- Israel

- /

- Aerospace & Defense

- /

- TASE:ISHI

Risks To Shareholder Returns Are Elevated At These Prices For Israel Shipyards Industries Ltd (TLV:ISHI)

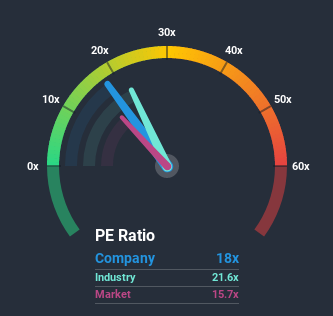

With a price-to-earnings (or "P/E") ratio of 18x Israel Shipyards Industries Ltd (TLV:ISHI) may be sending bearish signals at the moment, given that almost half of all companies in Israel have P/E ratios under 15x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For example, consider that Israel Shipyards Industries' financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Israel Shipyards Industries

How Is Israel Shipyards Industries' Growth Trending?

In order to justify its P/E ratio, Israel Shipyards Industries would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 49% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 18% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 63% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's alarming that Israel Shipyards Industries' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Israel Shipyards Industries currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 2 warning signs we've spotted with Israel Shipyards Industries (including 1 which is a bit unpleasant).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

If you decide to trade Israel Shipyards Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TASE:ISHI

Israel Shipyards Industries

Designs, constructs, markets, and sells military and civilian vessels in Israel and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives