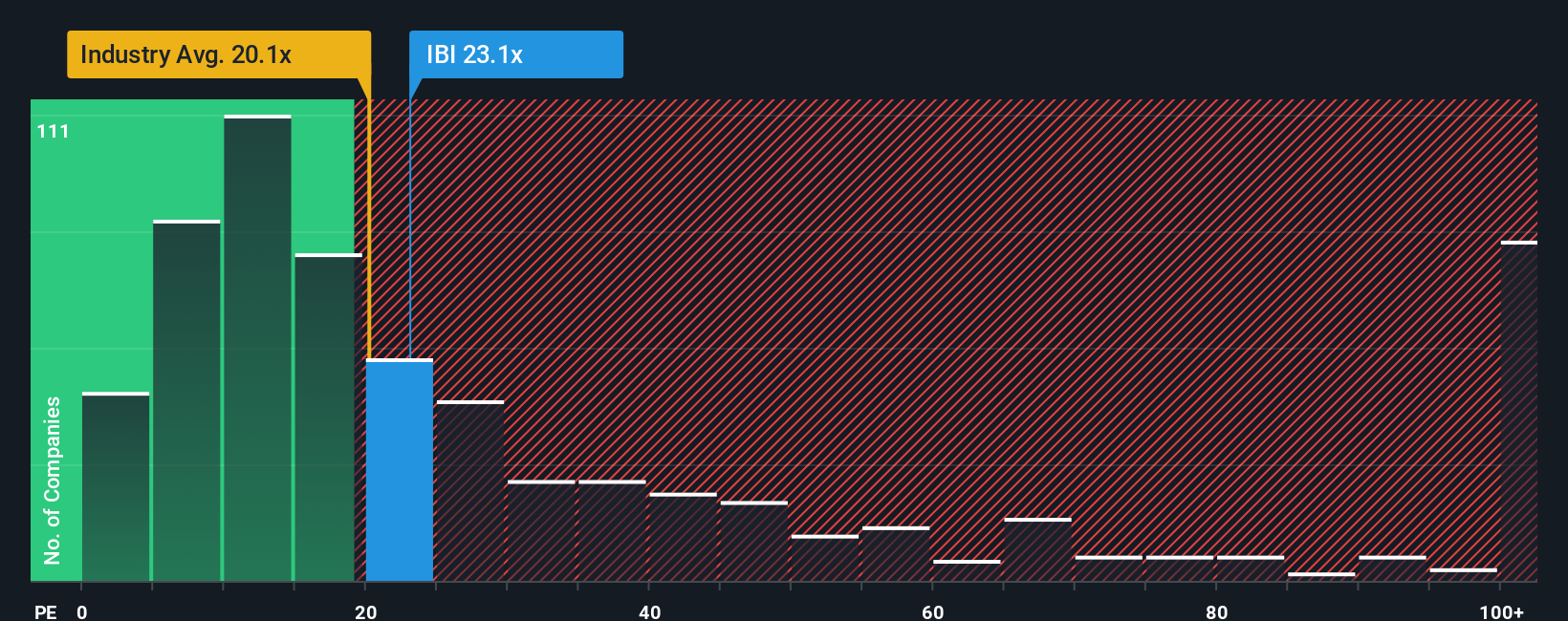

After such a large jump in price, I.B.I. Investment House may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.1x, since almost half of all companies in Israel have P/E ratios under 16x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

I.B.I. Investment House has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for I.B.I. Investment House

Is There Enough Growth For I.B.I. Investment House?

The only time you'd be truly comfortable seeing a P/E as high as I.B.I. Investment House's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.5% last year. The latest three year period has also seen an excellent 100% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's understandable that I.B.I. Investment House's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

I.B.I. Investment House's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of I.B.I. Investment House revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with I.B.I. Investment House, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on I.B.I. Investment House, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:IBI

I.B.I. Investment House

I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026