- Israel

- /

- Capital Markets

- /

- TASE:FEAT

Middle Eastern Penny Stock Opportunities With Market Caps Larger Than US$2M

Reviewed by Simply Wall St

Most Gulf markets have recently experienced gains, driven by positive corporate earnings and rising oil prices, with Abu Dhabi's index notably advancing due to strong performances from major financial institutions. In this context, identifying promising investment opportunities requires a focus on companies that demonstrate solid financial health and growth potential. While the term "penny stocks" may seem outdated, these smaller or emerging firms can still offer significant value when backed by robust fundamentals. This article will highlight three Middle Eastern penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.56 | SAR1.42B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.732 | ₪337.37M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.1B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED333.8M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.24 | AED13.82B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.814 | AED3.5B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.848 | ₪223.56M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

National Investor Pr. J.S.C (ADX:TNI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The National Investor Pr. J.S.C., operating in the United Arab Emirates, offers private equity, real estate investment and consultancy, economic feasibility studies, commercial agency services, and hospitality services with a market cap of AED108.10 million.

Operations: The company generates revenue from its Principal Investments segment, amounting to AED31.79 million.

Market Cap: AED108.1M

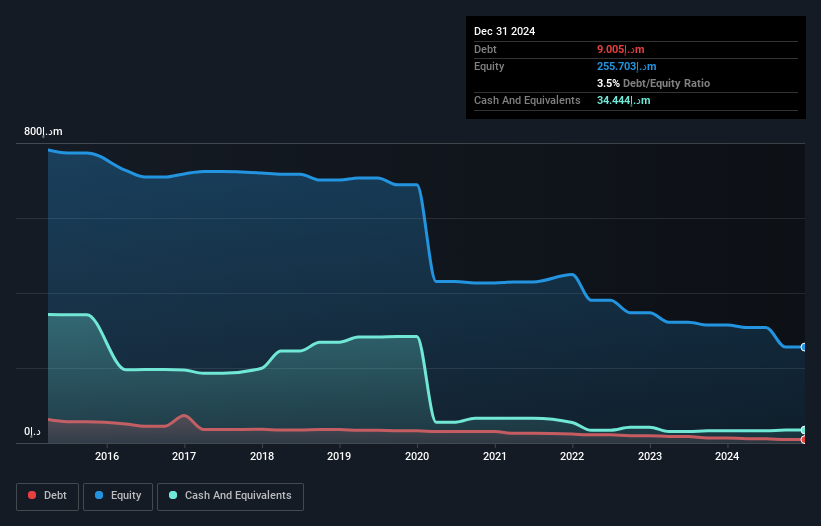

National Investor Pr. J.S.C., with a market cap of AED108.10 million, reported significant revenue growth for the half-year ending June 30, 2025, at AED20.23 million compared to AED10.25 million the previous year, and a net income of AED2.03 million from a prior net loss of AED6.71 million, indicating improving financial health despite being unprofitable overall. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, ensuring a stable cash runway exceeding three years due to positive free cash flow growth at 12.6% per year without meaningful shareholder dilution recently.

- Unlock comprehensive insights into our analysis of National Investor Pr. J.S.C stock in this financial health report.

- Understand National Investor Pr. J.S.C's track record by examining our performance history report.

Escort Teknoloji Yatirim (IBSE:ESCOM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Escort Teknoloji Yatirim A.S. offers technology-based products, solutions, and services both in Turkey and internationally, with a market cap of TRY2.22 billion.

Operations: The company's revenue is primarily derived from Turkey, amounting to TRY369.28 million.

Market Cap: TRY2.22B

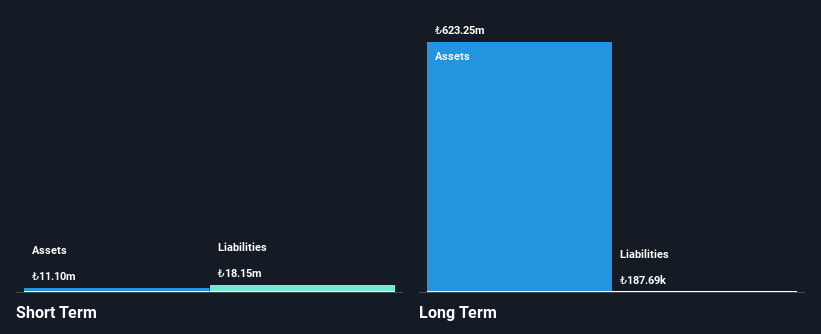

Escort Teknoloji Yatirim A.S., with a market cap of TRY2.22 billion, has shown signs of financial improvement despite being unprofitable. The company reported a net income of TRY2.06 million for the second quarter ending June 30, 2025, compared to a net loss in the previous year. Although its short-term assets (TRY28.2M) do not cover short-term liabilities (TRY63.6M), it remains debt-free and has managed to reduce losses over five years by 8.4% annually without significant shareholder dilution recently, reflecting potential resilience in its financial strategy amidst volatility challenges.

- Get an in-depth perspective on Escort Teknoloji Yatirim's performance by reading our balance sheet health report here.

- Examine Escort Teknoloji Yatirim's past performance report to understand how it has performed in prior years.

Feat Fund Investments - Limited Partnership (TASE:FEAT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Feat Fund Investments - Limited Partnership focuses on investing in the food, environment, agriculture, and technology sectors with a market cap of ₪7.22 million.

Operations: The company reports a revenue segment of Venture Capital amounting to -₪1.58 million.

Market Cap: ₪7.22M

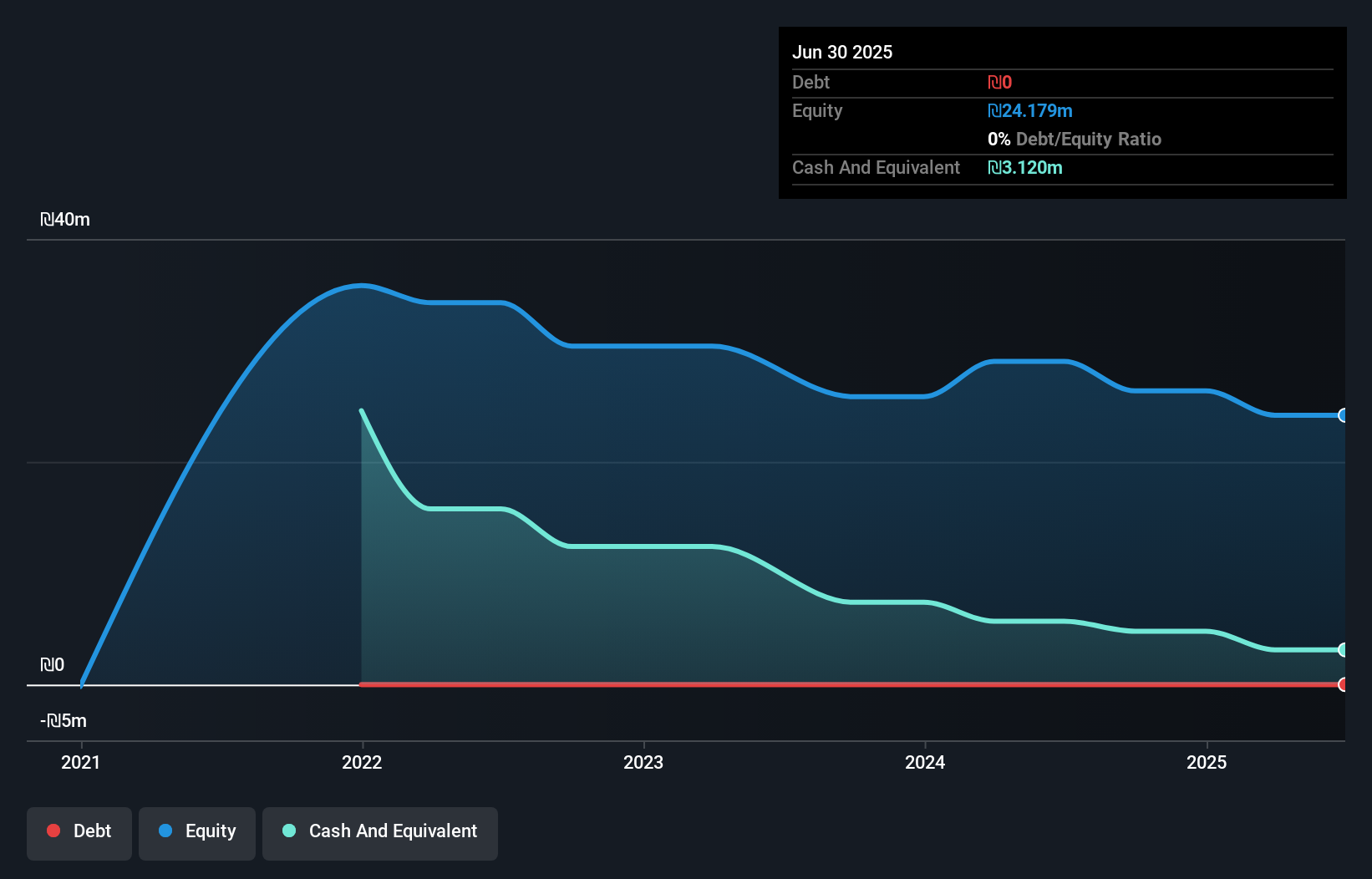

Feat Fund Investments - Limited Partnership, with a market cap of ₪7.22 million, is pre-revenue and focuses on sectors like food and technology. Despite being debt-free and having short-term assets (₪3.2M) that exceed liabilities (₪2.7M), it reported a significant net loss of ₪2.37 million for the first half of 2025, compared to a profit last year. The company recently completed equity offerings totaling over ₪22 million to bolster its financial position amidst high share price volatility. The board's average tenure suggests experienced governance while maintaining sufficient cash runway for over a year without meaningful shareholder dilution recently.

- Take a closer look at Feat Fund Investments - Limited Partnership's potential here in our financial health report.

- Assess Feat Fund Investments - Limited Partnership's previous results with our detailed historical performance reports.

Seize The Opportunity

- Take a closer look at our Middle Eastern Penny Stocks list of 79 companies by clicking here.

- Seeking Other Investments? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FEAT

Feat Fund Investments - Limited Partnership

Invests in food, environment, agriculture, and technology industries.

Flawless balance sheet with low risk.

Market Insights

Community Narratives