- Israel

- /

- Aerospace & Defense

- /

- TASE:RSEL

Shareholders May Not Be So Generous With RSL Electronics Ltd.'s (TLV:RSEL) CEO Compensation And Here's Why

Key Insights

- RSL Electronics to hold its Annual General Meeting on 16th of October

- CEO Zeev Degani's total compensation includes salary of ₪1.11m

- Total compensation is 489% above industry average

- Over the past three years, RSL Electronics' EPS grew by 50% and over the past three years, the total shareholder return was 266%

Under the guidance of CEO Zeev Degani, RSL Electronics Ltd. (TLV:RSEL) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 16th of October. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for RSL Electronics

How Does Total Compensation For Zeev Degani Compare With Other Companies In The Industry?

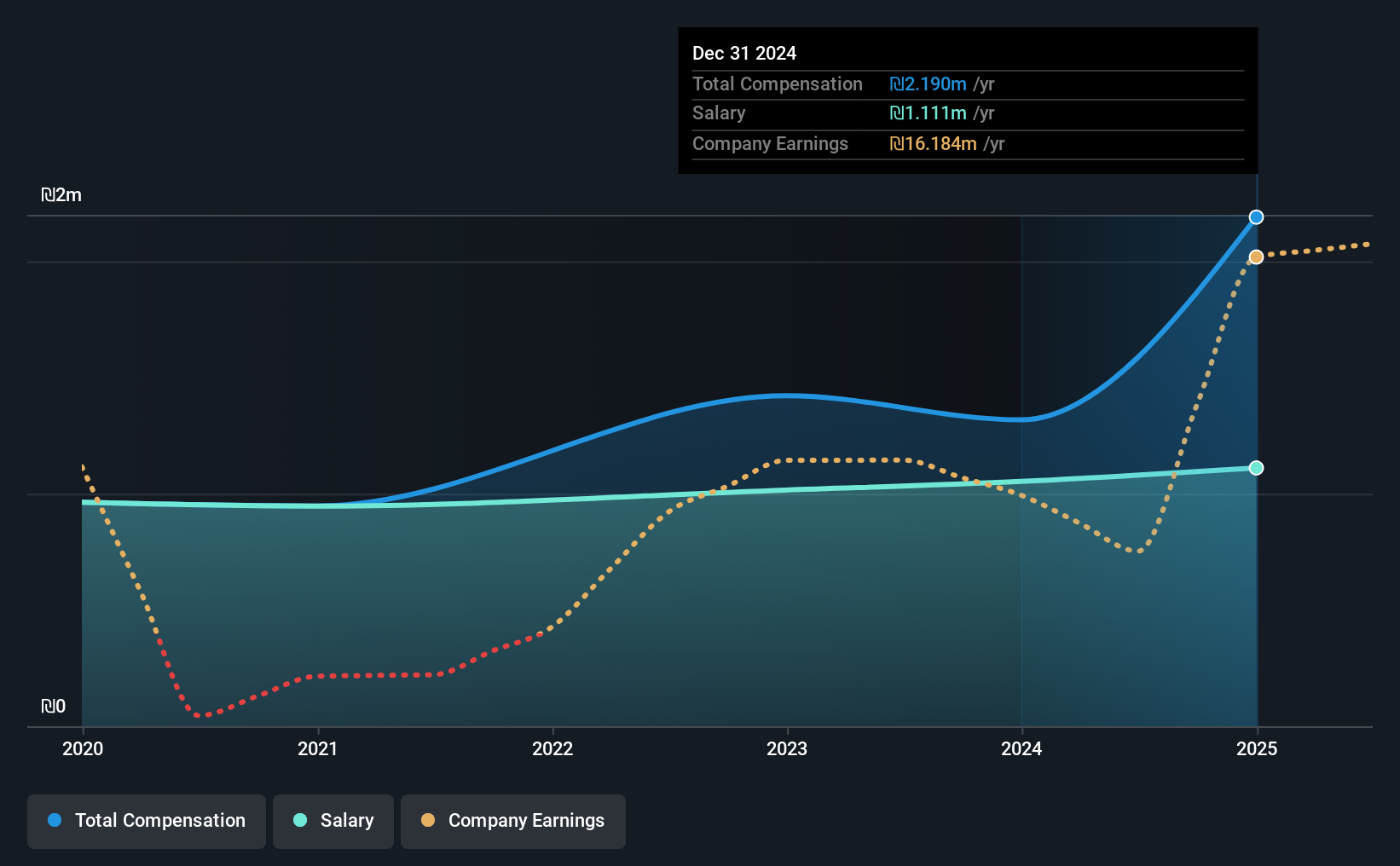

At the time of writing, our data shows that RSL Electronics Ltd. has a market capitalization of ₪122m, and reported total annual CEO compensation of ₪2.2m for the year to December 2024. Notably, that's an increase of 66% over the year before. Notably, the salary which is ₪1.11m, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the Israel Aerospace & Defense industry with market capitalizations below ₪649m, reported a median total CEO compensation of ₪372k. This suggests that Zeev Degani is paid more than the median for the industry. What's more, Zeev Degani holds ₪61m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₪1.1m | ₪1.1m | 51% |

| Other | ₪1.1m | ₪265k | 49% |

| Total Compensation | ₪2.2m | ₪1.3m | 100% |

On an industry level, around 56% of total compensation represents salary and 44% is other remuneration. RSL Electronics is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at RSL Electronics Ltd.'s Growth Numbers

RSL Electronics Ltd. has seen its earnings per share (EPS) increase by 50% a year over the past three years. Its revenue is up 123% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has RSL Electronics Ltd. Been A Good Investment?

We think that the total shareholder return of 266%, over three years, would leave most RSL Electronics Ltd. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for RSL Electronics (of which 2 are significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:RSEL

RSL Electronics

Develops, manufactures, and sells control systems, utilities, health monitoring, and diagnostics and prognostics systems for aerospace, railroad, energy, and defense sectors in Israel and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion