- Israel

- /

- Food and Staples Retail

- /

- TASE:RMLI

Rami Levi (TASE:RMLI) Net Margins Flat at 3%, Challenging Operating Leverage Narratives in Q3 2025

Reviewed by Simply Wall St

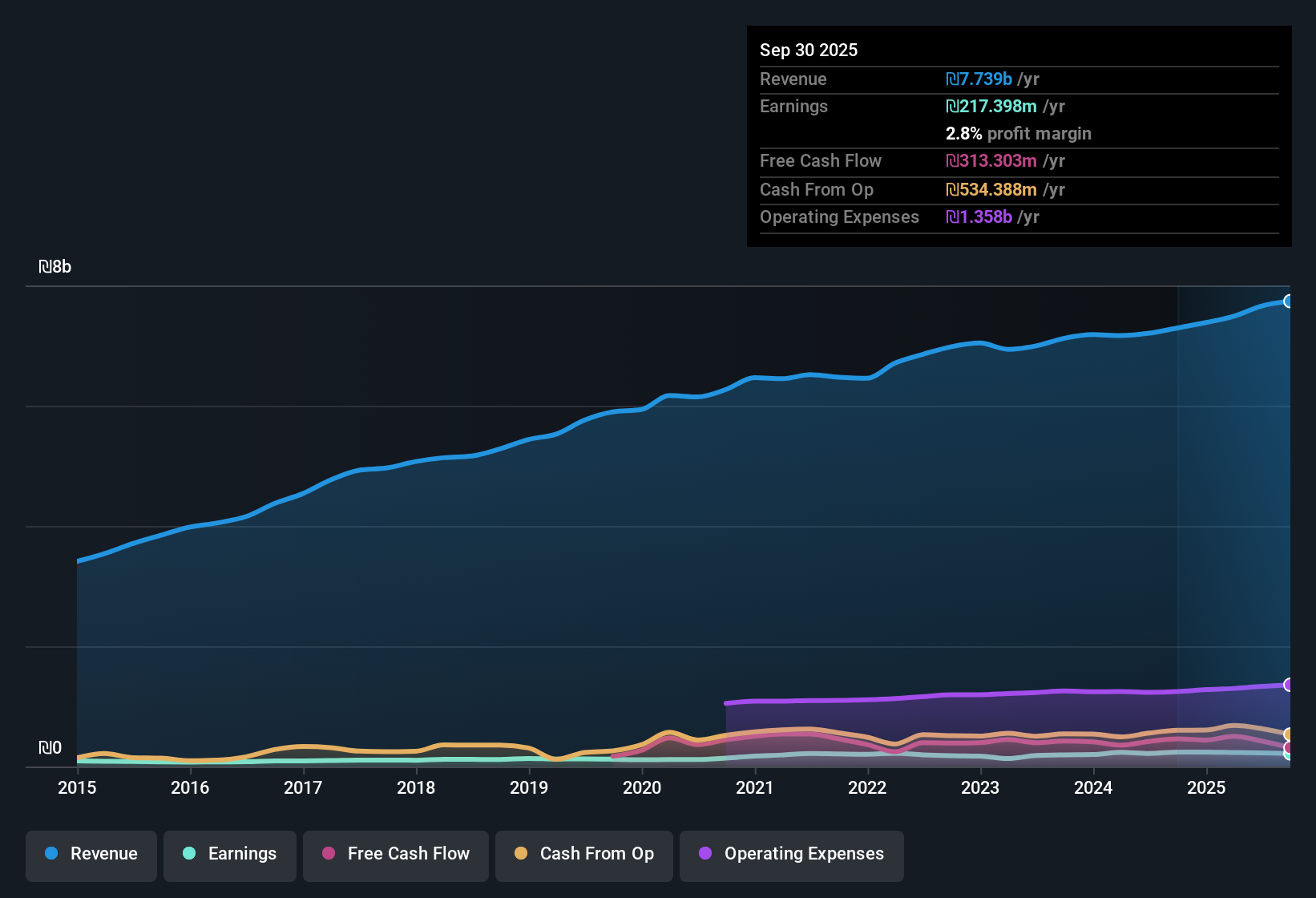

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI) just posted Q3 2025 results, revealing revenue of ₪2.0 billion and EPS of ₪4.27. Looking over recent quarters, the company has seen revenue move from ₪1.85 billion in Q4 2024 to ₪2.0 billion in Q2 2025, while EPS ranged between ₪3.7 and ₪4.81. It has been a year of steady progress, but with margins holding firm rather than widening, the spotlight is on what is sustaining those profitability levels.

See our full analysis for Rami Levi Chain Stores Hashikma Marketing 2006.Next up, we are comparing these numbers with the narratives that drive sentiment on Simply Wall St. Let us see where the data supports conventional wisdom and where it presents new insights.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Flat Despite Solid Revenue

- Net profit margins held steady at 3% over the trailing 12 months, despite revenue climbing to ₪7.7 billion. This underscores how incremental sales did not translate into wider profitability.

- The mainstream market perspective highlights that while Rami Levi's focus on essential goods and discount pricing supports stable cash flows, the lack of margin improvement amidst rising revenues raises questions about pricing power and competitive pressures.

- Margin stability at 3% contrasts with the view that scale and diversification should bring operating leverage. Even with nearly ₪2.0 billion in quarterly sales, profits did not expand further.

- With no year-on-year gain in net margin, the analysis points to sector rivalry and cost pressures offsetting the expected benefits of growth.

Valuation Risk: Price Premium to Peers

- The Price-To-Earnings ratio for Rami Levi stands at 20.6x, which is markedly above the peer average of 18.3x and the Asian Consumer Retailing industry’s 16.7x, despite the company’s DCF fair value being ₪199.61 versus a current share price of ₪339.10.

- Market commentary cautions that trading well above DCF fair value signals stretched optimism. Even though the company reports high-quality earnings, the premium multiple does not appear justified by recent growth:

- Year-on-year earnings growth slowed to 4.1%, falling behind the five-year average of 5.9%, making a 20.6x multiple more difficult to support.

- With the dividend yield at 5.14% but not fully covered by earnings, the stock’s elevated price invites closer scrutiny from value-focused investors.

Dividend Yield Attractive, but Not Fully Covered

- The company’s dividend yield of 5.14% stands out in the sector, but is highlighted as a risk because it is not well covered by recent earnings, according to the fiscal reports.

- Prevailing market analysis notes the strong appeal of a high yield in consumer retail but stresses that coverage concerns may limit dividend reliability:

- Net income for the last twelve months was ₪226.4 million, which appears stretched in relation to ongoing dividend payouts at current share levels.

- Dividend sustainability depends on reversing the moderate growth trend or improving margins, both of which remain uncertain based on this quarter's numbers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rami Levi Chain Stores Hashikma Marketing 2006's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Rami Levi’s premium valuation, slowing earnings growth, and insufficient dividend coverage present risks for investors seeking both value and income stability.

If you want stronger fundamentals and more attractive price points, browse these 920 undervalued stocks based on cash flows to discover companies with more compelling valuations and healthier upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:RMLI

Rami Levi Chain Stores Hashikma Marketing 2006

Operates a chain of discount format retail stores in Israel.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.