- Israel

- /

- Capital Markets

- /

- TASE:MPP

Exploring Three Undiscovered Gems in the Middle East Market

Reviewed by Simply Wall St

As Middle Eastern markets navigate the complexities of U.S. inflation concerns and rate uncertainties, many Gulf indices have experienced declines, with Saudi Arabia's benchmark index dropping 0.5% and oil prices falling by about 1%. Amidst this backdrop, discerning investors are on the lookout for stocks that can withstand market volatility and offer potential growth opportunities; three such undiscovered gems in the Middle East market may hold promise despite current challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 1.05% | 36.24% | 62.25% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

National Corporation for Tourism and Hotels (ADX:NCTH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: National Corporation for Tourism and Hotels focuses on investing in, owning, and managing hotels and leisure complexes in the United Arab Emirates with a market capitalization of AED4.53 billion.

Operations: NCTH generates revenue primarily from its hotel operations, with reported revenue of AED322.71 million. The company experienced a segment adjustment of AED626.39 million.

National Corporation for Tourism and Hotels (NCTH) stands out with a robust earnings growth of 114.4%, far surpassing the hospitality industry's -23.8%. The company reported a net income of AED 262.26 million in Q1 2025, up from AED 73.59 million the previous year, despite facing shareholder dilution over the past year. NCTH's debt to equity ratio increased to 19.3% over five years but remains manageable with a satisfactory net debt to equity ratio of 3.3%. The price-to-earnings ratio at 17.2x is attractive compared to industry standards, suggesting potential value for investors amidst recent executive changes and strategic reviews.

More Provident Funds (TASE:MPP)

