- Israel

- /

- Diversified Financial

- /

- TASE:VALC

Market Might Still Lack Some Conviction On Group Psagot for Finance and Investments Ltd (TLV:GPST) Even After 25% Share Price Boost

The Group Psagot for Finance and Investments Ltd (TLV:GPST) share price has done very well over the last month, posting an excellent gain of 25%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

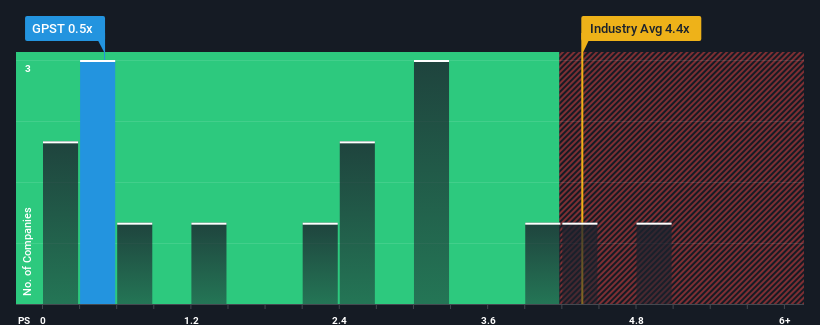

In spite of the firm bounce in price, it would still be understandable if you think Group Psagot for Finance and Investments is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in Israel's Diversified Financial industry have P/S ratios above 2.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Group Psagot for Finance and Investments

How Has Group Psagot for Finance and Investments Performed Recently?

The revenue growth achieved at Group Psagot for Finance and Investments over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Group Psagot for Finance and Investments' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Group Psagot for Finance and Investments' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 30% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 8.9% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Group Psagot for Finance and Investments' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Group Psagot for Finance and Investments' P/S?

Group Psagot for Finance and Investments' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Upon analysing the past data, we see it is unexpected that Group Psagot for Finance and Investments is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Before you take the next step, you should know about the 3 warning signs for Group Psagot for Finance and Investments that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:VALC

Value Capital One

Provides financial services to small and medium-sized, associations, regional councils, municipalities, corporations, and large companies in Israel.

Excellent balance sheet slight.

Market Insights

Community Narratives