- Israel

- /

- Aerospace & Defense

- /

- TASE:ESLT

Elbit Systems (TASE:ESLT): Assessing Valuation After 52-Week High and Bullish Analyst Forecasts

Reviewed by Kshitija Bhandaru

Elbit Systems (TASE:ESLT) has been on investors’ radar after reaching a 52-week high, supported by a solid streak of surpassing earnings forecasts and several upbeat estimate revisions in recent months.

See our latest analysis for Elbit Systems.

Elbit Systems’ share price momentum has gathered pace following its 52-week high, with investor optimism fueled by upbeat earnings and fresh analyst attention. While the 1-year total shareholder return signals confidence in the company’s direction, the stock’s current valuation has some questioning whether growth can keep up with expectations.

If Elbit’s recent run has sparked your curiosity, it could be the perfect time to explore other companies in the sector. See the full list in our Aerospace & Defense Screener. See the full list for free.

With such notable gains and bullish analyst forecasts, the key question now is whether Elbit Systems is trading at a bargain or if the market is already fully pricing in its future growth potential. Is there still a buying opportunity here?

Price-to-Earnings of 59.8x: Is it justified?

Elbit Systems currently trades at a Price-to-Earnings (P/E) ratio of 59.8x, which is noticeably higher than the last close price suggests when compared to sector averages. This elevated multiple stands out in the context of its recent strong performance and sustained earnings growth.

The P/E ratio measures how much investors are willing to pay for a unit of current earnings. For a defense contractor like Elbit, a high P/E can signal that the market expects rapid profit expansion or highly resilient business prospects, often due to long-term government contracts or technological advantages.

Despite its notable growth and profitability improvements, Elbit Systems is trading at a P/E multiple above both the Asian Aerospace & Defense industry average (57.3x) and the peer average (45.4x). This suggests that the market is pricing in superior future performance and placing a premium on the company’s earnings potential over its industry peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 59.8x (OVERVALUED)

However, concerns remain around whether current growth rates are sustainable and if Elbit’s elevated valuation could face pressure from shifting sector sentiment.

Find out about the key risks to this Elbit Systems narrative.

Another View: What Does Our DCF Model Say?

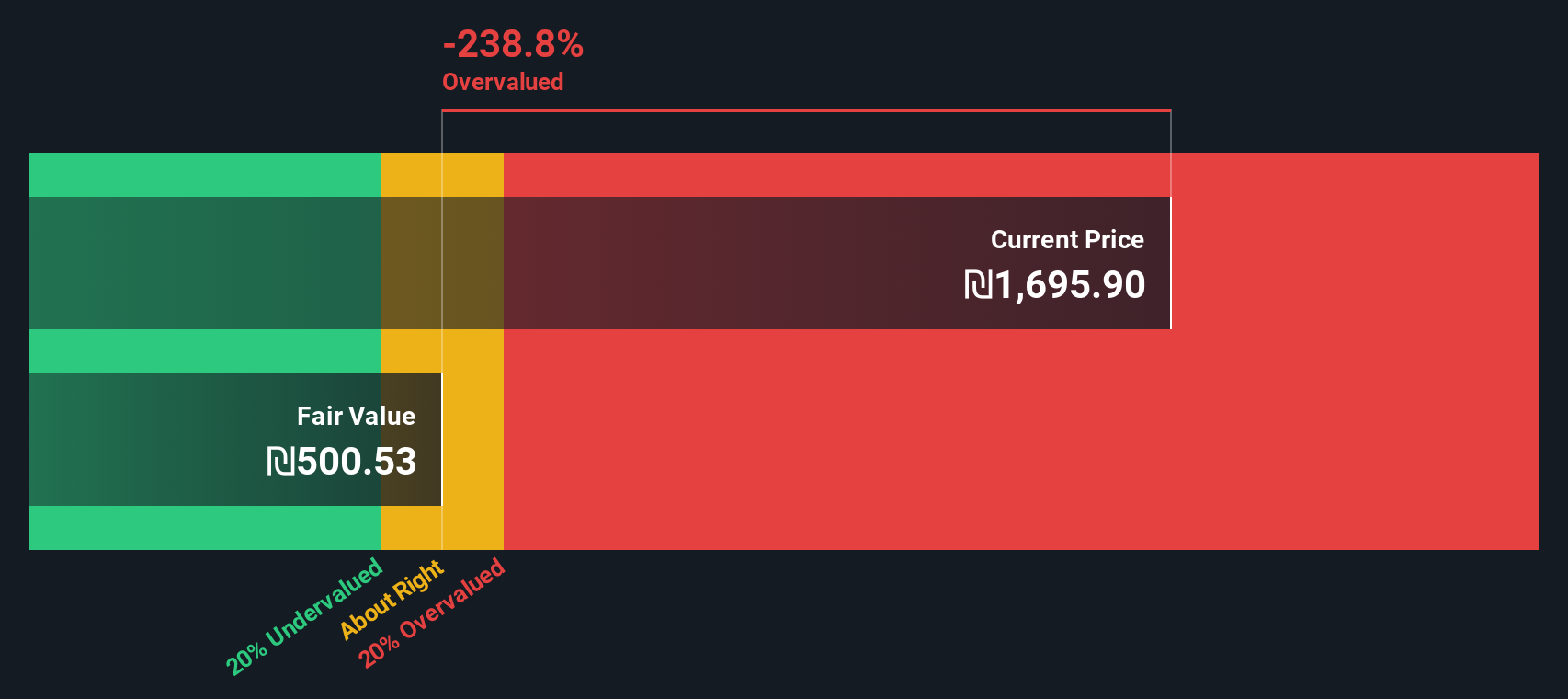

While the market’s high price-to-earnings ratio suggests Elbit Systems is trading at a premium, the SWS DCF model offers a very different perspective. Our model estimates fair value at ₪500.18 per share, which is far below the current price. This points to Elbit being overvalued by this measure. So, is the market too optimistic, or does it know something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elbit Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elbit Systems Narrative

If you have a different view or want to dive into the numbers on your own terms, you can quickly put together your own take, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Elbit Systems.

Looking for More Compelling Investment Ideas?

Smart investors know that the best opportunities often lie beyond the obvious headlines. Take action now so you do not miss out on market-moving trends and untapped potential.

- Secure your portfolio against volatility by tapping into stable income streams and see what high-yield earners are available with these 19 dividend stocks with yields > 3%.

- Boost your exposure to the artificial intelligence boom and uncover promising tech upstarts by checking out these 25 AI penny stocks.

- Stay ahead of the curve by unearthing value shares that the market may be underestimating with these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elbit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ESLT

Elbit Systems

Develops and supplies a portfolio of airborne, land, and naval systems and products for the defense, homeland security, and commercial aviation applications in Israel, North America, Europe, the Asia-Pacific, Latin America, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives