- Taiwan

- /

- Real Estate

- /

- TWSE:2545

Three Undiscovered Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As global markets navigate the uncertainties of a new U.S. administration and fluctuating economic indicators, small-cap stocks have been particularly impacted, with indices like the S&P MidCap 400 and Russell 2000 experiencing notable declines. In this environment, identifying undiscovered gems—stocks that may be overlooked yet possess strong fundamentals or unique growth potential—can provide valuable diversification and opportunity for investors seeking to enhance their portfolios amidst shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| SG Mart | 3.62% | 96.95% | 95.31% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bawan (SASE:1302)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bawan Company operates in the Kingdom of Saudi Arabia, focusing on the manufacturing and sale of metal and steel works, with a market capitalization of SAR2.71 billion.

Operations: Bawan generates revenue primarily from its Metal and Wood segment, contributing SAR2.12 billion, followed by the Electrical segment at SAR571.18 million and the Plastic segment at SAR365.98 million.

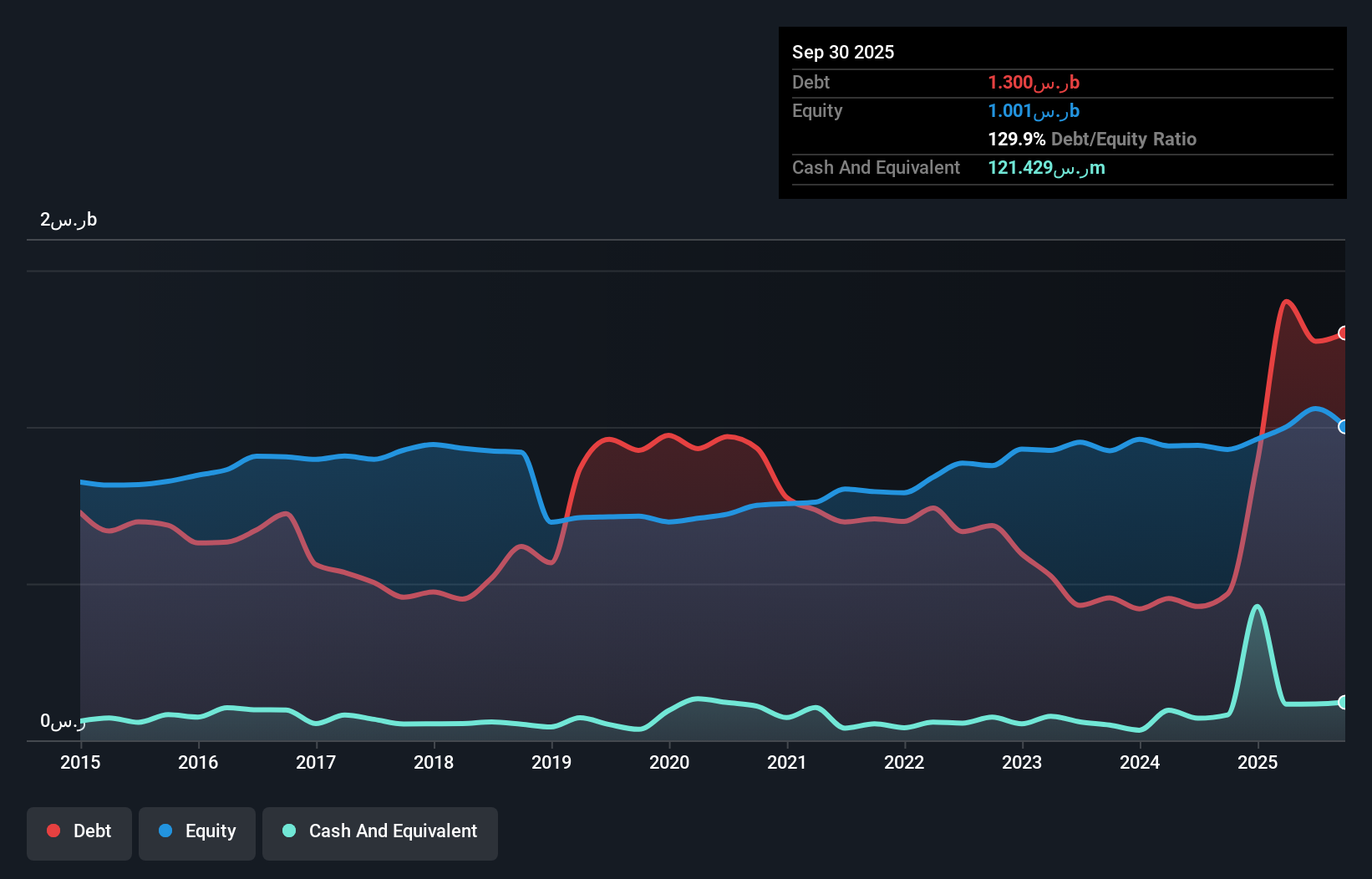

Bawan, a smaller player in the market, has shown some resilience despite recent challenges. The company's debt to equity ratio significantly improved from 129.4% to 50.4% over five years, indicating better financial management. However, its net debt to equity remains high at 41.6%, suggesting room for improvement in leveraging strategies. Earnings growth lags behind the industry at -6.1%, but forecasts suggest a potential annual growth of 17%. Recent earnings reports reveal sales of SAR 682 million and net income of SAR 23 million for Q3, down from last year's figures but still reflecting solid operational performance amidst sector-wide pressures.

- Take a closer look at Bawan's potential here in our health report.

Examine Bawan's past performance report to understand how it has performed in the past.

Bet Shemesh Engines Holdings (1997) (TASE:BSEN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bet Shemesh Engines Holdings (1997) Ltd specializes in the manufacturing and sale of jet engine parts in Israel, with a market capitalization of ₪2.64 billion.

Operations: Bet Shemesh Engines generates revenue primarily from two segments: Engines, contributing $80.08 million, and Manufacturing of Parts, with $165.10 million. The company does not report any "Other," "Unallocated," or "Inter-Segment" amounts in its financial data.

