- Israel

- /

- Consumer Durables

- /

- TASE:AZRM

Azorim (TASE:AZRM): Valuation Check After Mixed Q3 Results and Recent Share Price Pullback

Reviewed by Simply Wall St

Azorim-Investment Development & Construction (TASE:AZRM) just posted mixed third quarter and nine month results, with sales and revenue climbing but profitability slipping, giving investors plenty to unpack in the stock’s recent pullback.

See our latest analysis for Azorim-Investment Development & Construction.

That mixed earnings picture seems to be weighing on sentiment, with the latest ₪18.9 share price reflecting a 30 day share price return of minus 9.35 percent, even as the five year total shareholder return of 101.94 percent still signals long term value creation.

If Azorim’s wobble has you rethinking where growth and conviction overlap, this could be a good moment to explore fast growing stocks with high insider ownership.

With profits slipping even as revenues and long term returns remain solid, Azorim’s recent pullback raises a key question: is this a mispriced quality compounder, or is the market already discounting weaker future growth?

Price-to-Earnings of 30.4x: Is it justified?

On a price-to-earnings basis, Azorim shares at ₪18.9 look cheaper than close peers, yet still command a premium to the wider consumer durables space.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings, a common yardstick for mature, profit generating developers and real estate operators. At 30.4 times earnings, the market is effectively attaching a relatively rich price tag to each shekel of profit, which can signal confidence that current earnings pressure will eventually reverse.

Relative to similar companies, Azorim’s 30.4 times multiple screens as good value against peer average pricing of 39.2 times earnings, implying investors are paying less than they typically do for comparable exposure. However, when set against the broader Asian consumer durables industry average of 17.5 times, that same multiple looks stretched, suggesting the market is still pricing in a more robust earnings profile than the sector overall is delivering today.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.4x (ABOUT RIGHT)

However, sustained share price weakness and a lack of clear analyst upside could signal that the market doubts Azorim’s ability to reaccelerate earnings.

Find out about the key risks to this Azorim-Investment Development & Construction narrative.

Another View Using Our DCF Model

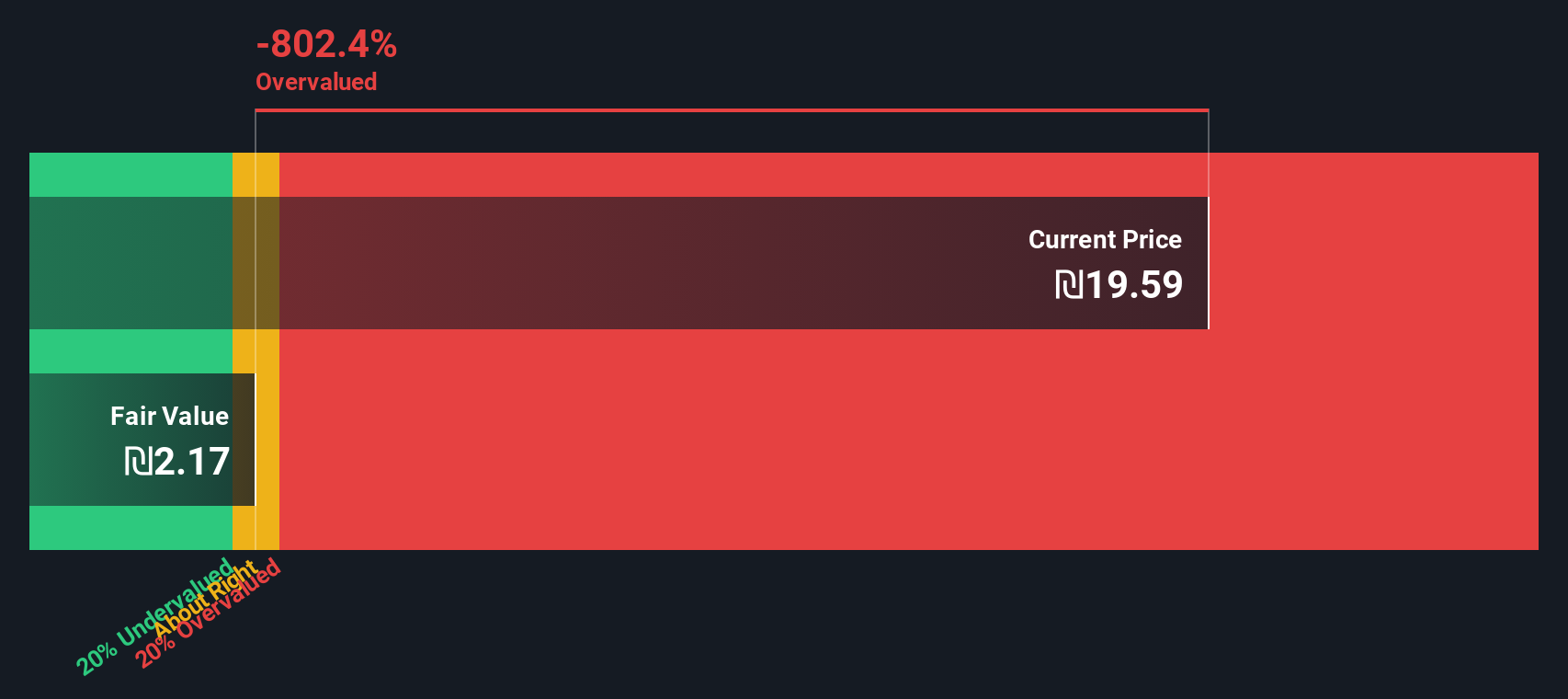

While the earnings multiple suggests Azorim-Investment Development & Construction is roughly fairly priced, our DCF model paints a harsher picture. It indicates the shares at ₪18.9 trade well above an estimated fair value of ₪2.17, implying substantial downside if cash flow expectations disappoint.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Azorim-Investment Development & Construction for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Azorim-Investment Development & Construction Narrative

If our view does not fully align with yours or you would rather dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Azorim-Investment Development & Construction research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Ready for more actionable investment ideas?

Do not stop with Azorim when stronger opportunities may be waiting. Use the Simply Wall St Screener now to pinpoint ideas that sharpen your edge.

- Capture early stage momentum by scanning these 3602 penny stocks with strong financials that pair tiny share prices with surprisingly resilient fundamentals and real business traction.

- Position ahead of the next digital shift by tracking these 81 cryptocurrency and blockchain stocks building payments, infrastructure, and services around blockchain and decentralized finance.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% offering yields above 3 percent without abandoning balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AZRM

Azorim-Investment Development & Construction

Azorim-Investment, Development & Construction Co.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026