- Israel

- /

- Commercial Services

- /

- TASE:VRDS

Veridis Environment (TASE:VRDS): Valuation Check After Sharp Earnings Turnaround and Strong Share Price Momentum

Reviewed by Simply Wall St

Veridis Environment (TASE:VRDS) just delivered a striking earnings turnaround, with net income and earnings per share jumping sharply in the third quarter and over the first nine months, even as headline sales edged lower.

See our latest analysis for Veridis Environment.

The earnings swing appears to have caught investors’ attention, with a 90 day share price return of 62.3 percent and a 1 year total shareholder return of 55.3 percent suggesting building momentum rather than a one off spike.

If Veridis success has you reassessing your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other fast moving opportunities with committed insiders.

With profits surging but revenues slipping and the share price already up strongly, is Veridis Environment still trading below its true potential, or are investors now fully pricing in the company’s future growth?

Price-to-Earnings of 24.5x: Is it justified?

On a trailing Price-to-Earnings ratio of 24.5 times at a last close of ₪37.2, Veridis Environment looks cheap against local peers but expensive versus the wider regional industry.

The price-to-earnings multiple compares the share price to the company’s per share earnings, offering a snapshot of how much investors are paying for each unit of profit. For a diversified environmental services and utilities style business such as Veridis, this metric is a common shorthand for how the market values its current profitability and its capacity to sustain or grow those earnings over time.

Against its closest peer set, Veridis trades at a marked discount to the average multiple of 60.7 times. This implies investors are not paying as rich a premium for its profits as they are for competitors. That could signal lingering doubts around the sustainability of its newly improved earnings profile, especially given the history of declining profits and the impact of one off gains on the latest results.

Stepping back to the broader Asian Commercial Services industry, however, the stock trades at a premium to the sector’s 16.1 times average multiple. This underscores how forcefully the recent turnaround and share price momentum have already been priced in. In other words, while Veridis looks inexpensive relative to immediate peers, it is far from a bargain versus the wider regional group, suggesting expectations have already shifted meaningfully in its favour.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.5x (ABOUT RIGHT)

However, investors still face risks from slipping revenues and potential earnings normalization, which could quickly challenge today’s optimistic pricing and momentum.

Find out about the key risks to this Veridis Environment narrative.

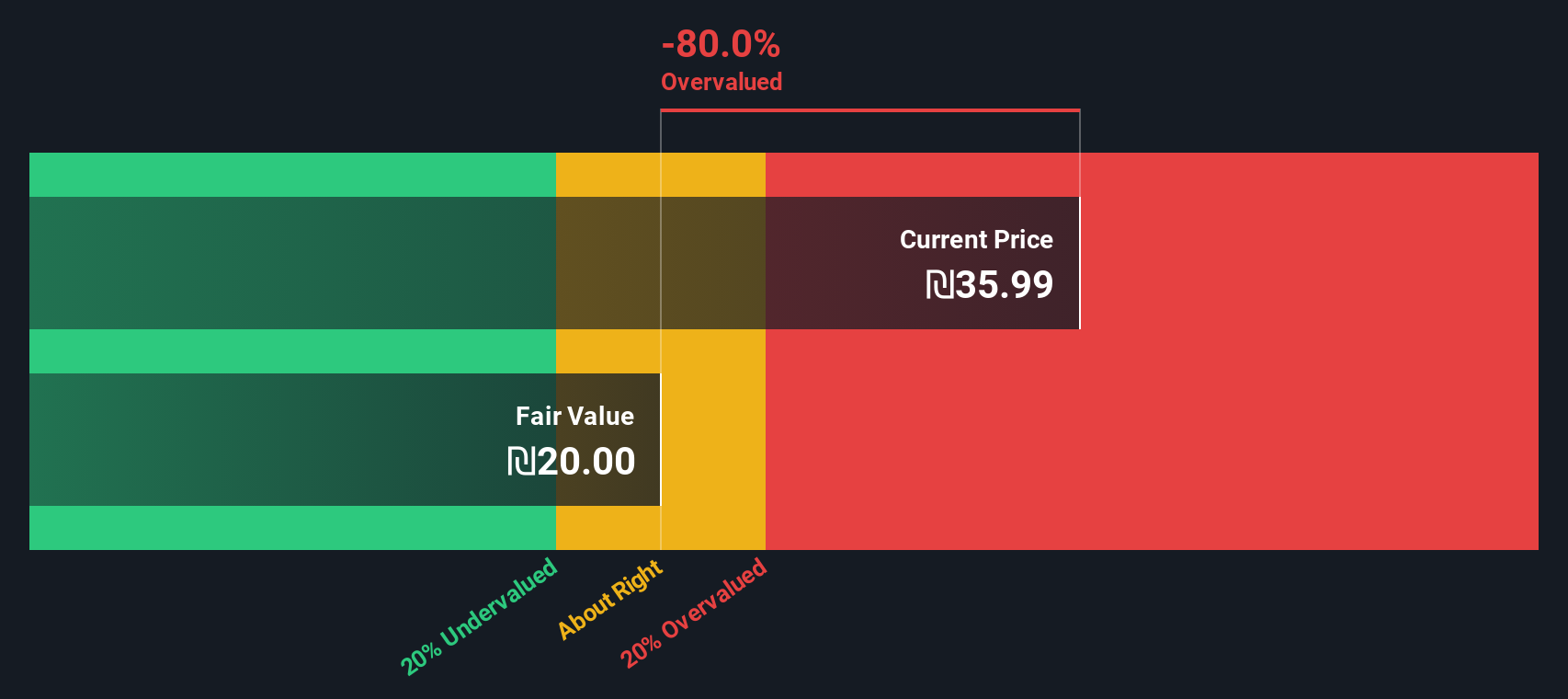

Another View: DCF Points to Overvaluation

While the current earnings multiple looks roughly reasonable, our DCF model paints a cooler picture. With Veridis trading around ₪37.2 versus an SWS DCF fair value estimate of about ₪20.11, the shares screen as significantly overvalued and this raises the risk that momentum could reverse if expectations slip.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veridis Environment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veridis Environment Narrative

If you see the numbers differently or want to dive into the assumptions yourself, you can build a personalised view in just a few minutes by starting with Do it your way.

A great starting point for your Veridis Environment research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock. Use the Simply Wall Street Screener to uncover focused opportunities that match your strategy before the market catches on.

- Capture potential mispricings by screening for these 915 undervalued stocks based on cash flows that may offer compelling upside based on strong cash flow fundamentals.

- Ride structural healthcare trends by targeting innovation leaders in these 30 healthcare AI stocks transforming diagnostics, treatment pathways, and patient outcomes.

- Tap into the digital asset revolution through these 81 cryptocurrency and blockchain stocks positioned at the crossroads of blockchain infrastructure, payment rails, and financial disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:VRDS

Veridis Environment

Provides environmental services in the areas of waste management, paper and cardboard, water, and energy in Israel.

Slight risk and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026