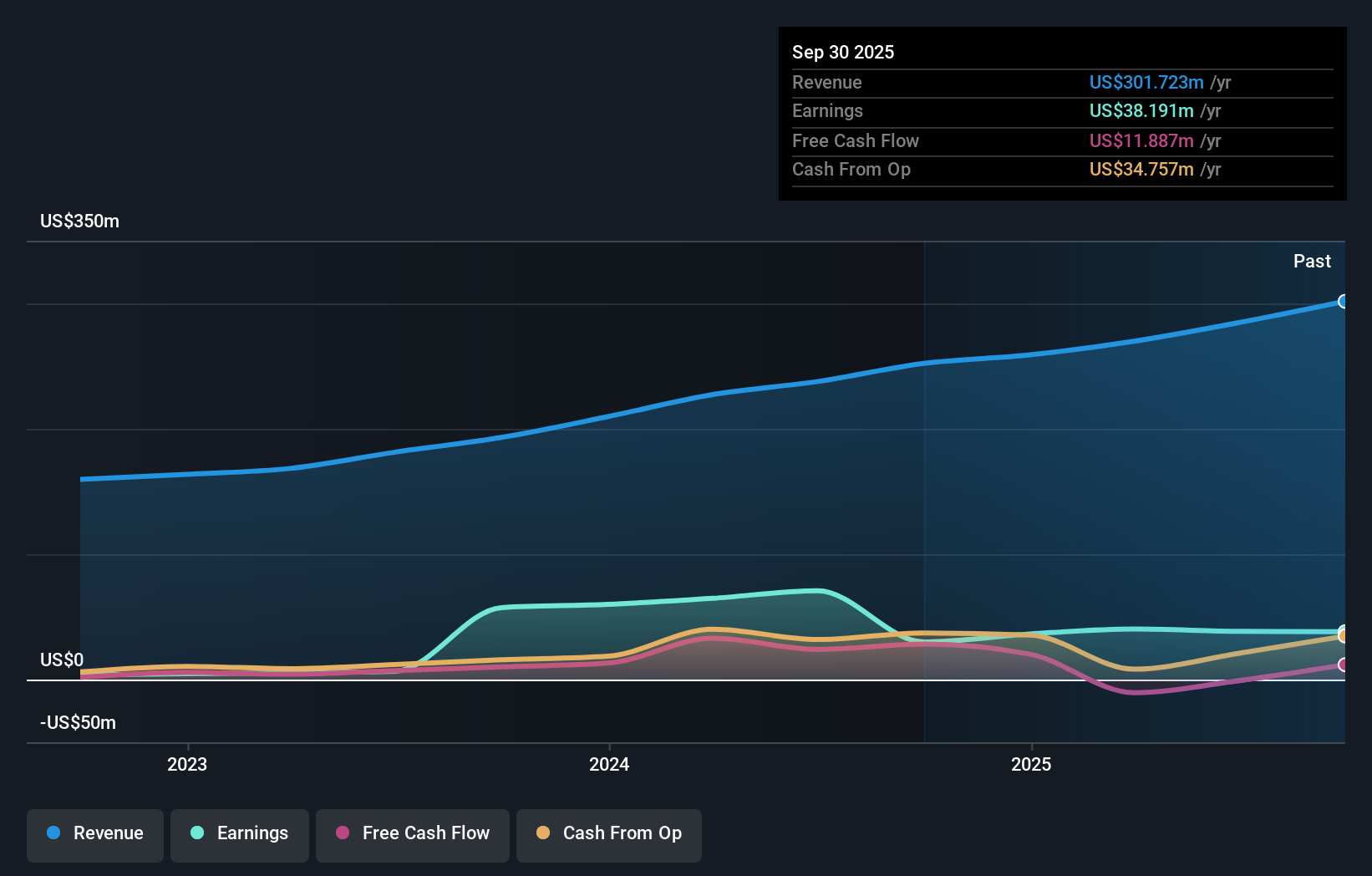

Bet Shemesh Engines, a player in the Aerospace & Defense sector, showcases impressive growth with earnings skyrocketing 968% over the past year, outpacing industry norms. The company's debt to equity ratio has improved significantly from 46.3% to 22.8% over five years, indicating effective financial management. Trading at a notable 67.1% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent inclusion in indices like TA-125 and S&P Global BMI highlights its rising prominence. With net income reaching US$9 million this quarter compared to US$3 million last year, Bet Shemesh is on an upward trajectory.

Huang Hsiang Construction (TWSE:2545)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Huang Hsiang Construction Corporation, along with its subsidiaries, is involved in building, selling, and renting public housing and commercial buildings in Taiwan with a market cap of NT$22.19 billion.

Operations: The company generates revenue primarily from the construction and sale of public housing and commercial buildings in Taiwan. It also earns income through rental activities. The financial performance includes a notable net profit margin trend, which has varied over recent periods.

