- Israel

- /

- Aerospace & Defense

- /

- TASE:FBRT

FMS Enterprises Migun (TASE:FBRT) Margin Slides to 34.5%, Challenging High-Quality Earnings Narrative

Reviewed by Simply Wall St

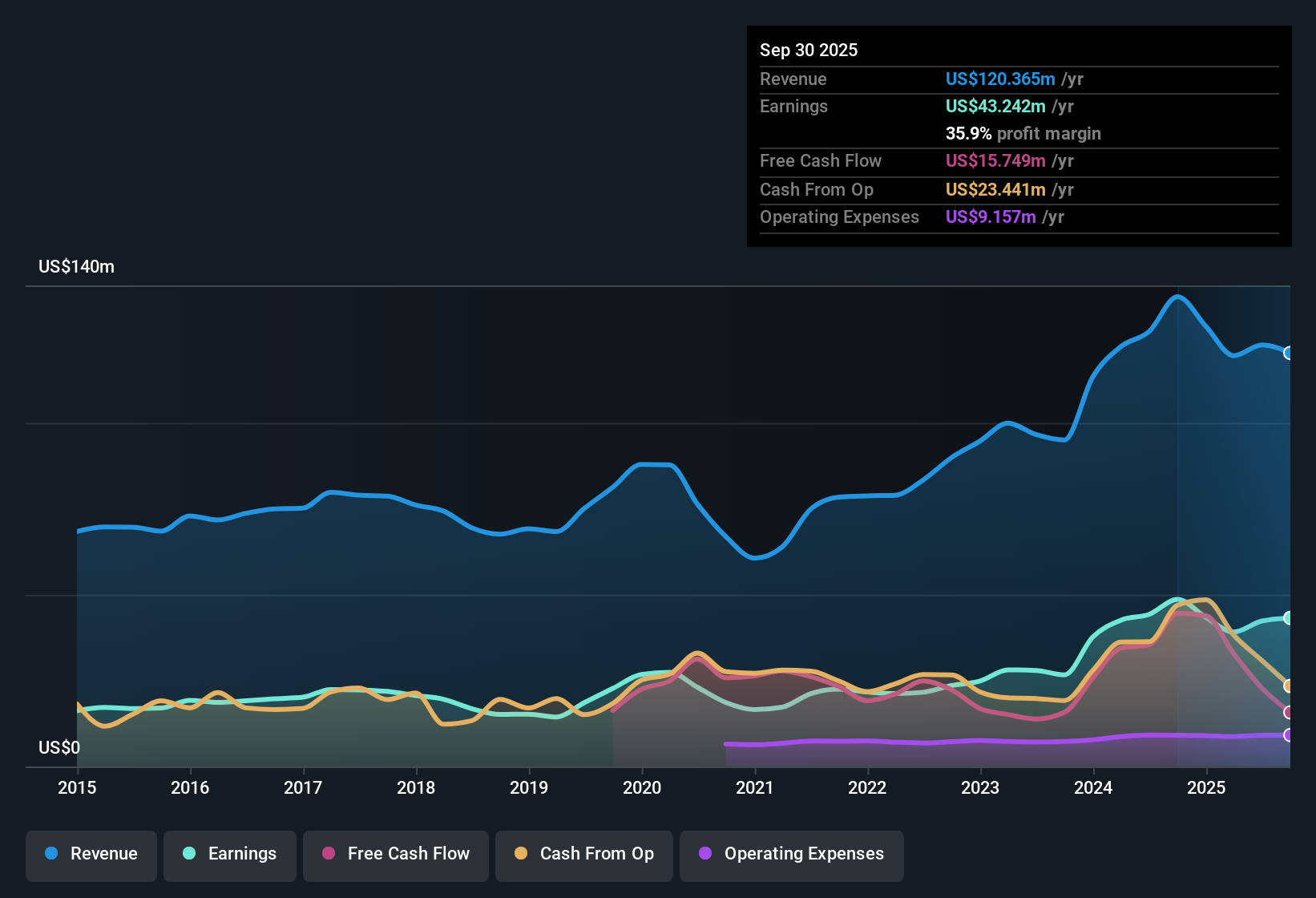

FMS Enterprises Migun (TASE:FBRT) just posted its Q3 2025 financials, recording revenue of $30.0 million and net income of $11.4 million, with EPS of $1.24. The company has seen revenue range from $26.8 million to $35.5 million over the last six quarters, while EPS has fluctuated between $0.89 and $1.43 during the same period. Investors will be weighing solid top-line performance against recent margin pressure as they parse the full story from this latest report.

See our full analysis for FMS Enterprises Migun.Next up, we compare these headline results with the key market narratives to see which expectations are in sync with the numbers and where surprises might lie.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides as Costs Nudge Higher

- Net profit margin for the last 12 months clocks in at 34.5%, just below last year’s 35% and weaker than the company’s long-term track record.

- The prevailing market opinion points to “strong earnings quality,” but the slight dip in profitability

- Highlights that, even with robust gross profits and a hefty margin, cost pressures are now visible in the trailing numbers.

- Challenges the notion that FMS remains immune to rising operating expenses or cyclical cost swings. It is important to monitor whether this becomes a trend or just short-term noise.

Payout Yield Impressive, but Cash Flow Lags

- Dividend yield stands out at 5.28%; however, filings highlight that free cash flow coverage is not robust, raising flags on the sustainability of this payout.

- Some investors might be drawn by the high headline yield, yet the underlying narrative from the data

- Warns that unless free cash flow improves, future dividends could be at risk of reduction or slower growth, despite strong net income.

- Counters the assumption that a high yield alone signals a reliable income stream. Investors are reminded to scrutinize whether earnings are translating into real cash.

Trading Below Peers but Above DCF Fair Value

- FMS trades at a P/E of 13.4x, well beneath both the Israeli market average (15.1x) and the broader Asian Aerospace & Defense sector (56.3x), but its ₪201.30 share price is above the calculated DCF fair value of ₪175.53.

- This split in valuation signals, according to the generalized market narrative,

- Underscores that the stock’s relatively low P/E may attract value-seekers who focus on earnings multiples versus peers, while the premium over DCF fair value gives more cautious investors pause about chasing further upside.

- Emphasizes that the company’s reputation for “high-quality earnings” is a draw, but stresses the importance of weighing both industry context and intrinsic value when assessing long-term potential.

FMS’s latest numbers continue to drive the debate on value, income, and sustainability. See how these themes play out across broader community narratives and read the full take on where the company could be headed next. See what the community is saying about FMS Enterprises Migun

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on FMS Enterprises Migun's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Although FMS continues to post robust earnings and dividends, its recent dip in profit margins and weak free cash flow coverage raise sustainability concerns. If you want to find companies where high yields are actually backed by reliable cash generation, check out these 1920 dividend stocks with yields > 3% to target better dividend sustainability and real income potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FBRT

FMS Enterprises Migun

Manufactures and sells ballistic protection raw materials and products worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.