- South Korea

- /

- Food

- /

- KOSE:A005610

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with key indices like the S&P 500 and Nasdaq Composite showing resilience despite economic headwinds, investors are increasingly looking towards small-cap stocks for potential opportunities. In this environment of cautious optimism, identifying stocks that possess strong fundamentals and growth potential can be crucial for enhancing portfolio performance.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

SPC Samlip (KOSE:A005610)

Simply Wall St Value Rating: ★★★★★★

Overview: SPC Samlip Co., Ltd. is a South Korean company that offers a diverse range of food products, with a market capitalization of ₩425.52 billion.

Operations: SPC Samlip generates its revenue primarily from the Distribution Business Division, contributing ₩1.74 trillion, followed by the Bakery Business Division at ₩909.23 billion and the Food Business Division at ₩740.82 billion.

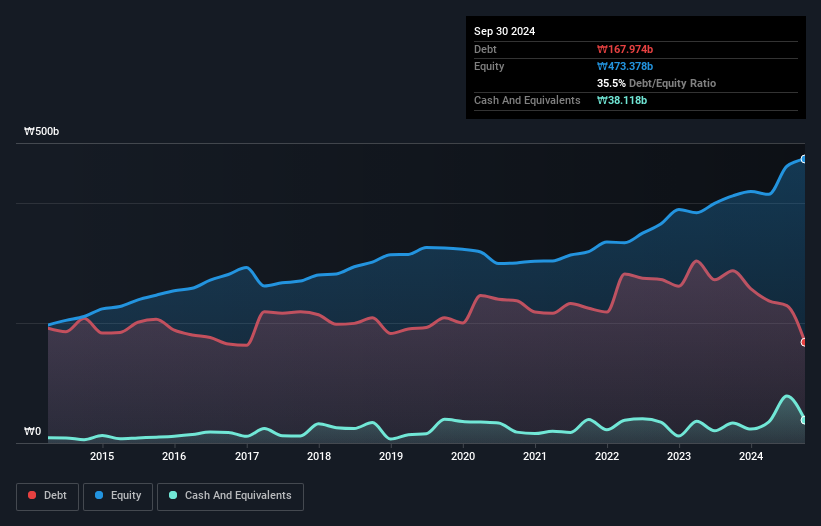

SPC Samlip, a player in the food industry, has shown impressive earnings growth of 60% over the past year, surpassing the sector's average of 3.8%. The company is trading at a significant discount to its fair value estimate by 98.9%, suggesting potential undervaluation. Its debt situation appears robust with a net debt to equity ratio of 27.4% and interest payments well covered by EBIT at 7.3 times coverage. However, future prospects seem challenging as earnings are expected to decline annually by an average of 8.9% over the next three years, despite recent positive free cash flow figures and high-quality past earnings performance.

Azorim-Investment Development & Construction (TASE:AZRM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Azorim-Investment, Development & Construction Co. engages in real estate development and construction activities, focusing on residential and income-producing properties primarily in Israel, with a market cap of ₪4.48 billion.

Operations: Azorim-Investment, Development & Construction Co. generates revenue primarily from residential construction in Israel, amounting to ₪1.43 billion, complemented by income from residences for rent and income-producing assets in Israel and the USA totaling approximately ₪156.59 million. The company's focus on residential construction significantly contributes to its financial performance.

