- Israel

- /

- Hospitality

- /

- TASE:ISTA

We Think That There Are More Issues For Issta (TLV:ISTA) Than Just Sluggish Earnings

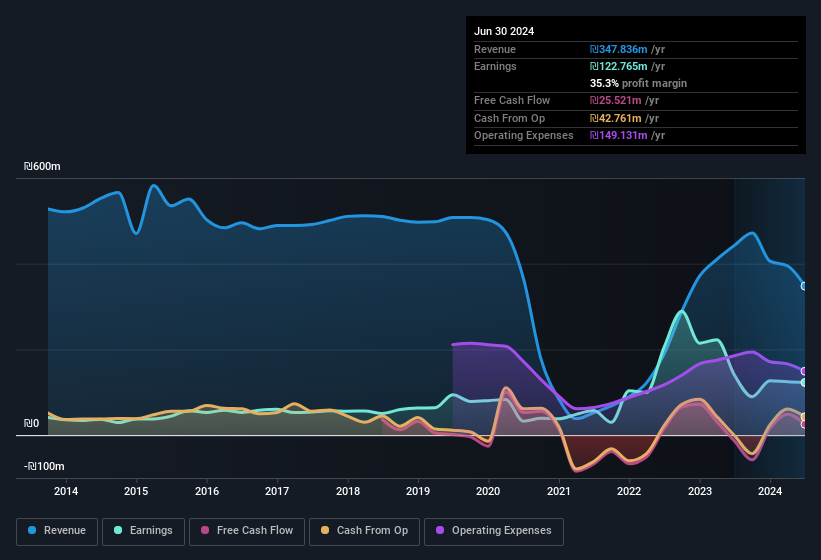

Issta Ltd's (TLV:ISTA) stock wasn't much affected by its recent lackluster earnings numbers. We did some analysis and found some concerning details beneath the statutory profit number.

Check out our latest analysis for Issta

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Issta issued 7.8% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Issta's historical EPS growth by clicking on this link.

A Look At The Impact Of Issta's Dilution On Its Earnings Per Share (EPS)

Issta has improved its profit over the last three years, with an annualized gain of 114% in that time. But EPS was only up 72% per year, in the exact same period. Net profit actually dropped by 12% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 17%. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Issta's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Issta.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Issta's net profit by ₪39m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Issta's positive unusual items were quite significant relative to its profit in the year to June 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Issta's Profit Performance

In its last report Issta benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue Issta's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Issta, you'd also look into what risks it is currently facing. To help with this, we've discovered 4 warning signs (1 is significant!) that you ought to be aware of before buying any shares in Issta.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:ISTA

Issta

Provides travel and tourism services to private and business customers, groups, and organizations in Israel and internationally.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.