Simply Wall St Value Rating: ★★★★☆☆

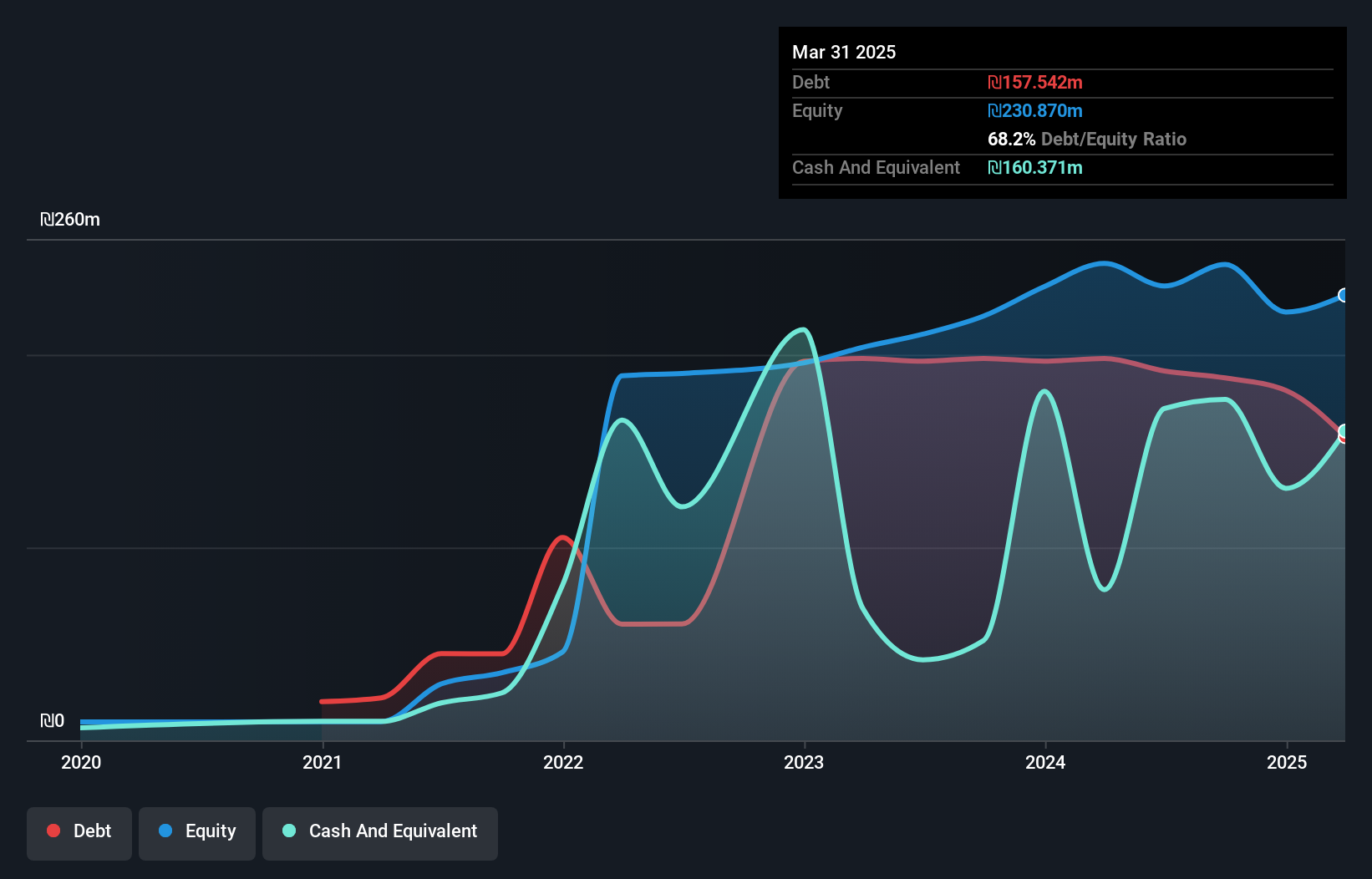

Overview: More Provident Funds Ltd. operates in Israel, managing provident and pension funds with a market capitalization of ₪1.47 billion.

Operations: More Provident Funds Ltd. generates revenue primarily from its provident sector, accounting for ₪513.62 million, and pension segment, contributing ₪27.20 million.