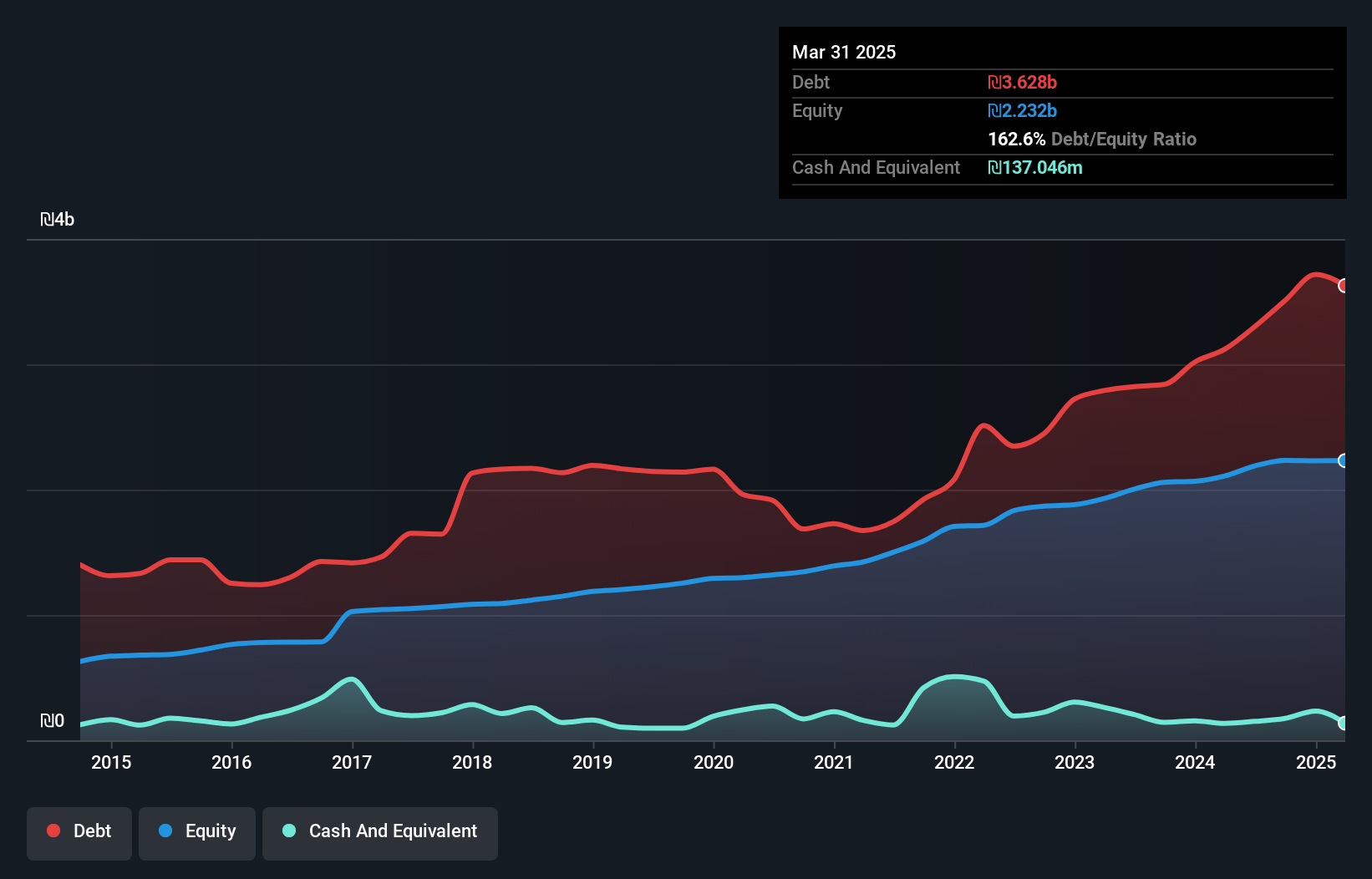

Azorim, a player in the construction sector, has been making waves with its recent financial performance. The company's revenue for Q3 2024 reached ₪504.71 million, up from ₪455.02 million the previous year, while net income climbed to ₪50.34 million from ₪38.44 million. Despite a hefty net debt to equity ratio of 149%, Azorim's interest payments are well-covered by EBIT at 3.2 times coverage, indicating solid financial management amidst high leverage concerns. Earnings grew by an impressive 22.6% over the past year, surpassing industry growth and showcasing Azorim's potential as an intriguing investment prospect in its niche market segment.

Taiwan Secom (TWSE:9917)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Secom Co., Ltd. offers security services in Taiwan and has a market capitalization of NT$55.21 billion.

Operations: The company's primary revenue streams include the Electronic Systems Department and Other Business Department, generating NT$7.61 billion and NT$4.84 billion, respectively. The Stay in Security Department also contributes significantly with NT$2.62 billion in revenue.

Taiwan Secom, a promising entity in the commercial services sector, has demonstrated solid financial performance with earnings growth of 8.9% over the past year, outpacing the industry average. Its net debt to equity ratio stands at a satisfactory 9.3%, indicating prudent financial management, while interest payments are well covered by EBIT at 32 times coverage. Recent results show revenue for Q3 2024 reached TWD 4.47 billion from TWD 4.29 billion last year and net income increased to TWD 726 million from TWD 656 million, reflecting robust operational efficiency and high-quality earnings that could appeal to discerning investors seeking value in niche markets.

- Navigate through the intricacies of Taiwan Secom with our comprehensive health report here.

Understand Taiwan Secom's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4662 more companies for you to explore.Click here to unveil our expertly curated list of 4665 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A005610

Flawless balance sheet and undervalued.

Market Insights

Community Narratives