- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

Elbit Systems (TASE:ESLT) Valuation After $210m Merkava Upgrade Contracts and AI Tech Boost

Reviewed by Simply Wall St

Elbit Systems (TASE:ESLT) just secured roughly $210 million in new Israel Ministry of Defense contracts to upgrade Merkava tanks, adding AI enhanced electro optical sights and long term maintenance, which represents a meaningful boost to its defense backlog.

See our latest analysis for Elbit Systems.

The deal lands while Elbit’s share price has cooled slightly in recent months. Even so, its year to date share price return remains strong and the one year total shareholder return is still very robust, suggesting that underlying momentum is intact.

If this contract has you rethinking defense exposure, it could be a good moment to explore other aerospace and defense stocks that might complement or diversify a position in Elbit.

With shares still up strongly over the past year and trading at a double digit discount to analyst targets, is Elbit now an underappreciated compounder, or has the market already priced in its next leg of growth?

Price-to-Earnings of 48x: Is it justified?

Elbit Systems last closed at ₪1,528, and at that price the shares trade at a rich price-to-earnings multiple of 48 times, slightly above close peers.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings, a key lens for mature, profitable defense contractors like Elbit.

At 48 times earnings versus the peer average of 46.3 times, investors appear willing to pay a premium for Elbit’s recent profit acceleration, even though our DCF model suggests the market price sits above an intrinsic value estimate of ₪1,071.84.

Yet compared with the broader Asian Aerospace and Defense group, where the average price-to-earnings multiple is 56.6 times, Elbit still trades at a noticeable discount, implying the market assigns it somewhat less upside than many regional rivals despite its strong recent earnings growth profile.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 48x (OVERVALUED)

However, the stretched valuation and reliance on sustained defense spending mean that any slowdown in contract wins or margin pressure could rapidly deflate sentiment.

Find out about the key risks to this Elbit Systems narrative.

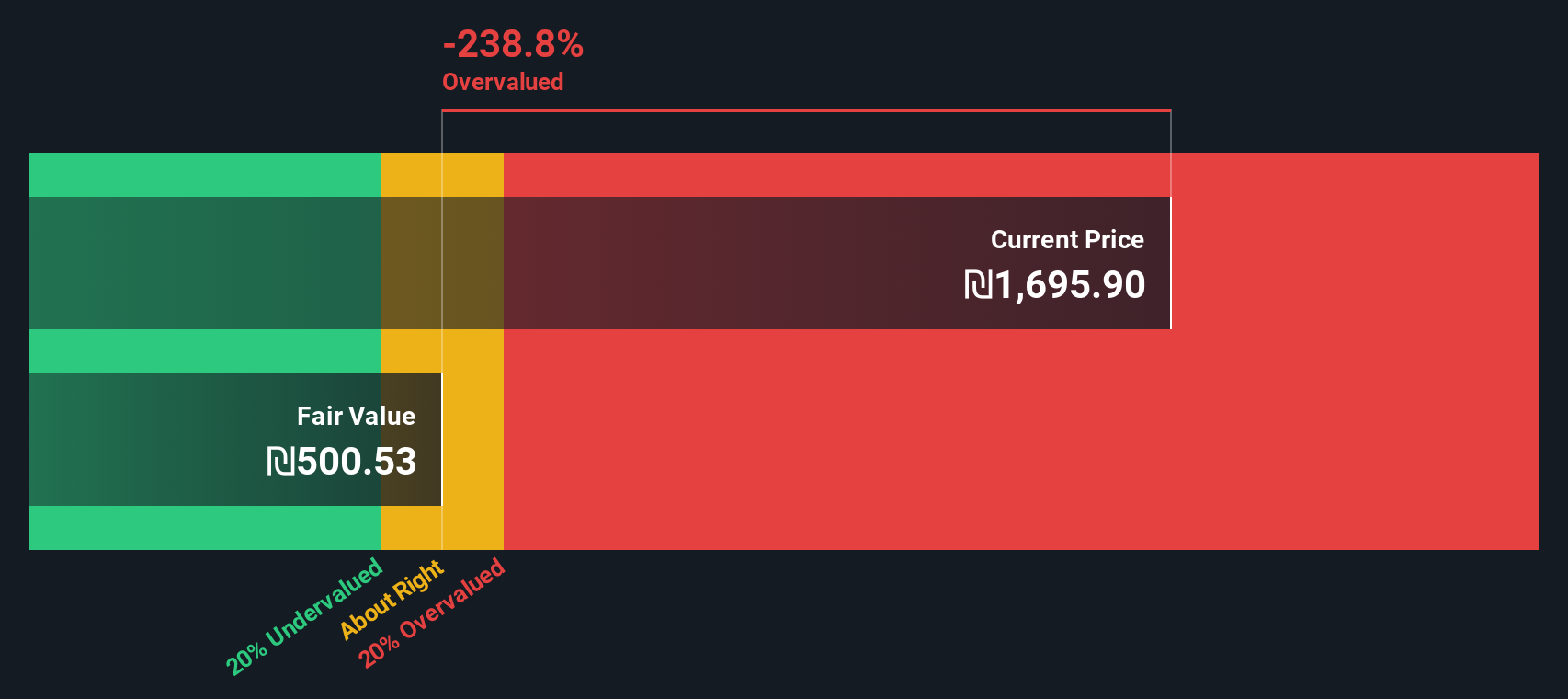

Another View: DCF Says the Price Looks Full

While the 48 times earnings multiple looks punchy, our DCF model is even more cautious. It points to a fair value around ₪1,071.84, meaning the stock trades at a hefty premium. Is the market rightly banking on sustained growth, or stretching optimism too far?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elbit Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elbit Systems Narrative

If you see the numbers differently or want to dive deeper into the data yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Elbit Systems.

Looking for more investment ideas?

Before you move on, give yourself the edge by uncovering fresh opportunities in minutes with our powerful screener tools built for serious long term investors.

- Capture potential multi baggers early by scanning these 3573 penny stocks with strong financials that already show balance sheet strength and improving fundamentals.

- Explore the next wave of intelligent automation by targeting these 25 AI penny stocks positioned at the intersection of software, data, and real world applications.

- Focus on quality at a discount by reviewing these 920 undervalued stocks based on cash flows that our models currently flag as potentially mispriced based on projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026