Further weakness as Rav-Bariach (08) Industries (TLV:BRIH) drops 12% this week, taking one-year losses to 19%

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Rav-Bariach (08) Industries Ltd. (TLV:BRIH) share price is down 19% in the last year. That's well below the market decline of 6.5%. Because Rav-Bariach (08) Industries hasn't been listed for many years, the market is still learning about how the business performs. And the share price decline continued over the last week, dropping some 12%.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Our analysis indicates that BRIH is potentially overvalued!

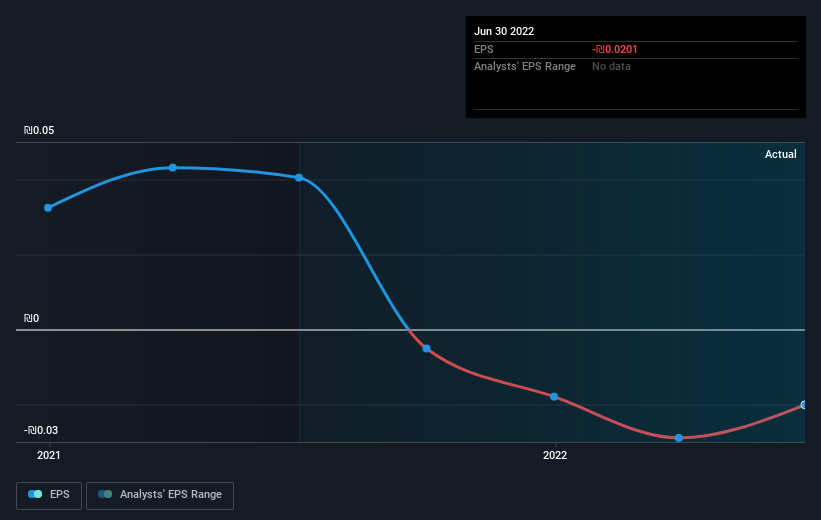

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Rav-Bariach (08) Industries saw its earnings per share drop below zero. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. Of course, if the company can turn the situation around, investors will likely profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Rav-Bariach (08) Industries' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Rav-Bariach (08) Industries shareholders are down 19% for the year, even worse than the market loss of 6.5%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 4.6% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Rav-Bariach (08) Industries better, we need to consider many other factors. For instance, we've identified 1 warning sign for Rav-Bariach (08) Industries that you should be aware of.

But note: Rav-Bariach (08) Industries may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IL exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TASE:BRIH

Rav-Bariach (08) Industries

Primarily engages in the development, manufacture, and marketing of security doors and solutions in Israel and internationally.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives