- Israel

- /

- Consumer Finance

- /

- TASE:DIFI

Getting In Cheap On Direct Finance of Direct Group (2006)Ltd (TLV:DIFI) Is Unlikely

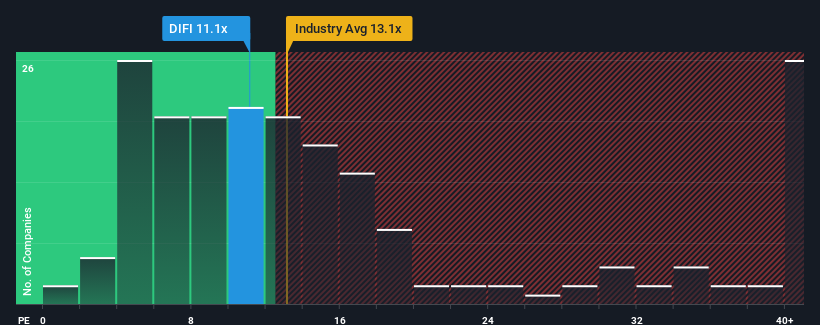

With a median price-to-earnings (or "P/E") ratio of close to 13x in Israel, you could be forgiven for feeling indifferent about Direct Finance of Direct Group (2006)Ltd's (TLV:DIFI) P/E ratio of 11.1x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen at a steady rate over the last year for Direct Finance of Direct Group (2006)Ltd, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

See our latest analysis for Direct Finance of Direct Group (2006)Ltd

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Direct Finance of Direct Group (2006)Ltd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.5% last year. Still, lamentably EPS has fallen 29% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 25% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Direct Finance of Direct Group (2006)Ltd is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Direct Finance of Direct Group (2006)Ltd currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Direct Finance of Direct Group (2006)Ltd (of which 1 is concerning!) you should know about.

If these risks are making you reconsider your opinion on Direct Finance of Direct Group (2006)Ltd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:DIFI

Direct Finance of Direct Group (2006)Ltd

Direct Finance of Direct Group (2006) Ltd provides consumer credit for vehicles, loans against vehicle liens, loans for various business.

Proven track record with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026