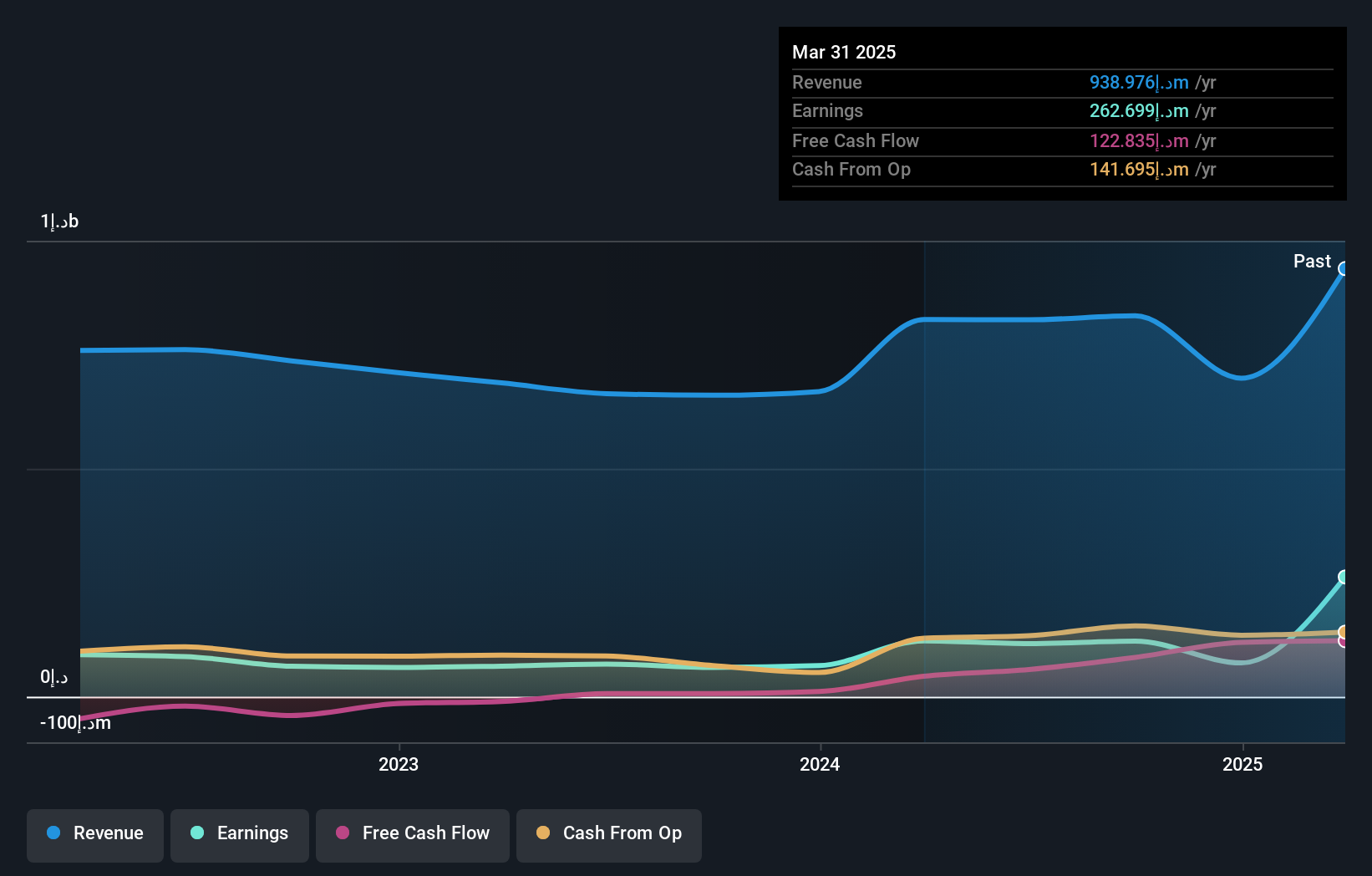

More Provident Funds, a smaller player in the financial sector, has shown promising growth with earnings rising 77.3% annually over the past five years. Despite not outpacing the Capital Markets industry last year, it boasts high-quality earnings and profitability that ensures its cash runway is secure. The firm’s debt to equity ratio increased from 52.3% to 68.2%, yet interest payments remain well-covered at an EBIT coverage of 11.5x. Recent results highlight a revenue increase to ILS 150.88 million and net income climbing to ILS 17.52 million for Q1 of this year, reflecting a positive trajectory in financial performance.

Orbit Technologies (TASE:ORBI)

Simply Wall St Value Rating: ★★★★★★

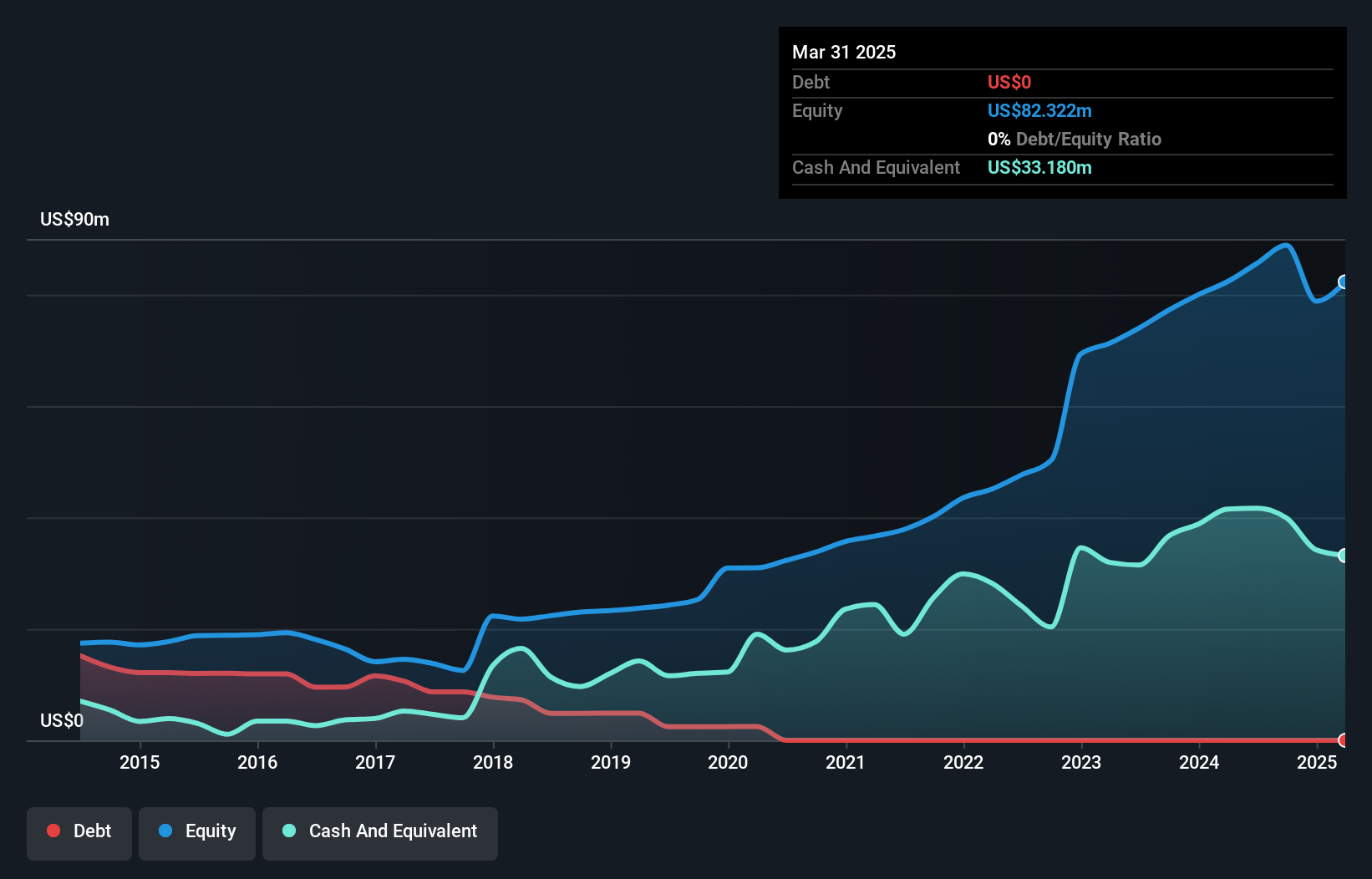

Overview: Orbit Technologies Ltd is a company that develops, manufactures, and sells communication products globally, with a market capitalization of ₪1.12 billion.

Operations: Orbit Technologies generates revenue primarily from the development, marketing, and creation of advanced communication systems, amounting to $73.28 million.

Orbit Technologies, a nimble player in the Aerospace & Defense sector, has been showing promising financial health with its debt-free status and robust earnings growth of 24.7% annually over the past five years. The company’s Price-To-Earnings ratio sits at 26.1x, which is attractively below the industry average of 35.6x, indicating potential value for investors. Recent performance highlights include a Q1 sales increase to US$18.36 million from US$15.13 million last year, alongside net income rising to US$3.26 million from US$2.19 million, reflecting strong operational execution and solidifying its position as an intriguing investment opportunity in the region.

- Click to explore a detailed breakdown of our findings in Orbit Technologies' health report.

Examine Orbit Technologies' past performance report to understand how it has performed in the past.

Where To Now?

- Discover the full array of 223 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:MPP

Proven track record with adequate balance sheet.

Market Insights

Community Narratives