- Israel

- /

- Aerospace & Defense

- /

- TASE:ISHI

Increases to Israel Shipyards Industries Ltd's (TLV:ISHI) CEO Compensation Might Cool off for now

Key Insights

- Israel Shipyards Industries will host its Annual General Meeting on 3rd of July

- Salary of ₪1.56m is part of CEO Zvi Schechterman's total remuneration

- The overall pay is 489% above the industry average

- Israel Shipyards Industries' three-year loss to shareholders was 20% while its EPS grew by 0.6% over the past three years

Shareholders of Israel Shipyards Industries Ltd (TLV:ISHI) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 3rd of July could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Israel Shipyards Industries

Comparing Israel Shipyards Industries Ltd's CEO Compensation With The Industry

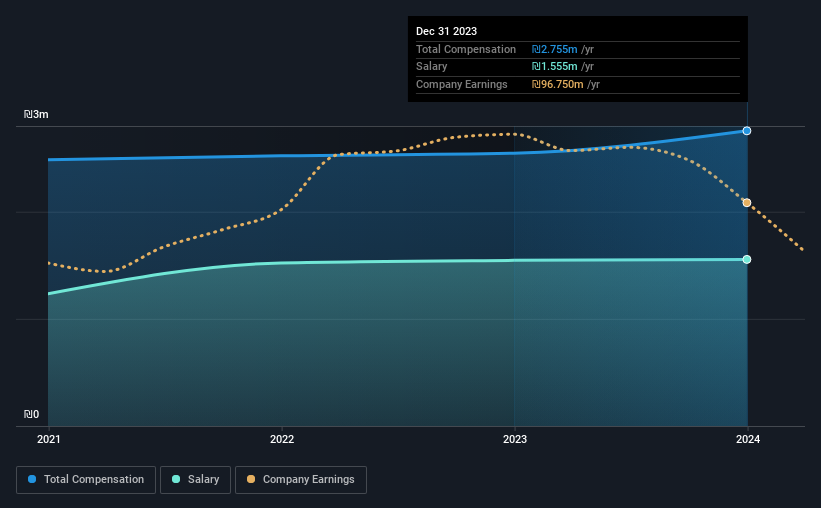

Our data indicates that Israel Shipyards Industries Ltd has a market capitalization of ₪1.4b, and total annual CEO compensation was reported as ₪2.8m for the year to December 2023. We note that's an increase of 8.2% above last year. In particular, the salary of ₪1.56m, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the Israel Aerospace & Defense industry with market capitalizations ranging between ₪751m and ₪3.0b had a median total CEO compensation of ₪467k. This suggests that Zvi Schechterman is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₪1.6m | ₪1.5m | 56% |

| Other | ₪1.2m | ₪1.0m | 44% |

| Total Compensation | ₪2.8m | ₪2.5m | 100% |

On an industry level, roughly 49% of total compensation represents salary and 51% is other remuneration. Israel Shipyards Industries is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Israel Shipyards Industries Ltd's Growth Numbers

Israel Shipyards Industries Ltd saw earnings per share stay pretty flat over the last three years. It saw its revenue drop 7.0% over the last year.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Israel Shipyards Industries Ltd Been A Good Investment?

Since shareholders would have lost about 20% over three years, some Israel Shipyards Industries Ltd investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Israel Shipyards Industries that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ISHI

Israel Shipyards Industries

Designs, constructs, markets, and sells military and civilian vessels in Israel and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives