- Israel

- /

- Aerospace & Defense

- /

- TASE:FBRT

3 Middle Eastern Dividend Stocks Yielding 3.7%

Reviewed by Simply Wall St

As Gulf markets continue to show resilience, closing higher despite geopolitical tensions and tariff uncertainties, investors are increasingly eyeing dividend stocks as a stable income source amidst fluctuating market conditions. In this environment, identifying stocks with solid dividend yields becomes crucial for those seeking consistent returns while navigating the complexities of the Middle Eastern economic landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.84% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.40% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.91% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.30% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.95% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.11% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.14% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.69% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.95% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.47% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Abu Dhabi Islamic Bank PJSC (ADX:ADIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Islamic Bank PJSC offers banking, financing, and investing services across the United Arab Emirates, the Middle East, and internationally, with a market cap of AED81.36 billion.

Operations: Abu Dhabi Islamic Bank PJSC generates revenue from several segments, including Global Retail Banking (AED5.29 billion), Global Wholesale Banking (AED1.79 billion), Associates & Subsidiaries (AED1.48 billion), Treasury (AED257.90 million), Real Estate (AED163.44 million), and Private Banking (AED243.19 million).

Dividend Yield: 3.7%

Abu Dhabi Islamic Bank PJSC presents a mixed picture for dividend investors. While the bank's dividends are currently covered by earnings with a payout ratio of 53.3%, its dividend yield of 3.72% is low compared to top-tier payers in the AE market. The bank has experienced volatile and unreliable dividend payments over the past decade, despite growing dividends in that period. A high level of bad loans (3.3%) and low allowance coverage (76%) may impact future stability.

- Click here to discover the nuances of Abu Dhabi Islamic Bank PJSC with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Abu Dhabi Islamic Bank PJSC shares in the market.

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in Saudi Arabia and internationally, with a market cap of SAR44.55 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from its Retail Banking segment at SAR6.11 billion, Corporate Banking at SAR5.59 billion, and Investment Banking & Brokerage at SAR593.84 million.

Dividend Yield: 5.6%

Banque Saudi Fransi's dividends, with a payout ratio of 55.3%, are covered by earnings and are forecasted to remain sustainable over the next three years. Despite an increase in dividend payments over the past decade, they have been volatile and unreliable. Recent financials show improved net income of SAR 1.34 billion for Q1 2025, while a recent dividend cut reflects ongoing challenges. The bank's price-to-earnings ratio is attractive compared to the SA market average.

- Click to explore a detailed breakdown of our findings in Banque Saudi Fransi's dividend report.

- Upon reviewing our latest valuation report, Banque Saudi Fransi's share price might be too optimistic.

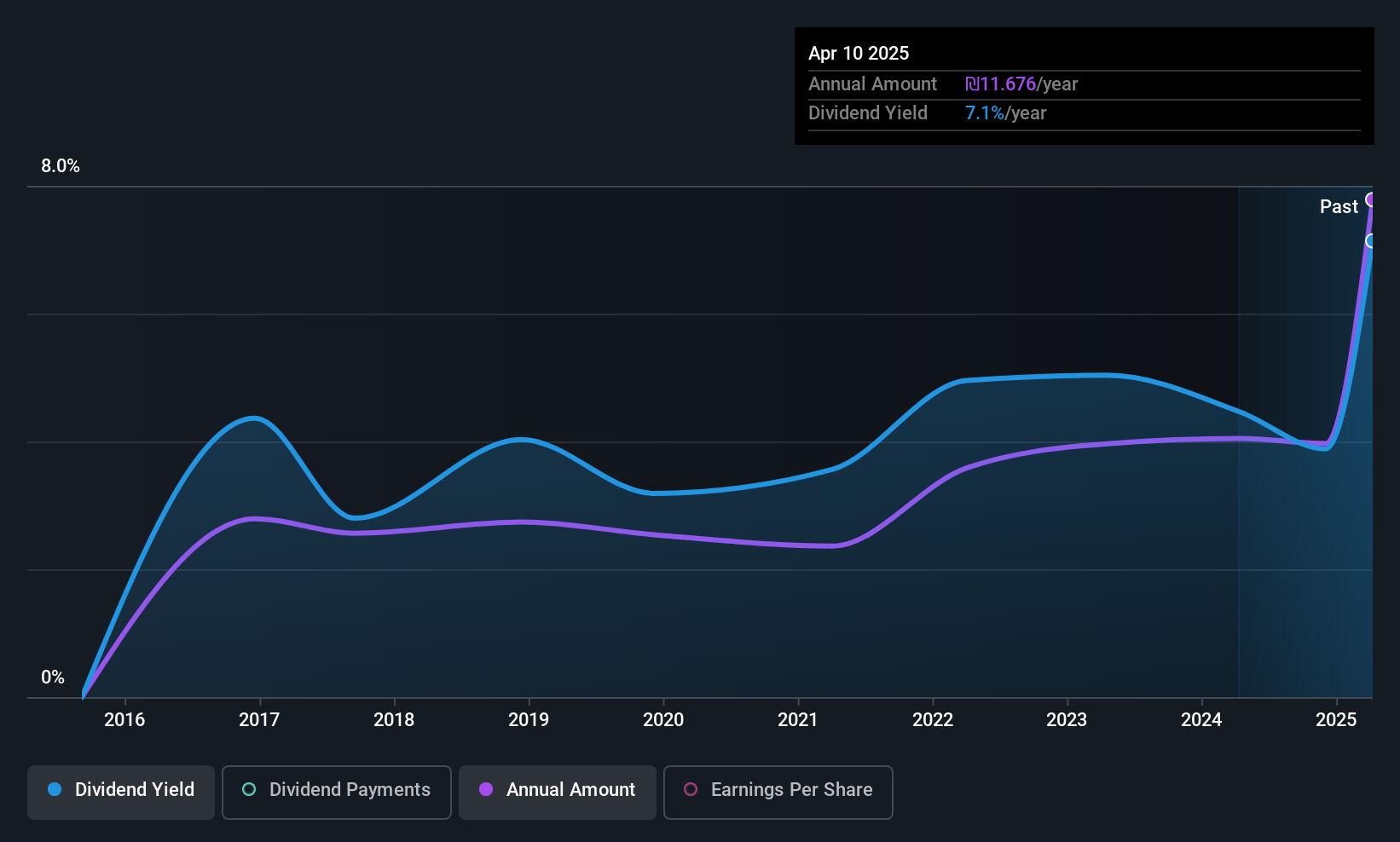

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FMS Enterprises Migun Ltd manufactures and sells ballistic protection raw materials and products globally, with a market cap of ₪1.38 billion.

Operations: FMS Enterprises Migun Ltd generates its revenue primarily from the Aerospace & Defense segment, amounting to $119.54 million.

Dividend Yield: 7.2%

FMS Enterprises Migun's dividend yield of 7.18% places it among the top 25% in the IL market, yet its high cash payout ratio of 91.3% raises sustainability concerns as dividends aren't well-covered by free cash flows. Despite this, dividends have been stable and growing over the past decade. Recent earnings show a decline with sales at US$26.96 million and net income at US$8.94 million for Q1 2025, indicating potential financial pressures ahead.

- Take a closer look at FMS Enterprises Migun's potential here in our dividend report.

- Our valuation report here indicates FMS Enterprises Migun may be undervalued.

Taking Advantage

- Delve into our full catalog of 74 Top Middle Eastern Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:FBRT

FMS Enterprises Migun

Manufactures and sells ballistic protection raw materials and products worldwide.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives