- Israel

- /

- Electrical

- /

- TASE:PAYT

I Built A List Of Growing Companies And Payton Industries (TLV:PAYT) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Payton Industries (TLV:PAYT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Payton Industries

Payton Industries's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Payton Industries's EPS has grown 22% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

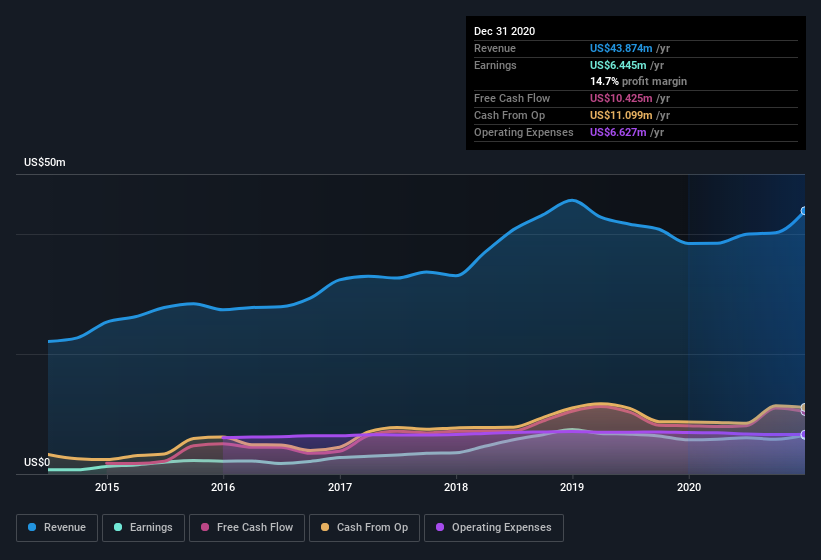

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Payton Industries maintained stable EBIT margins over the last year, all while growing revenue 14% to US$44m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Payton Industries isn't a huge company, given its market capitalization of ₪403m. That makes it extra important to check on its balance sheet strength.

Are Payton Industries Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that Payton Industries insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about US$206m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. For companies with market capitalizations under US$200m, like Payton Industries, the median CEO pay is around US$424k.

The CEO of Payton Industries was paid just US$189k in total compensation for the year ending . This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Payton Industries To Your Watchlist?

For growth investors like me, Payton Industries's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the takeaway for me is that Payton Industries is worth keeping an eye on. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Payton Industries.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:PAYT

Payton Industries

Develops, produces, trades, markets, and sells various types of transformers for communications, electronics, automotive, and industrial equipment industries in Israel, Europe, the United States, and Asia.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives