- Israel

- /

- Aerospace & Defense

- /

- TASE:ISI

ImageSat International (TASE:ISI) Delivers Q3 Profit, Challenging Persistent Loss Narrative

Reviewed by Simply Wall St

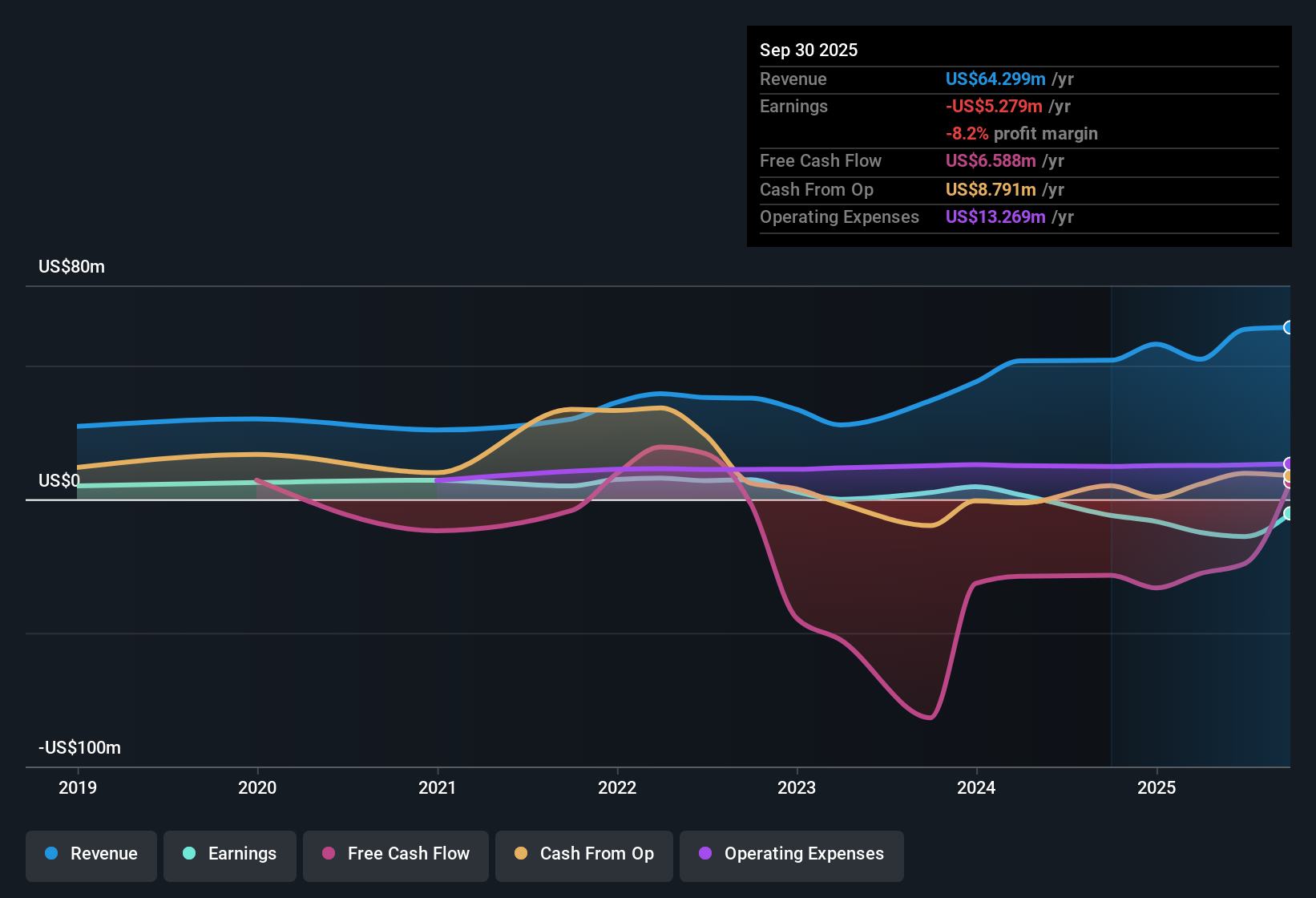

Imagesat International (TASE:ISI) reported Q3 2025 revenue of $15.7 million and basic EPS of $0.13, with net income excluding extra items at $7.72 million. The company has seen quarterly revenue range from $7.5 million to $21.9 million over the past six quarters, with basic EPS fluctuating between -$0.13 and $0.13 during the same period. Despite continued unprofitability on a trailing twelve-month basis, margins remain a key focus as investors weigh the company’s turnaround potential.

See our full analysis for Imagesat International (I.S.I).The next step is comparing these results against the trending narratives. We’ll see where consensus holds and where the market view faces a challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Shrink Despite 70% Five-Year Widening

- Trailing twelve-month net income (excluding extra items) stands at -$5.28 million, reflecting ongoing losses. This represents a notable improvement from the deeper -$13.94 million reported in the previous quarter.

- Although historical losses have increased at a 70.5% annual rate over five years, the prevailing market view notes that analysts now expect annual earnings growth of 157.95% and a return to profitability within three years.

- This projection contrasts with recent negative margins and suggests confidence in a significant financial turnaround.

- A continued lack of major flagged risks supports the outlook for recovery, but the track record of losses means that sustained improvement is needed to convince cautious investors.

Revenue Forecast: 36% Annual Growth Target

- Revenue is projected to grow at 36.1% per year, outpacing the Israel market average of 7.4%. This points to significant top-line expansion relative to local peers.

- According to prevailing market expectations, analysts highlight ISI’s differentiated niche in space-based intelligence as a growth driver. However, performance has remained volatile, with quarterly revenue fluctuating from $7.5 million to over $21.9 million in the past year.

- The wide revenue swings illustrate why some market participants are looking for more stable momentum to support the ambitious forecast.

- This revenue trajectory will need to materialize consistently in order to validate the optimistic forward multiples reflected in the market view.

Valuation: 85% Discount to DCF Fair Value

- ISI’s share price, at $11.34, trades about 85.1% below its DCF fair value of $75.90. Its Price-To-Sales ratio of 3.3x is also below the Asian Aerospace & Defense average of 7.1x, offering relative valuation appeal despite ongoing losses.

- The prevailing narrative suggests that this steep discount may attract value investors, though continued unprofitability and previously widening losses remain significant challenges.

- Investors will consider whether forecasted rapid earnings growth can close the valuation gap, or if persistent margin pressure will keep the stock undervalued.

- The absence of flagged risks over the last year is a slight positive, but financial discipline will be necessary for the discounted valuation to become attractive and sustainable.

If ISI’s rapid growth and improving loss trend continue to appear in quarterly results, prevailing analysis suggests it could be one to watch for a potential turnaround, especially at its current valuation.

See our latest analysis for Imagesat International (I.S.I).Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Imagesat International (I.S.I)'s growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

ISI’s volatile revenue and history of widening losses raise questions about its ability to deliver consistent growth and stable results.

If you want more reliability in your portfolio, use stable growth stocks screener (2074 results) to discover companies that show steady revenue and earnings regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISI

Imagesat International (I.S.I)

Provides space-based intelligence, satellite imagery, and data analytics solutions for homeland defense markets and civilian markets worldwide.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success