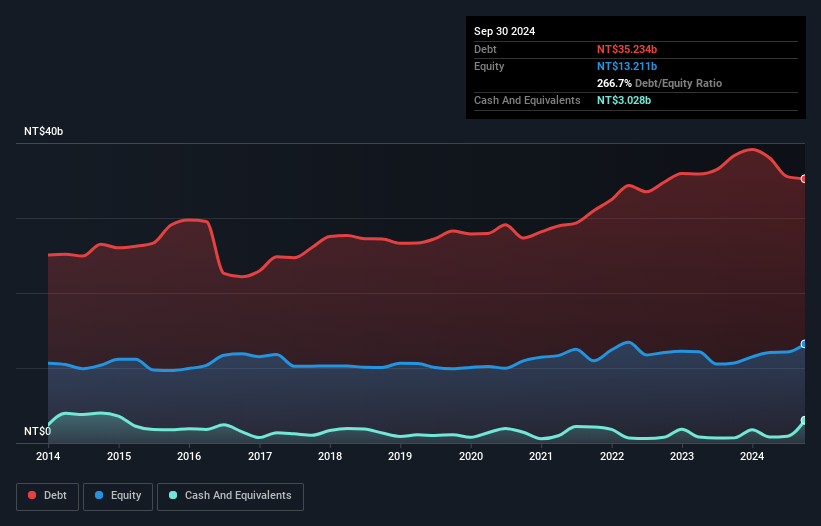

Huang Hsiang Construction, a smaller player in the construction industry, has shown remarkable growth with earnings surging 2.66 billion% over the past year, outpacing the broader real estate sector's 43.7%. The recent quarter saw sales jump to TWD 4.45 billion from TWD 848 million a year prior, while net income rose to TWD 1.08 billion from TWD 157 million. Despite trading at a significant discount of about 95% below its estimated fair value and having high-quality earnings, its net debt to equity ratio remains elevated at around 244%, though interest coverage is solid at nearly six times EBIT.

Make It Happen

- Reveal the 4651 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huang Hsiang Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2545

Huang Hsiang Construction

Engages in development of residential and commercial properties.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives