- Israel

- /

- Diversified Financial

- /

- TASE:GAON-M

Investors Continue Waiting On Sidelines For B. Gaon Holdings Ltd. (TLV:GAON-M)

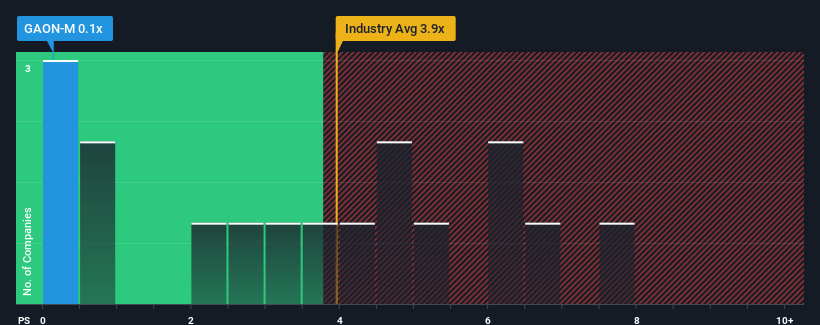

You may think that with a price-to-sales (or "P/S") ratio of 0.1x B. Gaon Holdings Ltd. (TLV:GAON-M) is definitely a stock worth checking out, seeing as almost half of all the Diversified Financial companies in Israel have P/S ratios greater than 4x and even P/S above 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for B. Gaon Holdings

How Has B. Gaon Holdings Performed Recently?

For instance, B. Gaon Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on B. Gaon Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For B. Gaon Holdings?

In order to justify its P/S ratio, B. Gaon Holdings would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.5% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that B. Gaon Holdings' P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What We Can Learn From B. Gaon Holdings' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that B. Gaon Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Before you take the next step, you should know about the 4 warning signs for B. Gaon Holdings (3 are significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if B. Gaon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:GAON-M

B. Gaon Holdings

Provides solutions for infrastructure, water transmission and sewage treatment, fuel and gas, industry and fire extinguishing, AMR/AMI systems, and desalination markets worldwide.

Slight risk and slightly overvalued.

Market Insights

Community Narratives