- Israel

- /

- Capital Markets

- /

- TASE:ALTF

Altshuler Shaham (TASE:ALTF) Net Profit Margin Falls to 11.9%, Testing Core Holding Narrative

Reviewed by Simply Wall St

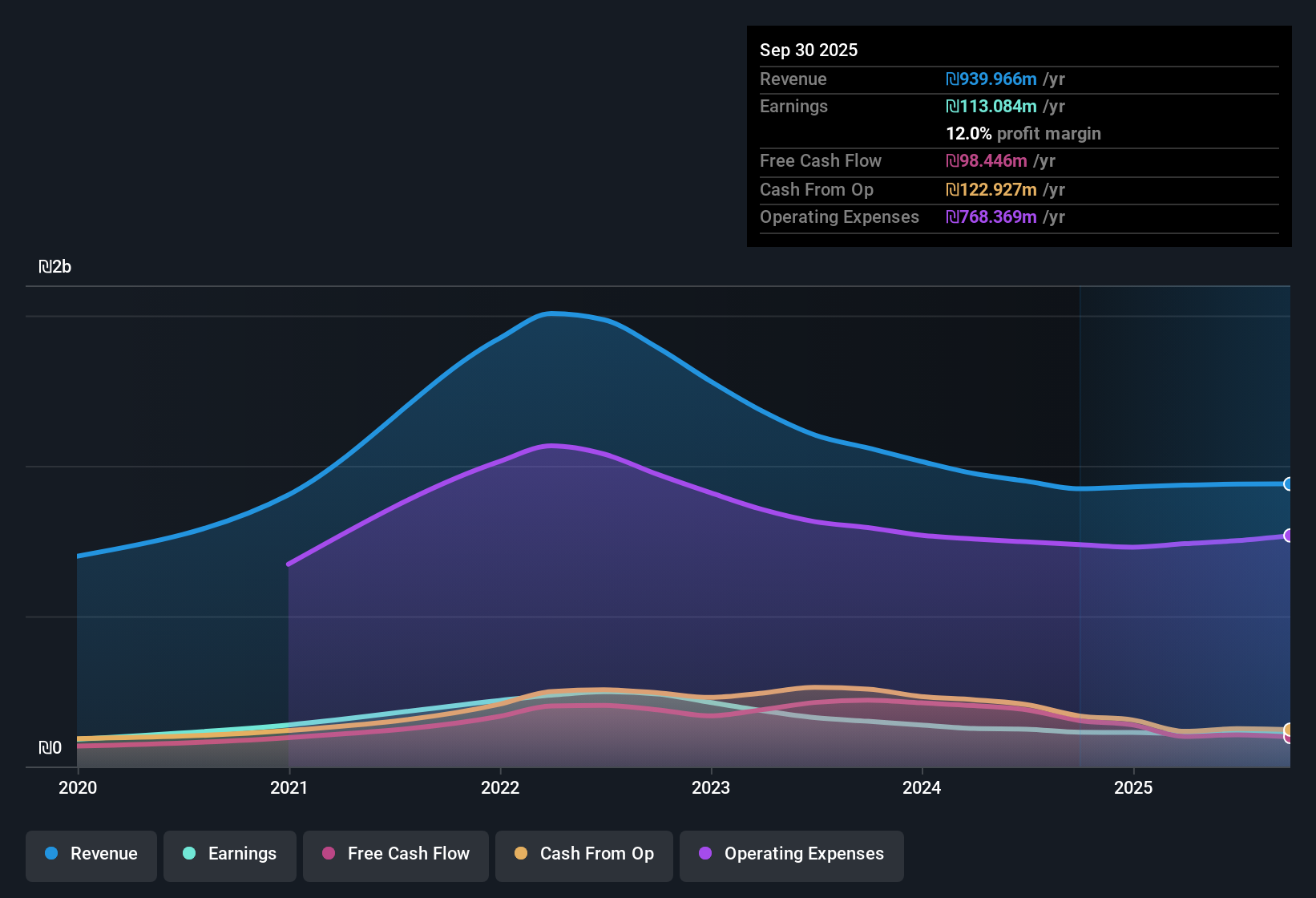

Altshuler Shaham Finance (TASE:ALTF) has just posted its Q2 2025 results, reporting revenue of 231.2 million ILS and basic EPS of 0.16 ILS for the quarter. Looking back over recent quarters, the company has seen revenue range from 229.6 million ILS to 235.3 million ILS, while EPS moved between 0.12 ILS and 0.16 ILS. This highlights a pattern of stable top-line and earnings figures. While the numbers remain steady, investors will be keeping a close watch on margins and profitability trends with each report.

See our full analysis for Altshuler Shaham Finance.Now, let’s see how these latest results compare to the narratives that typically drive sentiment in the market. Some expectations could be confirmed, while others may be put to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide to 11.9%

- Net profit margin dipped to 11.9% over the past year, down from 13.1% previously according to the latest analysis.

- Market opinion underscores the durability of Altshuler Shaham Finance’s revenue base; however, the margin erosion stands out as a challenge for supporters of the company’s “core holding” status.

- Although the overall earnings are considered high quality, the drop in margin shows that profitability is under pressure, increasing the importance of future efficiency gains.

- The defensive aspect of stable, compulsory pension flows is now more exposed to margin volatility, bringing operational performance into sharper focus.

Price Trades Above DCF Fair Value

- Shares changed hands at ₪8.65, above the DCF fair value estimate of ₪7.26, even as the price-to-earnings ratio of 15.3x remains below the industry average of 19.3x.

- Prevailing market analysis points to attractive relative valuation on a peer basis given the P/E discount, but the premium to intrinsic value means investors are balancing perceived value against empirical downside risk.

- This tension is complicated by the absence of clear near-term profit growth, with earnings declining by 17.5% annually over five years while the stock still commands a premium to DCF-based worth.

- Bulls may highlight sector leadership and defensive flows, but skeptics will focus on the earnings drop and the valuation disconnect.

Debt Levels and Dividend Instability Remain Central

- High leverage and an unstable dividend pattern were flagged as key risks for Altshuler Shaham Finance, according to the risk summary provided.

- The recent results prompt a discussion about the firm’s reward profile versus its risk. Investors weighing value from discounted multiples will need to account for both the financial leverage and irregular dividend payouts.

- Persistent debt could limit flexibility if profit pressures persist, meaning the company’s risk/reward mix remains open to debate after these results.

- For income-seeking shareholders, the lack of dividend consistency becomes more problematic amid muted growth and softer profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Altshuler Shaham Finance's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With elevated debt levels, dividend instability, and sliding margins, Altshuler Shaham Finance’s financial health appears more vulnerable after this quarter’s results.

Seek peace of mind in companies built to weather tougher times by checking out solid balance sheet and fundamentals stocks screener (1938 results) that feature lower leverage and sturdier balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ALTF

Altshuler Shaham Finance

Engages in the provident and pension funds management activities in Israel.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.